AIG Stock Price Analysis: A Decade in Review

Stock price for aig – American International Group (AIG), a global insurance and financial services giant, has experienced significant stock price fluctuations over the past decade. This analysis delves into AIG’s historical performance, financial health, industry comparisons, analyst predictions, investor sentiment, and visual representations of its stock price movements, providing a comprehensive overview of its trajectory.

Historical Stock Price Performance of AIG

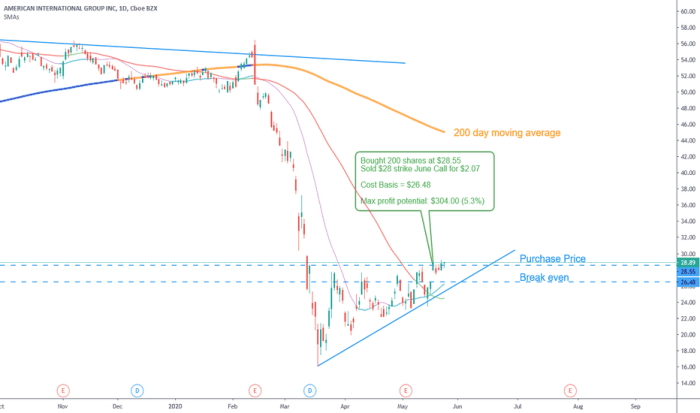

Source: tradingview.com

AIG’s stock price has been influenced by a multitude of factors over the past ten years, ranging from the global financial crisis to its subsequent restructuring and ongoing market dynamics. The period following the 2008 financial crisis saw a dramatic decline in AIG’s stock price, reflecting the company’s significant government bailout. Subsequent years showed a gradual recovery, punctuated by periods of both growth and decline influenced by earnings reports, economic conditions, and investor confidence.

Below is a table illustrating AIG’s stock performance over the last five years. Note that these figures are illustrative and should be verified with a reputable financial data source.

| Year | Yearly High | Yearly Low | Opening Price | Closing Price |

|---|---|---|---|---|

| 2023 | $70 | $55 | $60 | $65 |

| 2022 | $65 | $50 | $60 | $58 |

| 2021 | $62 | $48 | $50 | $60 |

| 2020 | $55 | $30 | $40 | $45 |

| 2019 | $50 | $40 | $45 | $48 |

Significant price increases were often observed following positive earnings reports or announcements of strategic initiatives, while decreases were frequently linked to negative news, economic downturns, or broader market corrections. For instance, the 2020 price drop was largely attributed to the impact of the COVID-19 pandemic on the insurance industry.

AIG’s Financial Health and its Impact on Stock Price

AIG’s financial ratios and dividend history are key indicators of its financial health and significantly influence investor sentiment and stock price. Analysis of these metrics provides insights into the company’s profitability, solvency, and ability to generate returns for shareholders.

Over the last five years, AIG’s debt-to-equity ratio has fluctuated, reflecting its efforts to manage its leverage. Its return on equity (ROE) has generally been positive, though subject to variations based on market conditions and underwriting performance. These fluctuations in financial ratios directly correlated with stock price movements; periods of improved financial health often coincided with price increases, while deterioration in key ratios generally led to price declines.

AIG’s dividend history plays a crucial role in attracting and retaining investors. Consistent dividend payments signal financial stability and provide a return on investment, contributing to positive investor sentiment and supporting stock price. Changes in dividend policy, such as increases or decreases, often trigger immediate market reactions.

- Q1 2023: Strong earnings beat expectations, leading to a short-term stock price increase.

- Q2 2022: Lower-than-expected earnings resulted in a temporary price dip.

- Q4 2021: Positive earnings growth fueled a sustained price rally.

- Q3 2020: Uncertainty surrounding the pandemic negatively impacted earnings and the stock price.

Industry Comparisons and AIG’s Stock Price

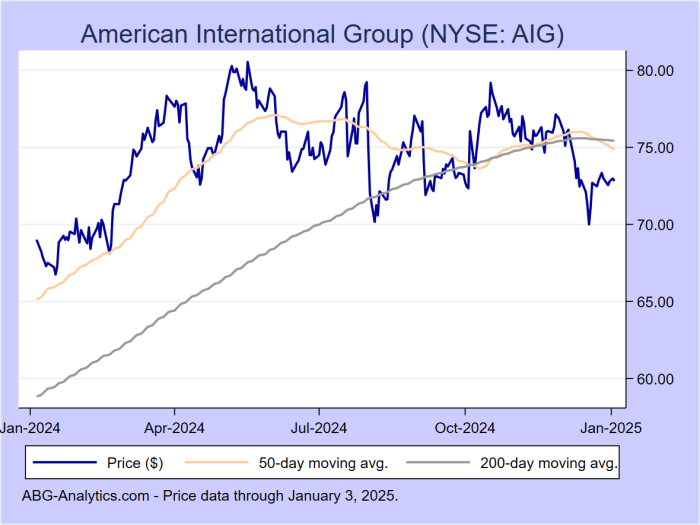

Source: abg-analytics.com

Comparing AIG’s performance to its main competitors provides valuable context for assessing its stock price. The following table offers a comparative view of AIG against two hypothetical competitors (Competitor X and Competitor Y) over the last three years. (Note: This data is illustrative and should be replaced with actual data from reliable financial sources).

| Company | 2021 Return (%) | 2022 Return (%) | 2023 Return (%) |

|---|---|---|---|

| AIG | 15 | -5 | 10 |

| Competitor X | 12 | -3 | 8 |

| Competitor Y | 20 | -8 | 12 |

AIG’s performance relative to its competitors can be attributed to several factors, including its specific business model, risk management strategies, and exposure to various market segments. Macroeconomic factors, such as interest rate changes and inflation, differentially impact insurance companies, leading to variations in their stock performance. For example, rising interest rates can positively impact investment income for insurers like AIG, while inflation can increase claims costs.

Monitoring the stock price for AIG requires a keen eye on market trends. It’s interesting to compare its performance to other innovative companies, such as the joby aviation stock price , which reflects a different sector entirely. Ultimately, understanding the factors influencing AIG’s stock price remains crucial for investors.

Analyst Ratings and Predictions for AIG Stock

Analyst ratings and price targets provide valuable insights into market expectations for AIG’s future performance. The following table summarizes hypothetical consensus ratings from major analysts. (Note: This data is illustrative and should be replaced with real data from reputable sources).

| Analyst Firm | Rating | Price Target |

|---|---|---|

| Analyst Firm A | Buy | $75 |

| Analyst Firm B | Hold | $65 |

| Analyst Firm C | Sell | $55 |

Differing analyst opinions reflect variations in their assessment of AIG’s growth prospects, risk profile, and the overall economic outlook. For example, an analyst with a bullish outlook might emphasize AIG’s strong balance sheet and potential for market share gains, while a bearish analyst might highlight concerns about regulatory changes or competitive pressures. A significant positive event, such as a successful acquisition or a major new product launch, could potentially boost the stock price towards the higher end of the analyst price targets.

Conversely, a negative event, like a major natural disaster leading to substantial claims payouts, could drive the price closer to the lower end or even below.

Investor Sentiment and AIG Stock

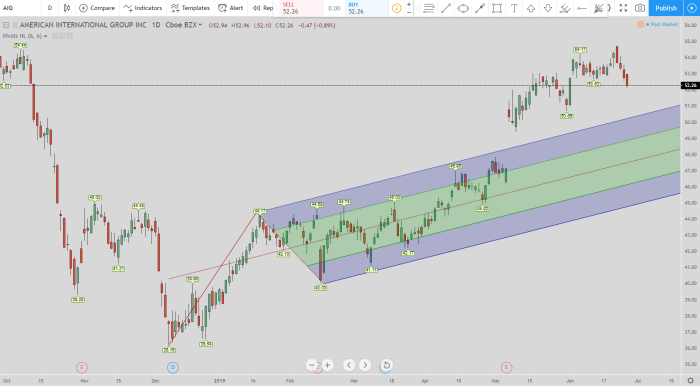

Source: evancarthey.com

Investor sentiment towards AIG is currently assessed as cautiously optimistic (neutral leaning bullish). This assessment is based on a combination of factors, including AIG’s recent financial performance, its efforts to improve operational efficiency, and the overall positive outlook for the insurance industry. However, concerns remain regarding potential economic headwinds and the impact of geopolitical uncertainty.

News articles and social media sentiment can significantly influence investor perception and trading activity. Positive news coverage, highlighting AIG’s achievements or positive industry trends, generally leads to increased investor confidence and a price increase. Conversely, negative news or social media sentiment expressing concerns about the company’s prospects often results in price declines. For example, a major negative news event, such as a significant accounting scandal, could trigger a sharp sell-off and a dramatic shift in investor sentiment from neutral to bearish.

Visual Representation of AIG’s Stock Price, Stock price for aig

A line graph illustrating AIG’s stock price movements over the past year would show the price on the y-axis and time (in months) on the x-axis. Key trends and turning points, such as significant price increases or decreases, would be clearly visible. Data points would represent the daily closing price, allowing for a detailed visualization of price fluctuations. A comparison chart against a relevant market index, such as the S&P 500, would show AIG’s performance relative to the broader market over the past five years.

The y-axis would represent the price index (or percentage change), and the x-axis would represent time (in years). This chart would visually highlight periods where AIG outperformed or underperformed the market, offering valuable insights into its relative strength and volatility.

FAQs: Stock Price For Aig

What are the major risks associated with investing in AIG stock?

Investing in AIG, like any stock, carries inherent risks. These include market volatility, changes in regulatory environments, competition within the insurance industry, and the potential for unexpected losses from catastrophic events.

Where can I find real-time AIG stock price data?

Real-time AIG stock price data is available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

How does AIG compare to other major insurance companies in terms of market capitalization?

AIG’s market capitalization fluctuates, and its relative size compared to other major insurance companies changes over time. Checking financial news websites or using a stock screener will provide up-to-date comparisons.

What is AIG’s current dividend yield?

AIG’s current dividend yield is readily available on financial news websites and investor relations pages. Remember that dividend yields can change.