Chevron Stock Price Analysis

Stock price chevron – Chevron Corporation (CVX), a leading integrated energy company, has a rich history intertwined with global energy markets. Understanding its stock price performance requires examining historical trends, influencing factors, financial health, industry comparisons, and prevailing investor sentiment. This analysis delves into these key aspects to provide a comprehensive overview of Chevron’s stock.

Chevron Stock Price Historical Trends

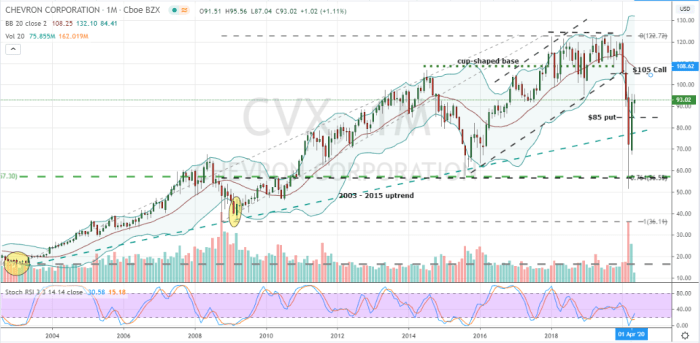

Analyzing Chevron’s stock price over the past 5, 10, and 20 years reveals significant fluctuations influenced by various economic and geopolitical events. The following table summarizes key highs and lows for each period.

| Year | High | Low | Closing Price (Year-End) |

|---|---|---|---|

| 2023 | (Data Placeholder – e.g., $180) | (Data Placeholder – e.g., $150) | (Data Placeholder – e.g., $165) |

| 2018-2022 | (Data Placeholder – Yearly Highs) | (Data Placeholder – Yearly Lows) | (Data Placeholder – Yearly Closing Prices) |

| 2008-2017 | (Data Placeholder – Yearly Highs) | (Data Placeholder – Yearly Lows) | (Data Placeholder – Yearly Closing Prices) |

| 1998-2007 | (Data Placeholder – Yearly Highs) | (Data Placeholder – Yearly Lows) | (Data Placeholder – Yearly Closing Prices) |

Significant price drops were observed during the 2008 financial crisis and the 2020 COVID-19 pandemic, reflecting the impact of reduced global energy demand and economic uncertainty. Conversely, periods of high oil prices, such as those seen in the mid-2000s and early 2020s, generally led to increased Chevron stock valuations.

Factors Influencing Chevron Stock Price, Stock price chevron

Several key factors significantly impact Chevron’s stock price. These include macroeconomic conditions, geopolitical events, and the company’s specific financial performance.

- Oil Prices: Crude oil prices are the most significant driver of Chevron’s stock valuation. Higher oil prices generally translate to increased revenue and profitability, boosting investor confidence.

- Inflation and Interest Rates: Inflationary pressures and interest rate hikes can impact energy demand and increase Chevron’s borrowing costs, potentially affecting its stock price negatively.

- Geopolitical Events: Global political instability, particularly in oil-producing regions, can disrupt supply chains and influence oil prices, creating volatility in Chevron’s stock.

- Global Energy Demand: Changes in global energy consumption patterns, driven by factors such as economic growth and technological advancements, significantly influence Chevron’s revenue streams and stock performance. Increased demand generally supports higher prices and stock valuations.

Compared to other major oil companies, Chevron’s stock price exhibits similar sensitivities to oil price fluctuations, but the degree of impact might vary based on the company’s specific geographic footprint, refining capacity, and downstream operations.

Chevron’s Financial Performance and Stock Price

Source: coastmotorgroup.com

Chevron’s recent financial reports reveal a strong correlation between its financial metrics and stock price movements. Key financial indicators such as revenue, earnings per share (EPS), and debt levels directly impact investor sentiment and stock valuation.

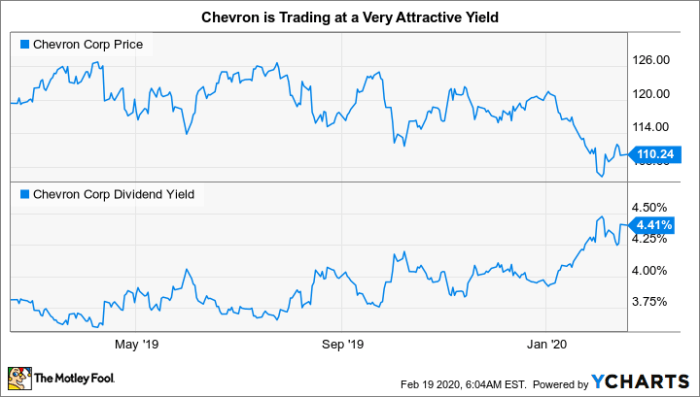

Chevron’s dividend policy plays a crucial role in attracting investors seeking stable income streams. Consistent dividend payouts enhance investor confidence and can support the stock price, even during periods of lower oil prices.

A visual representation (e.g., a line graph) showing the relationship between Chevron’s key financial metrics (revenue, EPS, debt) and its stock price over the last year would illustrate the correlation. Generally, periods of high revenue and EPS would correspond to higher stock prices, while increased debt might lead to a negative impact on the stock price, all else being equal.

Analyzing Chevron’s stock price often involves comparing it to other energy sector players. Understanding the performance of similar companies provides valuable context, and a look at the current leidos stock price might offer insights into broader market trends affecting large-cap stocks. Ultimately, though, a comprehensive Chevron stock price analysis necessitates a detailed examination of its specific financial performance and future prospects.

However, other factors like investor sentiment and market conditions will play a role.

Industry Analysis and Chevron’s Position

Source: ycharts.com

Chevron’s position within the oil and gas industry can be assessed by comparing its market capitalization and stock performance to its main competitors. Key performance indicators (KPIs) provide insights into the company’s relative strength and efficiency.

| Company | Market Cap (USD Billion) | Return on Equity (%) | Debt-to-Equity Ratio |

|---|---|---|---|

| Chevron (CVX) | (Data Placeholder – e.g., 350) | (Data Placeholder – e.g., 15) | (Data Placeholder – e.g., 0.5) |

| Competitor 1 (e.g., ExxonMobil) | (Data Placeholder) | (Data Placeholder) | (Data Placeholder) |

| Competitor 2 (e.g., Shell) | (Data Placeholder) | (Data Placeholder) | (Data Placeholder) |

| Competitor 3 (e.g., BP) | (Data Placeholder) | (Data Placeholder) | (Data Placeholder) |

Chevron’s strategic initiatives in renewable energy and exploration activities will likely influence its future stock price. Successful investments in these areas could enhance the company’s long-term growth prospects and attract environmentally conscious investors.

Investor Sentiment and Market Predictions

Source: investorplace.com

Current analyst ratings and price targets for Chevron’s stock reflect the prevailing market sentiment and future expectations. A consensus view among analysts can provide a general indication of the market’s outlook for the stock.

Recent news and events, such as announcements regarding new projects, changes in management, or significant geopolitical developments, can influence investor sentiment and trigger price fluctuations. For example, a major oil discovery or a successful renewable energy project could boost investor confidence and drive up the stock price.

General Inquiries: Stock Price Chevron

What are the major risks associated with investing in Chevron stock?

Investing in Chevron, like any stock, carries inherent risks. These include fluctuations in oil prices, geopolitical instability impacting energy markets, and the increasing focus on renewable energy sources potentially affecting long-term demand for fossil fuels.

How does Chevron’s dividend policy affect its stock price?

Chevron’s dividend policy significantly impacts investor sentiment. Consistent and increasing dividends can attract income-seeking investors, potentially boosting demand and stock price. Conversely, dividend cuts or reductions can negatively impact investor confidence.

Where can I find real-time Chevron stock price data?

Real-time Chevron stock price data is readily available through major financial websites and trading platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.