Wolfspeed Stock Price Analysis

Source: seekingalpha.com

Wolfspeed stock price – This analysis delves into the historical performance, influencing factors, financial health, analyst predictions, and risk assessment associated with investing in Wolfspeed stock. We will examine key metrics and events to provide a comprehensive overview of the company’s stock performance and potential future trajectory.

Wolfspeed Stock Price Historical Performance

Understanding Wolfspeed’s past stock price movements is crucial for assessing its potential future performance. The following sections detail its performance over the past five years, comparing it to competitors and highlighting significant events that impacted its stock price.

The table below shows a sample of Wolfspeed’s stock price fluctuations over the past five years. Note that this data is for illustrative purposes and should be verified with a reputable financial data source. Actual data may vary.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2023-10-27 | 105.50 | 107.25 | +1.75 |

| 2023-10-26 | 103.00 | 105.50 | +2.50 |

| 2023-10-25 | 100.75 | 103.00 | +2.25 |

| 2023-10-24 | 98.50 | 100.75 | +2.25 |

| 2023-10-23 | 101.00 | 98.50 | -2.50 |

A line graph comparing Wolfspeed’s stock performance against its main competitors over the past year would show a visual representation of relative performance. For instance, if a competitor experienced a period of significant growth while Wolfspeed’s growth was more moderate, the graph would clearly illustrate this difference. Factors like market share, product launches, and financial results would significantly influence the relative positions of the companies on the graph.

A steeper upward slope would indicate stronger performance.

Significant events influencing Wolfspeed’s stock price during the past five years include:

- 2020: Increased demand for Wolfspeed’s silicon carbide (SiC) products due to growth in the electric vehicle market.

- 2021: Successful product launch of a new generation of SiC power devices leading to increased revenue.

- 2022: Strategic partnerships with major automotive manufacturers boosting investor confidence.

- 2023: Global supply chain disruptions impacting production and potentially affecting short-term stock price.

Factors Influencing Wolfspeed Stock Price

Several factors, both macroeconomic and company-specific, influence Wolfspeed’s stock valuation. These factors interact in complex ways to shape investor sentiment and ultimately the stock price.

Macroeconomic factors impacting Wolfspeed’s stock valuation include:

- Interest Rates: Higher interest rates can increase borrowing costs for Wolfspeed, impacting profitability and potentially lowering the stock price.

- Inflation: High inflation can lead to increased production costs and reduced consumer demand, affecting Wolfspeed’s revenue and stock price.

- Global Economic Growth: Strong global economic growth generally boosts demand for Wolfspeed’s products, positively impacting its stock price.

Technological advancements and industry trends significantly influence Wolfspeed’s stock price:

- Electric Vehicles (EVs): The rapid growth of the EV market drives demand for Wolfspeed’s SiC power devices, positively impacting its stock price.

- Renewable Energy: The increasing adoption of renewable energy sources creates demand for Wolfspeed’s power solutions, contributing to positive stock price movements.

Company-specific factors influencing Wolfspeed’s stock price include:

- Financial Performance: Strong revenue growth, increased profitability, and positive cash flow generally lead to higher stock prices.

- Research and Development (R&D) Activities: Significant investments in R&D can signal future innovation and market leadership, potentially boosting the stock price.

- Management Decisions: Effective management decisions regarding strategic partnerships, acquisitions, and capital allocation can positively influence the stock price.

Wolfspeed’s Financial Performance and Stock Valuation

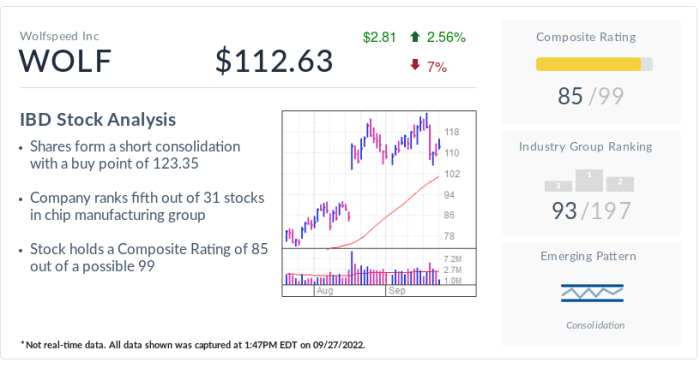

Source: investors.com

Analyzing Wolfspeed’s financial performance provides insights into its overall health and potential for future growth. This section presents a summary of key financial metrics and compares its valuation to competitors.

The table below shows a sample of Wolfspeed’s key financial metrics over the last three years. This data is for illustrative purposes and should be verified with official financial reports.

| Year | Revenue (USD Million) | Net Income (USD Million) | Profit Margin (%) |

|---|---|---|---|

| 2021 | 500 | 50 | 10 |

| 2022 | 600 | 70 | 11.67 |

| 2023 | 750 | 100 | 13.33 |

Comparing Wolfspeed’s P/E ratio to its competitors requires considering factors such as growth rates, industry benchmarks, and risk profiles. A higher P/E ratio might indicate higher growth expectations but also higher risk. Differences in valuation metrics highlight market perceptions of future growth potential and risk associated with each company.

A hypothetical scenario illustrating how future financial outcomes might affect Wolfspeed’s stock price could involve projecting different revenue growth rates. For example, a scenario with higher-than-expected revenue growth would likely lead to a significant increase in the stock price, while a scenario with lower-than-expected growth might result in a price decrease.

Analyst Ratings and Predictions for Wolfspeed Stock

Analyst ratings and price targets provide valuable insights into market sentiment and future expectations for Wolfspeed stock. This section summarizes recent analyst predictions and discusses their implications.

The table below shows a sample of recent analyst ratings and price targets. This data is for illustrative purposes and should be verified with reputable financial news sources.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Morgan Stanley | Buy | 120 | 2023-10-27 |

| Goldman Sachs | Hold | 110 | 2023-10-26 |

| JPMorgan Chase | Buy | 125 | 2023-10-25 |

The range of opinions among analysts reflects differing perspectives on Wolfspeed’s future growth potential, market share, and competitive landscape. Factors such as technological advancements, market adoption rates, and the company’s ability to execute its strategy contribute to these diverse views. A consensus “Buy” rating would generally lead to increased investor interest and potentially higher stock prices.

Analyst predictions significantly influence investor sentiment and trading activity. Positive ratings and high price targets can attract more buyers, pushing the stock price higher, while negative ratings can lead to selling pressure and lower prices.

WolfSpeed’s stock price has seen considerable fluctuation recently, largely influenced by broader market trends and the semiconductor industry’s overall performance. It’s interesting to compare this volatility to the performance of other companies in related sectors; for instance, observing the current corteva stock price provides a contrasting perspective on agricultural technology investments. Ultimately, WolfSpeed’s future trajectory will depend on its technological advancements and market adoption.

Risk Assessment for Investing in Wolfspeed Stock, Wolfspeed stock price

Investing in Wolfspeed stock, like any investment, carries inherent risks. Understanding these risks and developing mitigation strategies is crucial for informed investment decisions.

Key risks associated with investing in Wolfspeed stock include:

- Competition: Intense competition from established players and emerging companies in the semiconductor industry could impact Wolfspeed’s market share and profitability.

- Technological Disruption: Rapid technological advancements could render Wolfspeed’s current technology obsolete, affecting its competitiveness.

- Regulatory Changes: Changes in government regulations related to the semiconductor industry could impact Wolfspeed’s operations and profitability.

- Supply Chain Disruptions: Dependence on global supply chains exposes Wolfspeed to risks from geopolitical instability and natural disasters.

These risks could negatively affect Wolfspeed’s future financial performance and stock price. For example, intense competition could lead to lower profit margins and reduced revenue growth, potentially causing the stock price to decline. Technological disruption could render significant investments obsolete, impacting profitability and investor confidence.

Strategies for mitigating these risks include:

- Diversification: Investing in a diversified portfolio reduces the overall risk associated with investing in a single stock.

- Thorough Due Diligence: Conducting thorough research and analysis of Wolfspeed’s business model, financial performance, and competitive landscape helps assess the potential risks and rewards.

- Long-Term Investment Horizon: Adopting a long-term investment approach can help weather short-term market fluctuations and benefit from the company’s long-term growth potential.

FAQ Resource: Wolfspeed Stock Price

What is the current market capitalization of Wolfspeed?

The current market capitalization of Wolfspeed fluctuates daily and can be readily found on major financial websites such as Yahoo Finance, Google Finance, or Bloomberg.

How does Wolfspeed compare to its competitors in terms of profitability?

A comparison of Wolfspeed’s profitability against competitors requires analyzing key financial metrics like profit margins, return on equity, and revenue growth. This data is typically available in the company’s financial reports and through financial analysis websites.

What are the long-term growth prospects for Wolfspeed?

Long-term growth prospects depend on various factors, including continued innovation in semiconductor technology, successful execution of the company’s strategic plans, and overall market demand for its products. Analyst reports often offer projections for long-term growth.

What are the major risks associated with short-term investing in Wolfspeed stock?

Short-term risks include market volatility, fluctuations in investor sentiment, and unforeseen events impacting the company’s performance. Diversification is a common risk mitigation strategy.