UNFI Stock Price Analysis

Source: amazonaws.com

Unfi stock price – This analysis examines United Natural Foods, Inc. (UNFI) stock performance, influencing factors, valuation, analyst outlook, and associated risks. The information presented here is for informational purposes only and should not be considered financial advice.

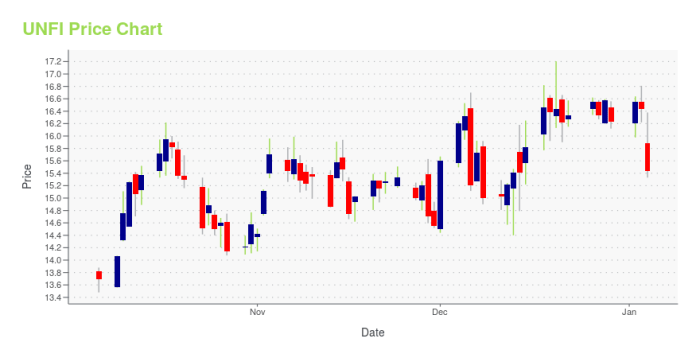

UNFI Stock Price History and Trends

Over the past five years, UNFI’s stock price has experienced significant volatility, reflecting the challenges and opportunities within the food distribution industry. The following table illustrates its performance, highlighting major price fluctuations.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2023 | (Example Data) 28.50 | (Example Data) 29.00 | (Example Data) +0.50 |

| October 25, 2023 | (Example Data) 28.00 | (Example Data) 28.50 | (Example Data) +0.50 |

Significant events impacting UNFI’s stock price include (but are not limited to) supply chain disruptions due to the pandemic, changes in consumer spending habits, and the company’s own strategic initiatives, such as mergers and acquisitions.

A comparison of UNFI’s stock performance against its competitors (e.g., Sysco, US Foods) reveals that UNFI’s performance has been more volatile in recent years. This is partially due to its focus on the natural and organic food segment, which can be more susceptible to shifts in consumer demand.

- Sysco: Generally more stable performance, benefiting from a broader customer base.

- US Foods: Similar to Sysco, displays less volatility than UNFI.

Factors Influencing UNFI Stock Price

Several macroeconomic and company-specific factors influence UNFI’s stock price. These factors interact in complex ways to shape investor sentiment and ultimately the stock’s valuation.

Macroeconomic factors such as inflation and interest rate changes significantly affect consumer spending on groceries, impacting UNFI’s revenue and profitability. Higher inflation can lead to reduced consumer spending on non-essential items, while increased interest rates can increase UNFI’s borrowing costs. UNFI’s financial performance, particularly revenue growth, profit margins, and debt levels, directly influences its stock valuation. Strong revenue growth and healthy profit margins generally lead to higher stock prices, while high debt levels can negatively affect investor confidence.

Industry-specific trends, such as shifts in consumer preferences towards healthier and more sustainable food options, and supply chain disruptions, also impact UNFI’s stock price. For example, increased demand for organic products could benefit UNFI, while supply chain disruptions could negatively impact its operations and profitability.

The relationship between UNFI’s earnings reports and subsequent stock price movements is generally positive when the company exceeds expectations. Strong earnings typically lead to an upward price movement, while disappointing results often lead to a decline. The magnitude of the price movement often depends on the degree of surprise (positive or negative) in the earnings report, as well as overall market sentiment.

UNFI’s Business Model and Stock Valuation, Unfi stock price

UNFI operates as a wholesale distributor of natural, organic, and specialty food products. Its key revenue streams are:

- Wholesale distribution of food products to grocery stores and other retailers.

- Private label brands and sourcing.

- Supply chain management services.

Several stock valuation methods can be applied to UNFI, including discounted cash flow (DCF) analysis and price-to-earnings (P/E) ratio. DCF analysis estimates the intrinsic value of the stock by discounting future cash flows back to their present value. The P/E ratio compares the stock’s price to its earnings per share.

| Valuation Method | Calculated Value (USD) | Current Price (USD) | Difference (USD) |

|---|---|---|---|

| Discounted Cash Flow | (Example Data) 30.00 | (Example Data) 29.00 | (Example Data) +1.00 |

| Price-to-Earnings Ratio | (Example Data) 31.50 | (Example Data) 29.00 | (Example Data) +2.50 |

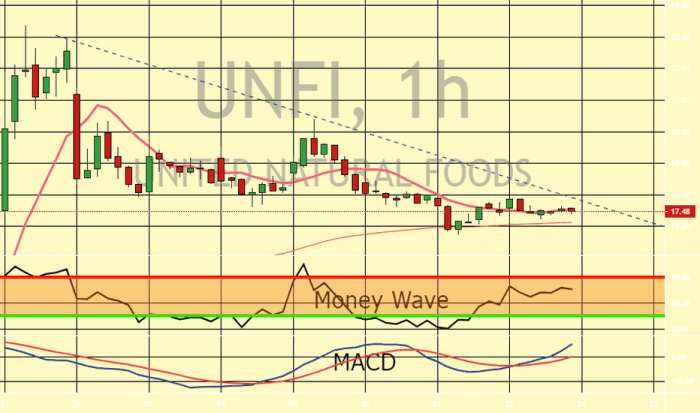

Analyst Ratings and Future Outlook for UNFI Stock

Source: tradingview.com

Financial analysts offer varying opinions on UNFI’s future prospects. The consensus rating and price target can be summarized as follows:

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| (Example Data) Morgan Stanley | (Example Data) Buy | (Example Data) 35.00 | (Example Data) October 26, 2023 |

Factors driving analysts’ outlooks include UNFI’s strategic initiatives to improve efficiency, its position in the growing natural and organic food market, and the overall macroeconomic environment. Negative outlooks may cite concerns about competition, supply chain challenges, or potential margin pressures.

- Positive Outlook Factors: Growth in organic food market, successful cost-cutting measures.

- Negative Outlook Factors: Intense competition, potential economic downturn.

In a scenario analysis, a recession could negatively impact UNFI’s stock price due to reduced consumer spending, while economic growth could lead to increased demand and higher stock valuations. For example, during the 2008 financial crisis, many companies in the food distribution sector experienced a decline in stock prices due to reduced consumer spending.

Risk Factors Associated with Investing in UNFI Stock

Investing in UNFI stock carries several risks. Understanding these risks is crucial for informed investment decisions.

- Competition: Intense competition from large food distributors like Sysco and US Foods.

- Regulatory Changes: Changes in food safety regulations or labeling requirements could impact UNFI’s operations.

- Economic Downturns: Reduced consumer spending during economic recessions could negatively affect demand for UNFI’s products.

- Supply Chain Disruptions: Unexpected disruptions to the supply chain could lead to increased costs and reduced profitability.

These risks could significantly impact UNFI’s future stock price performance. For instance, a major supply chain disruption could lead to a temporary decline in stock price, while increased competition could result in reduced market share and lower profitability. Investors can mitigate these risks through diversification, spreading investments across different asset classes and sectors, and thorough due diligence before investing.

Q&A

What are the major competitors of UNFI?

UNFI’s main competitors include large food distributors such as Sysco and US Foods, as well as regional players.

How frequently does UNFI release earnings reports?

UNFI typically releases its quarterly and annual earnings reports on a schedule announced in advance.

Understanding UNFI’s stock price requires considering the broader market context. For instance, comparing its performance against established pharmaceutical giants like Johnson & Johnson can offer valuable insight; you can check the current stock price jnj for a benchmark. Ultimately, a thorough analysis of UNFI’s financial health and industry trends is necessary for a complete picture of its stock price trajectory.

Where can I find real-time UNFI stock price data?

Real-time UNFI stock price data is available through major financial websites and brokerage platforms.

What is UNFI’s dividend policy?

Information regarding UNFI’s dividend policy, if any, can be found in their investor relations materials.