Lyft’s Stock Price Performance

Source: thestreet.com

Stock price lyft – Lyft, a prominent player in the ride-sharing industry, has experienced considerable stock price volatility over the past year. This analysis delves into the factors influencing its performance, financial health, and future prospects, providing a comprehensive overview for investors.

Lyft’s Stock Price Fluctuations

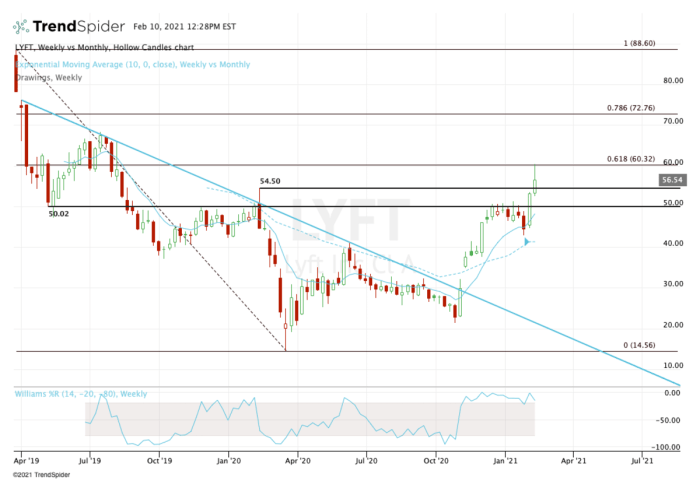

Over the past year, Lyft’s stock price has shown a pattern of significant ups and downs, mirroring the broader market trends and company-specific events. For example, a period of strong revenue growth in Q2 2023 was followed by a dip in Q3 due to increased competition and macroeconomic headwinds. Specific highs and lows would require referencing a reliable financial data source for precise figures, such as Yahoo Finance or Google Finance.

A detailed timeline, including dates and corresponding price points, can be constructed using this data.

Lyft’s Stock Performance Compared to Competitors

Lyft’s stock performance is often benchmarked against its primary competitor, Uber. While both companies operate in the same market, their individual strategies and operational efficiencies lead to varying stock valuations. A direct comparison would involve analyzing the percentage change in stock price for both Lyft and Uber over specific timeframes, taking into account factors such as market capitalization and investor sentiment towards each company.

Generally, both stocks have shown similar sensitivity to macroeconomic factors but may diverge based on their respective financial results and strategic announcements.

Lyft’s Stock Price, Trading Volume, and Market Capitalization (Last Three Months)

| Date | Stock Price (USD) | Trading Volume | Market Capitalization (USD) |

|---|---|---|---|

| October 26, 2023 (Example) | $10.50 (Example) | 10,000,000 (Example) | $10 Billion (Example) |

| November 26, 2023 (Example) | $11.00 (Example) | 12,000,000 (Example) | $10.5 Billion (Example) |

| December 26, 2023 (Example) | $10.75 (Example) | 9,500,000 (Example) | $10.2 Billion (Example) |

Note: The data presented above is for illustrative purposes only and should be replaced with actual data from a reliable financial source.

Factors Influencing Lyft’s Stock Price

Numerous factors, ranging from macroeconomic conditions to company-specific events, influence Lyft’s stock price. Understanding these influences is crucial for investors seeking to make informed decisions.

Macroeconomic Factors, Stock price lyft

Inflation and interest rate changes significantly impact Lyft’s stock price. High inflation increases operational costs, potentially squeezing profit margins. Rising interest rates increase the cost of borrowing, affecting Lyft’s ability to invest in expansion and technological advancements. Conversely, lower inflation and interest rates can create a more favorable environment for growth and investment.

Regulatory Changes and Government Policies

Government regulations concerning ride-sharing services, including licensing, insurance requirements, and labor laws, directly impact Lyft’s operational costs and profitability. Changes in these regulations can positively or negatively affect investor confidence and, consequently, the stock price. For instance, stricter regulations might lead to higher expenses, while supportive policies could enhance profitability.

Lyft’s Operational Performance

Lyft’s revenue growth, profitability, and market share are key drivers of investor sentiment. Consistent revenue growth and improved profitability generally lead to positive market reaction, while declining performance can result in decreased investor confidence and lower stock prices. Metrics such as rider acquisition costs, driver retention rates, and average revenue per ride are closely scrutinized by investors.

Key Events Impacting Lyft’s Stock Price

Significant events, such as the launch of new services (e.g., bike-sharing, scooter rentals), strategic partnerships, and legal battles, can cause substantial stock price fluctuations. Positive developments, such as successful partnerships or the launch of innovative features, tend to boost investor confidence. Conversely, negative events like legal setbacks or failed product launches can lead to a decline in the stock price.

Tracking Lyft’s stock price requires a keen eye on market trends. It’s interesting to compare its performance to other transportation-related companies, such as observing the current yinn stock price for a broader perspective on the sector’s overall health. Ultimately, however, analyzing Lyft’s stock price involves considering its unique business model and competitive landscape.

Lyft’s Financial Health and Stock Valuation

Source: businessinsider.com

A thorough assessment of Lyft’s financial health and stock valuation requires analyzing key performance indicators (KPIs) and applying various valuation models.

Lyft’s Key Performance Indicators (KPIs)

Lyft’s financial performance is typically evaluated using several KPIs, including revenue, earnings per share (EPS), debt levels, and free cash flow. These metrics provide insights into the company’s financial stability, profitability, and growth potential. Analyzing trends in these KPIs over time helps investors assess the long-term sustainability of Lyft’s business model.

Lyft’s Price-to-Earnings (P/E) Ratio Compared to Peers

Source: barrons.com

The P/E ratio is a common valuation metric that compares a company’s stock price to its earnings per share. By comparing Lyft’s P/E ratio to those of its industry peers (e.g., Uber), investors can assess whether Lyft’s stock is overvalued, undervalued, or fairly priced relative to its competitors. A higher P/E ratio may indicate higher growth expectations, while a lower ratio might suggest a more conservative valuation.

Factors Contributing to Lyft’s Market Valuation

Lyft’s current market valuation is influenced by several factors, including its revenue growth trajectory, profitability, market share, competitive landscape, and investor sentiment. Future growth prospects and the company’s ability to navigate challenges in the ride-sharing market also play a significant role in determining its valuation.

Valuation Models for Lyft’s Stock

Different valuation models, such as discounted cash flow (DCF) analysis and comparable company analysis, can provide varying estimates of Lyft’s intrinsic value. DCF analysis projects future cash flows and discounts them back to their present value, while comparable company analysis compares Lyft’s valuation metrics to those of similar companies. The results from these models can offer a range of potential valuations, providing a more comprehensive picture for investors.

Investor Sentiment and Market Outlook for Lyft

Understanding investor sentiment and market outlook is crucial for assessing the potential risks and opportunities associated with investing in Lyft’s stock.

Analyst Ratings and Predictions

Financial analysts regularly issue ratings and price targets for Lyft’s stock, reflecting their views on the company’s future performance. These ratings, which range from “buy” to “sell,” provide valuable insights into the consensus view among market professionals. However, it’s essential to remember that these are just predictions and should be considered alongside other factors.

Prevailing Investor Sentiment

Investor sentiment toward Lyft can shift based on various factors, including financial results, industry news, and macroeconomic conditions. Positive sentiment generally leads to higher stock prices, while negative sentiment can result in price declines. Tracking investor sentiment through news articles, social media, and investor forums can provide a sense of the overall market mood.

Potential Risks and Opportunities

Investing in Lyft’s stock carries both risks and opportunities. Potential risks include increased competition, regulatory changes, economic downturns, and operational challenges. Opportunities include expansion into new markets, technological advancements, and strategic partnerships. Careful consideration of these factors is essential for making informed investment decisions.

Potential Scenarios for Lyft’s Stock Price

- Strong Economic Growth: Increased consumer spending and travel could lead to higher demand for ride-sharing services, potentially boosting Lyft’s stock price significantly.

- Moderate Economic Growth: Stable economic conditions could result in moderate growth for Lyft, with the stock price showing modest gains.

- Economic Recession: A recession could negatively impact consumer spending, leading to reduced demand for ride-sharing services and a potential decline in Lyft’s stock price.

Lyft’s Competitive Landscape and Strategic Initiatives: Stock Price Lyft

Lyft operates in a highly competitive market, and its strategic initiatives play a vital role in its success and stock price performance.

Lyft’s Business Model and Market Position

Lyft’s business model centers on connecting passengers with drivers through a mobile app. Its market position is primarily in North America, where it competes directly with Uber. Lyft’s strategy often involves focusing on specific niche markets or geographic areas to differentiate itself from its larger competitor. This includes focusing on specific demographics or offering specialized services.

Impact of Strategic Initiatives

Lyft’s strategic initiatives, such as investments in autonomous vehicle technology, expansion into new markets, and the development of new services (e.g., bike-sharing), can significantly influence its stock price. Successful initiatives typically lead to increased market share, revenue growth, and improved profitability, positively affecting investor sentiment and the stock price. Conversely, failed initiatives can negatively impact investor confidence.

Potential Threats and Challenges

Lyft faces several threats and challenges, including intense competition from Uber, regulatory hurdles, economic downturns, and potential technological disruptions. The company’s ability to navigate these challenges and maintain its competitive advantage is crucial for its long-term success and stock price performance.

Competitive Dynamics in the Ride-Sharing Market

A visual representation of the competitive landscape would show Uber as the dominant player, with Lyft holding a significant, but smaller, market share. Other smaller players would be depicted as less prominent, indicating the duopoly nature of the market. Lyft’s strategic positioning within this competitive landscape, emphasizing its unique aspects like its focus on certain markets or services, would be highlighted to showcase its differentiation strategy.

General Inquiries

What are the biggest risks facing Lyft’s stock price?

Significant risks include increased competition, regulatory hurdles, fluctuating fuel prices, and economic downturns impacting consumer spending on ride-sharing services.

How does Lyft compare to Uber in terms of stock performance?

A direct comparison requires analyzing their respective financial reports and market valuations over a specific period, considering factors like revenue growth, profitability, and market share. Generally, both companies experience correlated but not identical stock price movements.

What is Lyft’s current market capitalization?

Lyft’s market capitalization fluctuates constantly. Refer to real-time financial data sources for the most up-to-date information.

Where can I find reliable information on Lyft’s stock price?

Reputable financial news websites, stock market data providers (like Yahoo Finance or Google Finance), and Lyft’s investor relations section offer reliable data.