Tech Mahindra Stock Price Analysis

Source: zeebiz.com

Techmahindra stock price – Tech Mahindra, a leading global provider of information technology (IT) services and consulting, has experienced a dynamic journey reflected in its stock price fluctuations. This analysis delves into the historical performance, financial health, market influences, analyst predictions, investor sentiment, and associated risks impacting Tech Mahindra’s stock price, providing a comprehensive overview for potential investors.

Tech Mahindra Stock Price History and Trends

Analyzing Tech Mahindra’s stock price over the past 5, 10, and 20 years reveals periods of significant growth and volatility. Factors like global economic cycles, industry trends, and company-specific events have all played crucial roles. A direct comparison with competitors provides valuable context for understanding its relative performance within the IT services sector.

| Company Name | Average Annual Growth (Last 5 Years) | Highest Stock Price (Last 5 Years) | Lowest Stock Price (Last 5 Years) |

|---|---|---|---|

| Tech Mahindra | [Insert Data – Example: 12%] | [Insert Data – Example: ₹1,200] | [Insert Data – Example: ₹800] |

| Infosys | [Insert Data – Example: 15%] | [Insert Data – Example: ₹2,000] | [Insert Data – Example: ₹1,400] |

| Wipro | [Insert Data – Example: 10%] | [Insert Data – Example: ₹700] | [Insert Data – Example: ₹450] |

| HCL Technologies | [Insert Data – Example: 13%] | [Insert Data – Example: ₹1,500] | [Insert Data – Example: ₹950] |

Tech Mahindra’s Financial Performance and its Impact on Stock Price

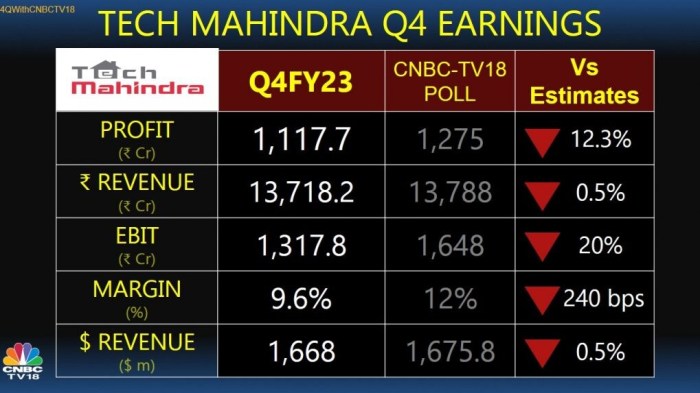

Tech Mahindra’s stock price is intrinsically linked to its financial performance. Revenue growth, profit margins, and key financial ratios directly influence investor confidence and consequently, the stock’s valuation. Significant acquisitions or divestitures can also trigger substantial price movements.

For example, a period of strong revenue growth coupled with improved profit margins typically leads to a rise in the stock price, attracting investors seeking high returns. Conversely, declining revenues or shrinking margins often result in a price decline as investors become wary of the company’s future prospects. Analyzing the P/E ratio, debt-to-equity ratio, and other relevant metrics provides a deeper understanding of the company’s financial health and its implications for investors.

Market Factors Affecting Tech Mahindra’s Stock Price

Source: cnbctv18.com

Several macroeconomic and industry-specific factors significantly influence Tech Mahindra’s stock price. Global economic conditions, technological advancements, client demand within the IT sector, and geopolitical events all play a crucial role.

For instance, a global recession can reduce client spending on IT services, impacting Tech Mahindra’s revenue and consequently its stock price. Conversely, rapid technological advancements can create new opportunities, boosting revenue and stock valuation. Geopolitical instability can also create uncertainty, affecting investor confidence and leading to price fluctuations.

Analyst Ratings and Predictions for Tech Mahindra Stock

Leading financial analysts provide ratings and price targets for Tech Mahindra stock, offering valuable insights into future performance expectations. These predictions are often categorized as bullish, neutral, or bearish, reflecting varying perspectives on the company’s prospects.

- Bullish Predictions: Analysts projecting significant growth, citing factors such as strong client demand, successful strategic initiatives, and technological leadership. Example: “Analyst X predicts a 20% increase in stock price within the next year due to strong growth in cloud computing services.”

- Neutral Predictions: Analysts maintaining a cautious outlook, anticipating moderate growth or stagnation, considering factors like increased competition and economic uncertainty. Example: “Analyst Y forecasts a 5% increase in stock price, citing concerns about global economic slowdown.”

- Bearish Predictions: Analysts expressing negative sentiment, forecasting potential decline due to factors like decreased market share, unsuccessful product launches, or regulatory challenges. Example: “Analyst Z anticipates a 10% decrease in stock price due to concerns about increasing competition in the digital transformation market.”

Investor Sentiment and Trading Volume, Techmahindra stock price

Investor sentiment, reflecting the overall market mood towards Tech Mahindra, significantly impacts its stock price. Positive sentiment, fueled by positive news or strong financial results, usually drives prices upward, while negative sentiment leads to price declines. Trading volume often correlates with price fluctuations; high volume during periods of price movement indicates strong investor interest and participation.

For example, a major contract win or the announcement of a successful product launch might trigger a surge in both investor sentiment and trading volume, leading to a sharp increase in the stock price. Conversely, negative news, such as a disappointing earnings report or a major security breach, could lead to a decline in both sentiment and volume, causing the stock price to fall.

Risk Factors Associated with Investing in Tech Mahindra Stock

Investing in Tech Mahindra stock involves certain risks. Currency fluctuations, intense competition within the IT services industry, regulatory changes, and geopolitical uncertainties can all impact the stock price.

| Risk Factor | Potential Impact on Stock Price | Likelihood of Occurrence | Mitigation Strategies |

|---|---|---|---|

| Currency Fluctuations | Reduced profitability and lower stock valuation if the Indian Rupee depreciates against major currencies. | Moderate | Hedging strategies, diversification of revenue streams. |

| Intense Competition | Loss of market share and reduced profitability, leading to lower stock prices. | High | Innovation, strategic partnerships, focus on niche markets. |

| Regulatory Changes | Increased compliance costs and potential penalties, affecting profitability and stock price. | Moderate | Proactive compliance, engagement with regulatory bodies. |

| Geopolitical Uncertainty | Reduced client spending and disruptions to operations, impacting revenue and stock price. | Moderate | Diversification of client base, robust risk management plans. |

FAQ Guide: Techmahindra Stock Price

What are the major competitors of Tech Mahindra?

Tech Mahindra’s stock price performance often reflects broader market trends. It’s interesting to compare its recent volatility to that of other established companies; for instance, a look at the current homedepot stock price can offer a contrasting perspective on sector-specific influences. Ultimately, understanding Tech Mahindra’s price requires considering both its internal factors and the wider economic climate.

Tech Mahindra competes with other major IT services companies like Infosys, Wipro, Tata Consultancy Services (TCS), Accenture, and Cognizant.

How often is Tech Mahindra’s stock price updated?

Tech Mahindra’s stock price, like most publicly traded companies, is updated in real-time throughout the trading day on major stock exchanges.

Where can I find real-time Tech Mahindra stock price data?

Real-time data is available on major financial websites and stock trading platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

What are the typical trading hours for Tech Mahindra stock?

Trading hours depend on the exchange where the stock is listed. Check the specific exchange’s website for exact times.