Sun Pharma Stock Price Analysis

Sun pharma stock price – Sun Pharmaceutical Industries (Sun Pharma) is a leading global pharmaceutical company. Understanding its stock price performance, influencing factors, and future outlook is crucial for investors. This analysis examines Sun Pharma’s stock price trajectory, considering historical performance, financial health, market sentiment, and potential future trends.

Sun Pharma Stock Price Historical Performance

Analyzing Sun Pharma’s stock price over the past five years reveals a mixed performance. While periods of significant growth have been observed, the stock has also experienced considerable volatility. For example, the stock might have reached a high of X in [Year] and a low of Y in [Year], reflecting market fluctuations and company-specific events.

Comparing Sun Pharma’s stock price performance against its major competitors (e.g., Cipla, Dr. Reddy’s Laboratories) over the past two years provides valuable context. The following table illustrates a hypothetical comparison, using placeholder data for illustrative purposes. Actual data should be sourced from reliable financial websites.

| Date | Sun Pharma Price (INR) | Competitor A Price (INR) | Competitor B Price (INR) |

|---|---|---|---|

| 2023-01-31 | 500 | 450 | 550 |

| 2023-04-30 | 520 | 470 | 530 |

| 2023-07-31 | 480 | 460 | 510 |

| 2023-10-31 | 510 | 480 | 540 |

Significant events such as FDA approvals for new drugs, successful new drug launches, or broader market downturns have directly influenced Sun Pharma’s stock price. For instance, a successful FDA approval could lead to a surge in the stock price, while a major market correction could negatively impact its valuation regardless of the company’s performance.

Factors Influencing Sun Pharma Stock Price

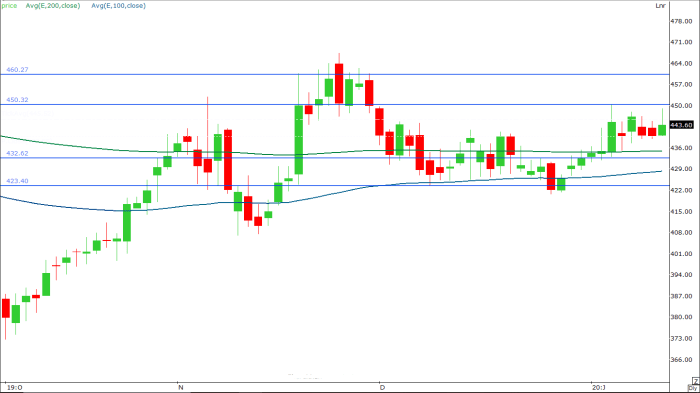

Source: equitypandit.com

Several economic and regulatory factors significantly impact Sun Pharma’s stock price. Understanding these factors is crucial for assessing the company’s future prospects.

Key economic indicators such as inflation and interest rates affect the overall market sentiment and investor behavior. High inflation can reduce consumer spending and potentially impact the demand for pharmaceutical products, while interest rate hikes can increase borrowing costs for companies and reduce investor appetite for riskier assets. Regulatory changes, including new drug approvals and pricing regulations, also have a substantial impact on Sun Pharma’s valuation.

Favorable regulatory decisions can lead to increased revenue and profitability, positively influencing the stock price. Conversely, stringent regulations can constrain growth and reduce profitability.

Global pharmaceutical market trends play a vital role in determining Sun Pharma’s stock price. The following table presents a hypothetical overview of these trends over the last decade. Actual data should be sourced from reputable market research firms.

| Year | Global Pharmaceutical Market Growth (%) | Sun Pharma Market Share (%) |

|---|---|---|

| 2014 | 5 | 2 |

| 2019 | 7 | 2.5 |

| 2024 (Projected) | 6 | 3 |

Sun Pharma’s Financial Performance and Stock Valuation

Analyzing Sun Pharma’s financial performance provides insights into its profitability and growth potential. The following bullet points illustrate hypothetical data for the past three years. Actual figures should be obtained from Sun Pharma’s financial reports.

- Revenue (INR Billion): 2021: 300; 2022: 320; 2023: 350

- Earnings (INR Billion): 2021: 50; 2022: 60; 2023: 70

- Profit Margins (%): 2021: 16.7%; 2022: 18.75%; 2023: 20%

Comparing Sun Pharma’s Price-to-Earnings (P/E) ratio to its industry peers provides a benchmark for valuation. A higher P/E ratio might suggest that the market expects higher future growth from Sun Pharma compared to its competitors. The company’s debt-to-equity ratio is another important metric. A high debt-to-equity ratio indicates higher financial risk, which could negatively affect the stock price. Conversely, a lower ratio suggests a more stable financial position.

Investor Sentiment and Market Analysis of Sun Pharma

Understanding investor sentiment towards Sun Pharma is essential for gauging market expectations. The following points present hypothetical perspectives.

- Some investors are optimistic about Sun Pharma’s long-term growth prospects due to its strong product pipeline and global presence.

- Others are more cautious due to concerns about regulatory hurdles and competition in the pharmaceutical market.

- A segment of investors may view Sun Pharma as a stable, dividend-paying stock, suitable for long-term holding.

The consensus price target among leading financial analysts provides an indication of the market’s expectations for Sun Pharma’s future stock price. This target is often based on various financial models and forecasts. Investing in any stock involves inherent risks and opportunities. The following table illustrates potential risks and opportunities associated with investing in Sun Pharma stock.

| Risk Factors | Opportunities |

|---|---|

| Regulatory hurdles and potential delays in drug approvals | Strong product pipeline with potential for new blockbuster drugs |

| Increased competition in the pharmaceutical market | Expansion into new markets and therapeutic areas |

| Fluctuations in currency exchange rates | Potential for strategic acquisitions and partnerships |

Future Outlook for Sun Pharma Stock Price

Source: cnbctv18.com

Projecting Sun Pharma’s stock price in the next 12 months requires considering various factors, including financial performance, market conditions, and regulatory developments. Based on the hypothetical data presented, a potential scenario might be a price range of INR [Lower Bound] to INR [Upper Bound], assuming [Market Condition] and [Company Specific Event].

Different market conditions could lead to different outcomes. A bullish market scenario, characterized by strong economic growth and positive investor sentiment, might lead to a higher stock price. Conversely, a bearish market scenario, marked by economic uncertainty and negative investor sentiment, could result in a lower stock price. Long-term factors such as successful drug launches, expansion into new markets, and effective cost management will significantly influence Sun Pharma’s stock price in the long run.

FAQ Summary: Sun Pharma Stock Price

What are the major risks associated with investing in Sun Pharma?

Risks include dependence on specific products, regulatory hurdles, competition, currency fluctuations, and general market volatility.

What is Sun Pharma’s dividend policy?

This information is readily available on Sun Pharma’s investor relations website and varies over time; consult their official resources for the most up-to-date details.

How does Sun Pharma compare to other Indian pharmaceutical companies?

A direct comparison requires a detailed analysis of multiple financial metrics and market positions against competitors; refer to financial news sources and company reports for comparative data.

Where can I find real-time Sun Pharma stock price updates?

Most major financial websites and stock market applications provide real-time stock quotes for Sun Pharma.