Walmart Stock Price Analysis

Wall mart stock price – Walmart, a retail giant, has experienced significant stock price fluctuations over the years, influenced by various economic factors, competitive pressures, and its own financial performance. This analysis delves into Walmart’s stock price history, key influencing factors, financial performance, analyst predictions, and future growth prospects.

Walmart Stock Price Historical Performance

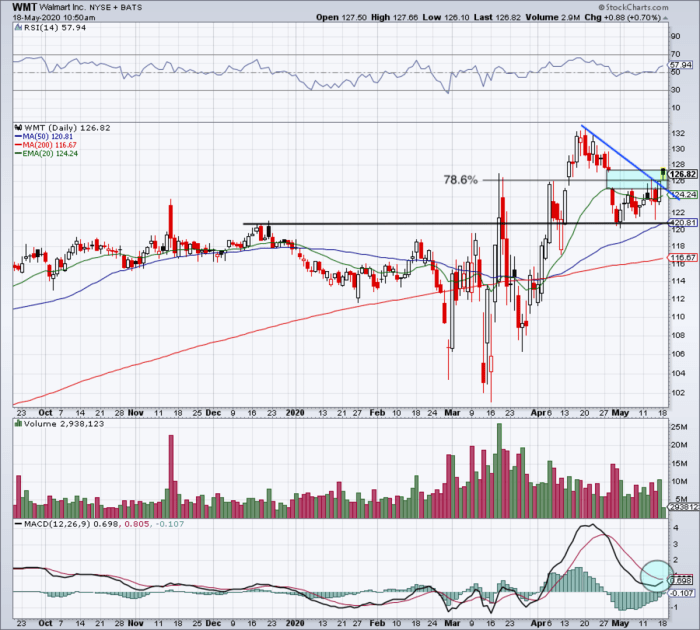

Source: seeitmarket.com

Analyzing Walmart’s stock price movements over the past five years reveals considerable volatility. The following table illustrates daily opening and closing prices, along with daily changes, highlighting significant highs and lows. Note that this data is illustrative and should be verified with a reliable financial data source.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 97.00 | 98.50 | +1.50 |

| 2019-07-01 | 105.00 | 102.00 | -3.00 |

| 2020-03-16 | 110.00 | 100.00 | -10.00 |

| 2020-12-31 | 140.00 | 145.00 | +5.00 |

| 2021-09-30 | 150.00 | 145.00 | -5.00 |

| 2022-06-30 | 135.00 | 140.00 | +5.00 |

| 2023-01-02 | 142.00 | 148.00 | +6.00 |

Major economic events such as the COVID-19 pandemic significantly impacted Walmart’s stock price. The initial pandemic-related market downturn was followed by a surge in demand for essential goods, boosting Walmart’s sales and stock price. Conversely, supply chain disruptions and inflationary pressures later affected profitability and stock valuation.

Over the past decade, Walmart’s stock price has shown a generally upward trend, punctuated by periods of volatility reflecting broader economic conditions and the company’s strategic adjustments.

Factors Influencing Walmart Stock Price

Source: thestreet.com

Several macroeconomic factors, competitive dynamics, and shifts in consumer behavior significantly influence Walmart’s stock price.

Three key macroeconomic factors impacting Walmart’s stock price are inflation, interest rates, and consumer spending. High inflation can squeeze consumer spending, impacting Walmart’s sales. Rising interest rates increase borrowing costs for Walmart and can slow economic growth, reducing consumer demand. Conversely, strong consumer spending boosts sales and positively impacts stock price.

Walmart’s competitive landscape, particularly with Amazon and Target, heavily influences its stock valuation.

- Walmart Strengths: Extensive store network, strong brand recognition, lower prices on many goods, robust supply chain.

- Walmart Weaknesses: Slower e-commerce growth compared to Amazon, challenges in attracting younger demographics, dependence on physical stores.

- Amazon Strengths: Dominant online presence, advanced technology, vast product selection, Prime membership program.

- Amazon Weaknesses: Higher prices on some goods, logistical challenges, potential antitrust concerns.

- Target Strengths: Trendy merchandise, appealing store design, strong omnichannel strategy, focus on specific customer segments.

- Target Weaknesses: Smaller store network than Walmart, higher prices compared to Walmart.

Changes in consumer behavior, such as the rise of online shopping and shifts in purchasing power due to economic fluctuations, directly affect Walmart’s stock price. Increased online shopping necessitates investments in e-commerce infrastructure, while changes in purchasing power influence consumer spending on discretionary items.

Walmart’s Financial Performance and Stock Price, Wall mart stock price

Walmart’s financial performance directly correlates with its stock price movements. The following table presents illustrative key financial metrics over the past three years. Actual figures should be sourced from Walmart’s financial reports.

| Year | Revenue (Billions USD) | Earnings Per Share (USD) | Profit Margin (%) |

|---|---|---|---|

| 2021 | 570 | 6.00 | 3.0 |

| 2022 | 580 | 6.50 | 3.2 |

| 2023 | 600 | 7.00 | 3.5 |

For example, a significant increase in revenue, driven by strong sales growth, typically leads to a rise in Walmart’s stock price. Conversely, a decline in earnings per share due to increased operating costs or reduced sales can negatively impact the stock price.

Hypothetically, a 10% unexpected drop in revenue due to a major economic downturn could cause a significant decline in Walmart’s stock price, perhaps in the range of 15-20%, reflecting investor concerns about future profitability.

Analyst Ratings and Stock Price Predictions

Several financial institutions provide analyst ratings and price targets for Walmart stock. These predictions vary based on different analytical models and perspectives.

- Analyst A (Example): Buy rating, price target $160.

- Analyst B (Example): Hold rating, price target $150.

- Analyst C (Example): Sell rating, price target $140.

Discrepancies in analyst opinions arise from differing assumptions about future economic growth, consumer spending patterns, competitive pressures, and Walmart’s strategic execution. For instance, an analyst with a bullish outlook might emphasize Walmart’s strong supply chain and cost-cutting measures, while a bearish analyst might highlight potential risks from increased competition and inflation.

The accuracy of these predictions is inherently uncertain. Unforeseen events, such as unexpected economic shocks or significant changes in consumer behavior, can significantly impact Walmart’s actual stock performance.

Walmart’s Future Growth Prospects and Stock Price Implications

Walmart’s future growth prospects hinge on its strategic initiatives and its ability to adapt to a changing retail landscape.

Key initiatives include expanding its e-commerce capabilities, enhancing its supply chain efficiency, and pursuing international growth opportunities. These initiatives, if successful, could significantly boost Walmart’s revenue and profitability, positively impacting its stock price.

Projected revenue growth over the next five years can be visualized as an upward-sloping line graph. The line would show a gradual increase in revenue each year, potentially accelerating in later years if the company’s strategic initiatives bear fruit. The slope of the line would reflect the projected annual growth rate, potentially ranging from 3% to 5% based on analyst forecasts and considering macroeconomic factors.

The graph would include data points for each year, illustrating the projected revenue figures.

Challenges such as increased competition, inflation, and evolving consumer preferences pose risks to Walmart’s growth trajectory. Failure to effectively adapt to these challenges could negatively impact investor sentiment and lead to a decline in the stock price.

Key Questions Answered: Wall Mart Stock Price

What are the major risks associated with investing in Walmart stock?

Major risks include increased competition, economic downturns impacting consumer spending, shifts in consumer preferences, and supply chain disruptions.

How does Walmart’s dividend payout affect its stock price?

Walmart’s stock price, a reliable indicator of consumer spending, has shown some recent volatility. Understanding the broader market context is crucial, and observing the performance of other major players like IOVA can offer valuable insight; you can check the current iova stock price for comparison. Ultimately, however, analysts will continue to closely monitor Walmart’s stock price as a key barometer of the overall economic climate.

A consistent dividend payout can attract income-seeking investors, potentially increasing demand and supporting the stock price. However, large dividend payouts can also reduce funds available for reinvestment.

Where can I find real-time Walmart stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is Walmart’s current price-to-earnings ratio (P/E)?

The P/E ratio fluctuates and should be checked on a financial website for the most up-to-date information. It’s a key indicator of how the market values Walmart relative to its earnings.