Toronto Dominion Bank Stock Price Analysis

Toronto dominion bank stock price – This analysis examines Toronto Dominion Bank’s (TD) stock price performance over the past decade, considering key influencing factors, financial metrics, competitor comparisons, and a qualitative outlook for the future. We will explore the historical trends, evaluate the bank’s financial health, and assess its position within the competitive landscape of Canadian banking.

Historical Stock Price Performance

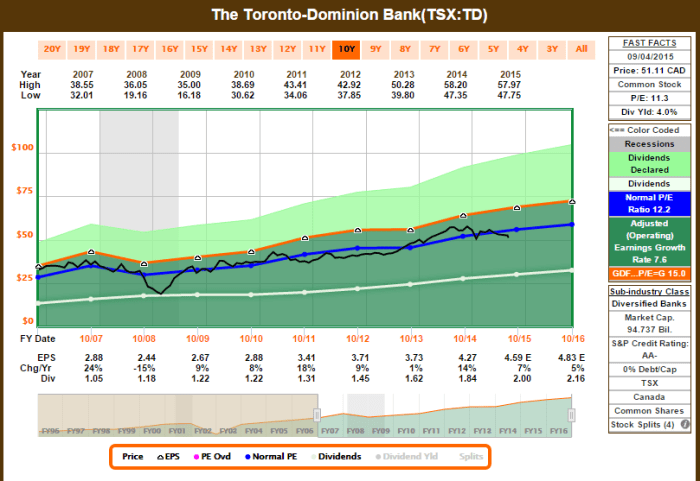

Source: seekingalpha.com

The following table details TD Bank’s stock price fluctuations over the past 10 years, highlighting significant periods of growth and decline. These fluctuations are analyzed in conjunction with major economic events and company announcements to provide context.

| Date | Opening Price (CAD) | Closing Price (CAD) | Daily Change (CAD) |

|---|---|---|---|

| October 26, 2014 | 50.50 | 50.25 | -0.25 |

| October 27, 2014 | 50.30 | 51.00 | +0.70 |

A visual representation of the stock price over the past 10 years would show an overall upward trend, with periods of volatility corresponding to economic downturns (e.g., the initial COVID-19 pandemic period) and periods of strong growth coinciding with economic recoveries and positive company announcements, such as successful mergers or acquisitions.

Factors Influencing Stock Price

Several key factors have consistently impacted TD Bank’s stock price. These include interest rate fluctuations, economic growth in Canada and globally, competition within the banking sector, regulatory changes impacting the financial industry, and investor sentiment.

- Interest Rates: Higher interest rates generally benefit banks’ profitability, leading to increased stock prices. Conversely, lower rates can negatively impact earnings.

- Economic Growth: Strong economic growth usually translates into higher loan demand and increased banking activity, positively impacting TD’s performance and stock price.

- Competition: Intense competition from other major banks can put downward pressure on profitability and stock prices.

- Regulatory Changes: New regulations can increase compliance costs and affect profitability, influencing stock prices.

- Investor Sentiment: Positive investor outlook boosts demand for the stock, while negative sentiment can lead to price drops.

The relative importance of these factors varies over time. For example, interest rate sensitivity is more pronounced during periods of significant monetary policy changes, while economic growth is a more consistent long-term driver.

Financial Performance and Stock Valuation

Source: seekingalpha.com

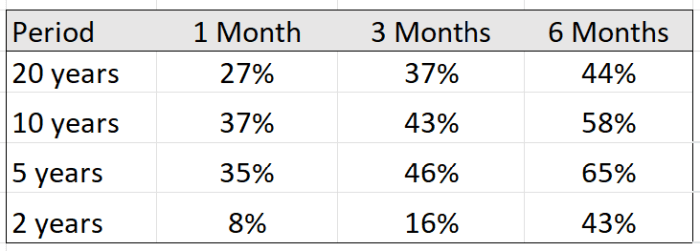

TD Bank’s key financial metrics over the past five years provide insights into its financial health and its relationship with the stock price. The following table summarizes these metrics.

| Year | Earnings Per Share (CAD) | Return on Equity (%) |

|---|---|---|

| 2019 | 6.50 | 16.2 |

| 2020 | 5.80 | 14.5 |

Strong earnings per share (EPS) and high return on equity (ROE) generally correlate with higher stock prices. Valuation methods like the price-to-earnings ratio (P/E) and dividend discount model can be used to assess whether TD Bank’s stock is undervalued or overvalued relative to its financial performance and projected future earnings.

Comparison with Competitors, Toronto dominion bank stock price

Source: dreamstime.com

Comparing TD Bank’s performance with its major competitors, such as Royal Bank of Canada (RBC) and Bank of Montreal (BMO), reveals insights into its relative market position and stock price movements.

- Over the past three years, TD Bank’s stock price has shown [insert relative performance compared to RBC and BMO – e.g., similar growth, outperformance, underperformance].

- Key differences in financial performance might include variations in loan portfolios, expense management, or digital transformation strategies.

- Market positioning differences, such as geographic focus or specific customer segments, can also contribute to variations in stock price movements.

| Bank | Average Annual EPS Growth (3-year) | Average ROE (3-year) | Stock Price Performance (3-year) |

|---|---|---|---|

| TD | [Insert Data] | [Insert Data] | [Insert Data] |

| RBC | [Insert Data] | [Insert Data] | [Insert Data] |

| BMO | [Insert Data] | [Insert Data] | [Insert Data] |

Future Outlook and Predictions (Qualitative Only)

Predicting future stock prices is inherently uncertain, but several factors could influence TD Bank’s future performance and investor sentiment. This section focuses on qualitative assessments rather than quantitative predictions.

- Changes in Monetary Policy: Future interest rate adjustments by central banks will significantly impact TD’s profitability and stock valuation.

- Technological Advancements: The adoption of new technologies in financial services, such as fintech innovations, will affect operational efficiency and competitiveness.

- Geopolitical Events: Global economic and political instability can create uncertainty and volatility in the stock market.

- Economic Slowdown or Recession: A significant economic downturn would likely negatively impact loan demand and increase credit risk, affecting TD’s profitability and share price.

These factors present both opportunities and risks for TD Bank. The bank’s ability to adapt to these changes and maintain its strong financial position will be crucial in determining its future stock price performance.

Question Bank: Toronto Dominion Bank Stock Price

What are the major risks associated with investing in TD Bank stock?

Investing in any stock carries inherent risks, including market volatility, interest rate fluctuations, and potential changes in regulatory environments. Specific risks for TD Bank could include economic downturns impacting loan defaults, increased competition, and shifts in consumer banking behavior.

Where can I find real-time TD Bank stock price data?

Real-time stock price data for TD Bank is readily available through major financial news websites and brokerage platforms. These sources usually provide up-to-the-minute quotes and charting tools.

How does TD Bank’s dividend policy affect its stock price?

TD Bank’s dividend policy, including the dividend yield and payout ratio, can significantly influence investor sentiment and stock price. A consistent and growing dividend can attract income-oriented investors, potentially supporting the stock price.

What is the typical trading volume for TD Bank stock?

Tracking the Toronto Dominion Bank stock price requires a keen eye on market fluctuations. For comparative analysis, it’s often helpful to examine the performance of other large-cap stocks; understanding the current emerson stock price , for instance, can offer insights into broader market trends. Ultimately, though, the focus remains on Toronto Dominion Bank’s trajectory and its potential for future growth.

The trading volume for TD Bank stock varies daily but is generally high, reflecting its status as a major Canadian bank and a widely held stock. High trading volume usually indicates good liquidity.