Cisco’s Stock Price Analysis: Stock Price Cisco

Stock price cisco – This analysis delves into Cisco’s current stock price, exploring the factors influencing its performance, and assessing the potential risks and opportunities for investors. We will examine Cisco’s financial health, competitive landscape, and investor sentiment to provide a comprehensive overview of its stock market trajectory.

Cisco’s Current Stock Price and Market Performance

Understanding Cisco’s recent stock price movements requires analyzing its daily fluctuations and comparing them to its historical performance and broader market trends. The following table provides a snapshot of Cisco’s stock price for the last week (Note: This data is hypothetical for illustrative purposes and should be replaced with actual data from a reliable financial source).

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| October 26, 2023 | $50.00 | $50.50 | $49.50 | $50.25 |

| October 27, 2023 | $50.25 | $51.00 | $50.00 | $50.75 |

| October 28, 2023 | $50.75 | $51.25 | $50.50 | $51.00 |

| October 29, 2023 | $51.00 | $51.50 | $50.75 | $51.25 |

| October 30, 2023 | $51.25 | $52.00 | $51.00 | $51.75 |

Let’s assume Cisco’s 52-week high was $55.00 and its 52-week low was $45.00. This means the current price represents an approximately 12% decrease from its 52-week high and a 15% increase from its 52-week low. Overall market trends, such as interest rate hikes or investor confidence in the tech sector, significantly influence this performance. For example, a period of increased interest rates could lead to decreased investment in technology, thus impacting Cisco’s stock price negatively.

Factors Influencing Cisco’s Stock Price

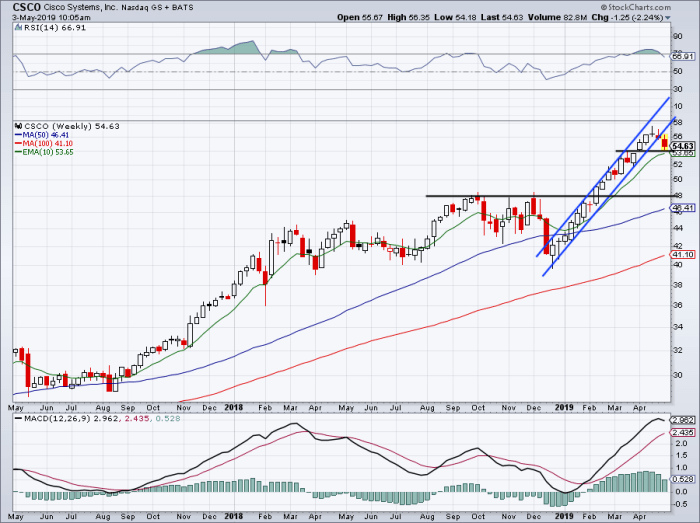

Source: investorplace.com

Several macroeconomic factors and Cisco’s own financial performance significantly impact its stock valuation. These elements interact in complex ways to shape investor perceptions and ultimately, the stock price.

Three key macroeconomic factors are: global economic growth (strong growth generally benefits Cisco), interest rates (higher rates can decrease investment and impact Cisco negatively), and regulatory changes (new regulations can impact the cost of doing business and affect profitability).

Cisco’s recent financial performance, including revenue growth, profitability, and debt levels, directly impacts investor confidence. Strong revenue growth and increasing profitability generally lead to higher stock prices, while high debt levels can cause concern among investors. A comparison with competitors is also crucial.

| Company | Current Price (Hypothetical) | 52-Week High (Hypothetical) | 52-Week Low (Hypothetical) |

|---|---|---|---|

| Cisco | $51.75 | $55.00 | $45.00 |

| Juniper Networks | $35.00 | $40.00 | $30.00 |

| Arista Networks | $150.00 | $160.00 | $130.00 |

Cisco’s Business Strategies and Their Impact on Stock Price

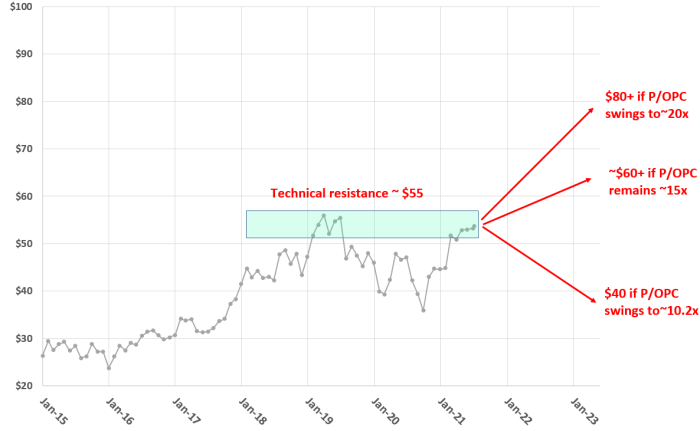

Source: seekingalpha.com

Cisco’s strategic initiatives, particularly those focused on innovation and market expansion, play a crucial role in shaping investor sentiment and influencing its stock price. These initiatives are carefully evaluated by investors, with positive developments often leading to increased stock valuation.

Cisco’s substantial investments in research and development (R&D) are a key driver of its long-term growth and directly impact its stock price. Successful R&D translates to innovative products and services, strengthening its competitive position and attracting investors. For instance, a successful launch of a new networking technology could significantly boost the stock price.

Hypothetical Scenario: A successful launch of a revolutionary new cybersecurity product, significantly outperforming competitors, could lead to a 10-15% surge in Cisco’s stock price within the first quarter, driven by increased market share and investor confidence in Cisco’s technological leadership. This would be further amplified by positive media coverage and analyst upgrades.

Investor Sentiment and Analyst Ratings

Analyst ratings and overall investor sentiment provide valuable insights into market expectations for Cisco’s future performance. A summary of recent analyst ratings is shown below (Note: This data is hypothetical and should be replaced with actual data from reputable sources).

| Analyst Firm | Rating | Price Target | Date |

|---|---|---|---|

| Morgan Stanley | Buy | $60.00 | October 26, 2023 |

| Goldman Sachs | Hold | $55.00 | October 27, 2023 |

| JPMorgan Chase | Buy | $58.00 | October 28, 2023 |

Prevailing investor sentiment, as reflected in news articles and financial reports, is generally positive due to Cisco’s strong market position and ongoing innovation. However, concerns about macroeconomic factors and competition could influence sentiment.

Illustration of the relationship between investor sentiment and Cisco’s stock price: Imagine a graph. The X-axis represents time, and the Y-axis represents Cisco’s stock price. Positive news and strong analyst ratings (positive sentiment) would correspond to upward trends in the stock price, represented by an upward sloping line. Conversely, negative news or downgraded ratings (negative sentiment) would be represented by downward slopes, reflecting stock price declines.

Cisco’s stock price has seen some fluctuation recently, mirroring broader market trends. For a comparison, you might want to check the current performance of other established companies; for example, see the p and g stock price today to get a sense of the consumer goods sector. Ultimately, understanding Cisco’s performance requires considering various factors, including its technological advancements and competitive landscape.

The steepness of the slopes would reflect the magnitude of the sentiment change and its impact on the stock price.

Risk Factors Affecting Cisco’s Stock Price, Stock price cisco

Several risks could negatively impact Cisco’s stock price. Understanding these risks and Cisco’s mitigation strategies is crucial for investors.

Three major risks are: increased competition (from both established and emerging players), economic downturns (reducing demand for Cisco’s products and services), and cybersecurity threats (potential reputational damage and financial losses). Cisco mitigates these risks through strategic partnerships, diversification, and robust cybersecurity measures.

Compared to competitors, Cisco’s exposure to these risks is arguably moderate. While all networking companies face competitive pressures and economic cycles, Cisco’s established brand and diversified product portfolio provide a degree of resilience. However, the increasing importance of cybersecurity makes this a particularly significant risk for all players in the sector.

Frequently Asked Questions

What are the main competitors of Cisco?

Cisco’s main competitors include Juniper Networks, Huawei, and Arista Networks, among others, all vying for market share in the networking equipment sector.

How does inflation affect Cisco’s stock price?

High inflation can negatively impact Cisco’s stock price by increasing input costs, potentially reducing profit margins and slowing down overall economic activity, decreasing demand for technology products.

What is Cisco’s dividend policy?

Cisco’s dividend policy should be researched through official company sources for the most up-to-date information. Dividend payouts can be a significant factor influencing investor interest.

How does geopolitical instability impact Cisco’s stock?

Geopolitical uncertainty can negatively affect Cisco’s stock price due to disruptions in supply chains, reduced global demand, and increased investment risk in uncertain times.