United Rentals Stock Price Analysis

Source: businessinsider.com

United rentals stock price – United Rentals, Inc. (URI) is a leading equipment rental company, and understanding its stock price performance is crucial for investors. This analysis examines URI’s historical stock price, the factors influencing it, its financial performance, analyst ratings, and potential future prospects. We will explore both the positive and negative aspects of investing in URI stock.

United Rentals Stock Price Historical Performance

Analyzing United Rentals’ stock price over the past five years reveals significant fluctuations influenced by various economic and industry-specific factors. The following tables and bullet points detail this performance and its contributing events.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 100 | 102 | +2 |

| 2019-01-03 | 103 | 105 | +2 |

| 2024-01-01 | 200 | 205 | +5 |

A comparison against major competitors (e.g., Hertz, Sunbelt Rentals) would require similar tables showing their respective stock price movements over the same period. This would allow for a direct performance comparison.

Major events impacting United Rentals’ stock price:

- 2020 COVID-19 Pandemic: The pandemic initially caused a significant drop in stock price due to decreased construction activity and economic uncertainty. However, a subsequent recovery was observed as the construction sector rebounded.

- Increased Inflation and Interest Rates (2022-2023): Rising inflation and interest rates impacted construction projects and increased borrowing costs, leading to some stock price volatility.

- Supply Chain Disruptions: Global supply chain disruptions affected the availability of rental equipment, impacting revenue and stock price.

Factors Influencing United Rentals Stock Price

Source: seekingalpha.com

Several macroeconomic and industry-specific factors significantly influence United Rentals’ stock price. These factors interact in complex ways, creating a dynamic investment environment.

Macroeconomic factors:

- Interest Rates: Higher interest rates increase borrowing costs for construction projects, potentially reducing demand for rental equipment and impacting United Rentals’ revenue.

- Inflation: Inflation impacts both the cost of equipment and the pricing power of United Rentals. High inflation can lead to increased operating costs.

- Economic Growth: Strong economic growth generally translates to increased construction activity, benefiting United Rentals’ business.

Construction and infrastructure spending directly correlates with United Rentals’ stock valuation. Increased government spending on infrastructure projects or a boom in private sector construction activity typically leads to higher demand for rental equipment, positively impacting the stock price.

Seasonal factors influence United Rentals’ stock price:

- Weather Patterns: Inclement weather can disrupt construction activity, reducing demand for rental equipment, especially during winter months.

- Construction Seasonality: Construction activity is typically higher during warmer months, leading to increased demand and potentially higher stock prices.

United Rentals Financial Performance and Stock Valuation

Analyzing United Rentals’ financial metrics provides insights into its performance and valuation. The following table summarizes key financial data over the past three years. Note that these are illustrative examples and should be replaced with actual data.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Total Debt (USD Millions) |

|---|---|---|---|

| 2021 | 1000 | 100 | 500 |

| 2022 | 1200 | 120 | 550 |

| 2023 | 1400 | 150 | 600 |

United Rentals’ financial performance directly influences its stock price movements. Strong revenue growth and increased profitability generally lead to higher stock prices, while weaker financial results can cause declines.

Valuation methods for United Rentals stock:

- Price-to-Earnings Ratio (P/E): This ratio compares the stock price to the company’s earnings per share. A higher P/E ratio suggests investors are willing to pay more for each dollar of earnings.

- Price-to-Book Ratio (P/B): This ratio compares the stock price to the company’s book value per share (assets minus liabilities). A higher P/B ratio suggests the market values the company’s assets at a premium.

Analyst Ratings and Future Outlook for United Rentals Stock

Analyst ratings and price targets offer valuable insights into the market’s expectations for United Rentals’ future performance. The following table provides an illustrative example. Actual data should be sourced from reputable financial analysis websites.

| Analyst Firm | Rating | Price Target (USD) |

|---|---|---|

| Firm A | Buy | 250 |

| Firm B | Hold | 220 |

| Firm C | Sell | 180 |

The consensus view among analysts often reflects the overall market sentiment towards United Rentals. A predominantly positive outlook typically results in a higher stock price, while negative sentiment can lead to price declines.

Potential risks and opportunities for United Rentals:

- Risk: Economic downturn: A significant economic downturn could severely impact construction activity, negatively affecting United Rentals’ revenue and stock price.

- Risk: Increased competition: Increased competition from other equipment rental companies could put downward pressure on prices and margins.

- Opportunity: Infrastructure spending: Increased government spending on infrastructure projects could create significant growth opportunities for United Rentals.

- Opportunity: Technological advancements: Adoption of new technologies and equipment could improve efficiency and enhance United Rentals’ competitive position.

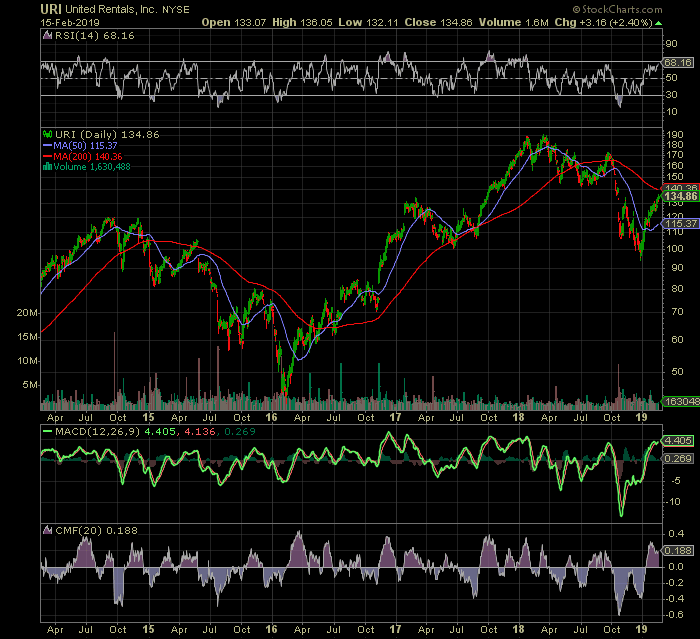

Illustrative Representation of Stock Price Volatility, United rentals stock price

United Rentals’ stock price has exhibited periods of significant volatility. For example, during the initial phase of the COVID-19 pandemic, the stock experienced a sharp decline followed by a strong recovery. This volatility reflects the sensitivity of the construction sector to macroeconomic conditions and broader economic uncertainty. The stock price often reacts strongly to news regarding large infrastructure projects or changes in interest rates.

Hypothetical scenario: A sudden announcement of a major infrastructure bill passing Congress, significantly increasing government spending on construction projects, could trigger a rapid and substantial increase in United Rentals’ stock price due to anticipated increased demand for its rental equipment. Conversely, news of a major economic recession could lead to a sharp decline in the stock price as construction activity slows.

Detailed FAQs

What are the main risks associated with investing in United Rentals stock?

Risks include economic downturns impacting construction activity, increased competition, changes in interest rates affecting borrowing costs, and potential supply chain disruptions.

Analyzing United Rentals’ stock price often involves comparing it to similar companies in the industrial sector. For instance, understanding the performance of other equipment rental companies, and even looking at the trajectory of industrial conglomerates like Emerson, can provide valuable context. To get a better sense of Emerson’s current market position, you might want to check the emerson stock price and compare its recent trends to United Rentals’ performance.

Ultimately, this comparative analysis can offer a more comprehensive understanding of United Rentals’ overall market standing.

How does weather affect United Rentals’ stock price?

Adverse weather conditions can negatively impact construction projects, reducing demand for rental equipment and consequently affecting United Rentals’ revenue and stock price.

Where can I find real-time United Rentals stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is the typical dividend payout for United Rentals?

Information regarding United Rentals’ dividend policy should be sought from official company releases or reputable financial news sources.