Facebook Stock Price Analysis

Price fb stock – This analysis examines the historical price performance of Facebook (now Meta) stock, explores factors influencing its price, compares it to competitors, and presents potential future scenarios and investment strategies. The information provided is for informational purposes only and does not constitute financial advice.

Historical Price Performance of FB Stock, Price fb stock

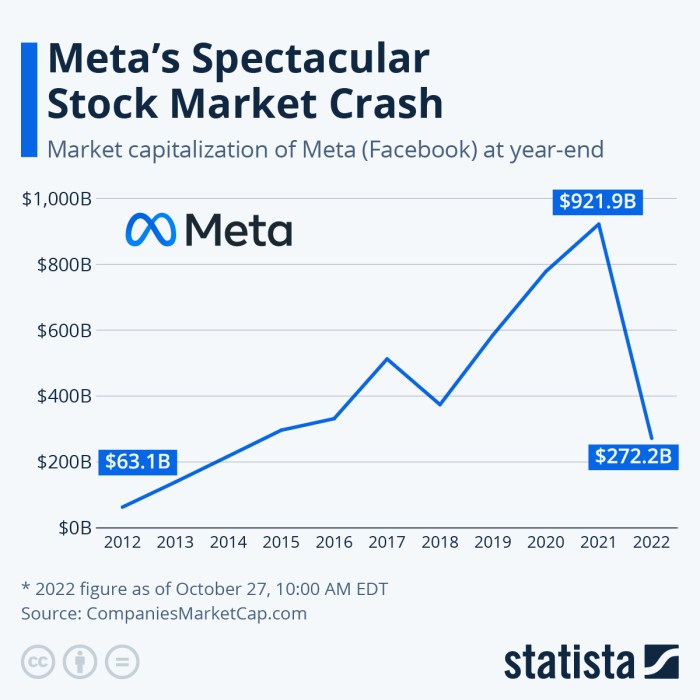

Source: statcdn.com

A line graph illustrating the price of Meta stock over the past five years would show significant volatility. The graph would highlight key price points, such as the peak reached in September 2021, followed by a substantial decline. Major events impacting the price, such as the Cambridge Analytica scandal, increased regulatory scrutiny, and the company’s pivot towards the metaverse, would be clearly marked on the graph.

The highest price reached during this period was approximately [Insert Highest Price and Date], while the lowest was around [Insert Lowest Price and Date].

A comparison of Meta’s performance against the S&P 500 index over the same period would reveal [Insert Comparison – e.g., periods of outperformance and underperformance].

| Metric | Meta | S&P 500 |

|---|---|---|

| Average Annual Return | [Insert Data] | [Insert Data] |

| Volatility (Standard Deviation) | [Insert Data] | [Insert Data] |

| Beta | [Insert Data] | 1.0 (by definition) |

Factors Influencing FB Stock Price

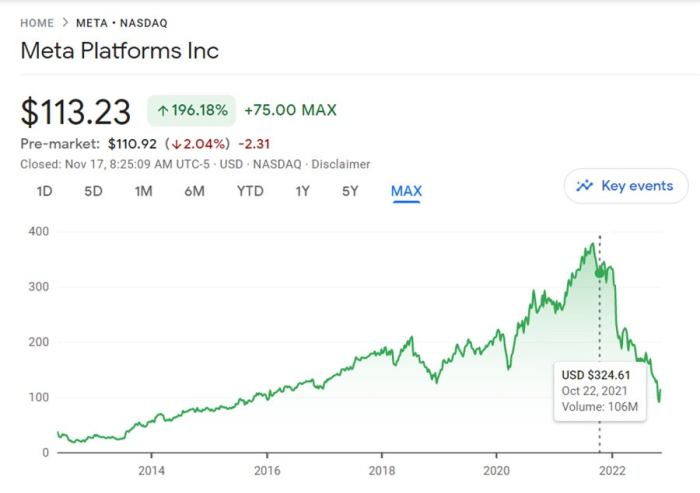

Source: sftcdn.net

Three major macroeconomic factors impacting Meta’s stock price in the past year include interest rate hikes, inflation, and global economic uncertainty. Rising interest rates increased the discount rate applied to future earnings, impacting valuations. High inflation reduced consumer spending, affecting advertising revenue, a key driver of Meta’s profits. Global economic uncertainty created investor anxiety, leading to market volatility and impacting Meta’s stock price.

Company-specific news, such as earnings reports, product launches (e.g., the launch of new features on Instagram and Facebook), and regulatory changes (e.g., antitrust investigations), significantly influenced Meta’s stock price. For instance, a disappointing earnings report typically leads to a stock price drop, while successful product launches can boost investor confidence and drive the price upwards.

Investor sentiment and market speculation play a crucial role in shaping Meta’s stock price fluctuations. Positive news and strong earnings often lead to increased investor optimism, driving the price up. Conversely, negative news or concerns about the company’s future prospects can lead to selling pressure and price declines. Speculation around new technologies or regulatory actions also contributes to volatility.

Comparison with Competitor Stock Prices

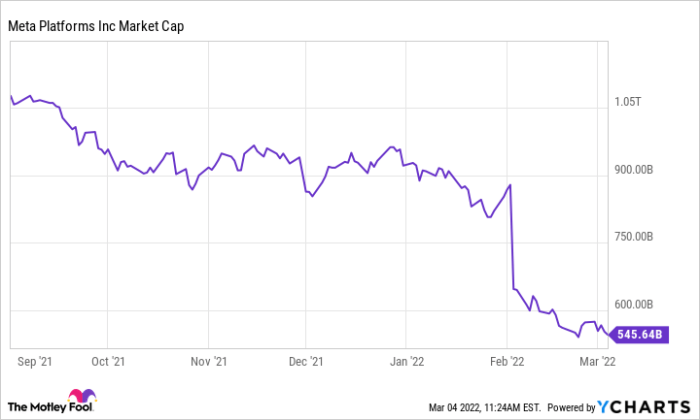

Source: ycharts.com

Comparing Meta’s price performance to its main competitors (e.g., Alphabet (Google), Twitter, Snap) over the past year reveals varying levels of performance. Some competitors might have experienced stronger growth, while others might have faced similar challenges. This comparison highlights the competitive landscape and the factors influencing the relative valuations of these companies.

| Company | Average Annual Return (Past Year) | Volatility (Past Year) |

|---|---|---|

| Meta | [Insert Data] | [Insert Data] |

| Alphabet (Google) | [Insert Data] | [Insert Data] |

| Twitter (X) | [Insert Data] | [Insert Data] |

| Snap | [Insert Data] | [Insert Data] |

Similarities and differences in price performance are often driven by factors such as market share, revenue growth, profitability, and investor sentiment. For example, companies with strong revenue growth and high profitability tend to outperform their peers.

A hypothetical investment portfolio might include Meta and Alphabet (Google), offering diversification across the tech sector. This strategy balances potential high growth with some level of risk mitigation by investing in two established tech giants with different business models.

Future Price Predictions and Scenarios

Three plausible scenarios for Meta’s stock price over the next year consider different economic and company-specific factors. These scenarios are based on assumptions about the overall market conditions, the company’s performance, and potential regulatory changes. Each scenario presents a range of possible outcomes.

| Scenario | Assumptions | Projected Price Range (Next Year) | Potential Risks |

|---|---|---|---|

| Bullish | Strong economic growth, successful metaverse initiatives, positive regulatory developments. | [Insert Price Range] | Overvaluation, increased competition. |

| Neutral | Moderate economic growth, mixed results from metaverse initiatives, stable regulatory environment. | [Insert Price Range] | Slow revenue growth, increased operating costs. |

| Bearish | Economic slowdown, challenges in the metaverse, negative regulatory developments. | [Insert Price Range] | Significant revenue decline, loss of market share. |

Investment Strategies Related to FB Stock

Two investment strategies for profiting from Meta stock are long-term buy-and-hold and short-term trading. The buy-and-hold strategy focuses on long-term growth potential, while short-term trading aims to capitalize on short-term price fluctuations.

A long-term buy-and-hold strategy, with a $10,000 investment, would involve purchasing shares and holding them for several years, aiming to benefit from long-term growth. The potential benefits include substantial returns if the stock price appreciates significantly. However, it also carries the risk of losses if the stock price declines over the holding period.

A short-term trading strategy, also with a $10,000 investment, would involve actively buying and selling shares based on short-term price movements. This strategy aims to profit from short-term price fluctuations but carries higher risk due to market volatility and requires more active monitoring and trading skills.

Popular Questions: Price Fb Stock

What are the major risks associated with investing in FB stock?

Risks include market volatility, competition from other tech companies, regulatory changes impacting the company’s operations, and shifts in consumer behavior and advertising trends.

How does FB stock compare to other social media companies?

Comparison requires looking at various metrics like market capitalization, revenue growth, user engagement, and profitability. Each company faces unique challenges and opportunities within the social media space.

Understanding the price of FB stock requires considering various market factors. A helpful comparison might be analyzing the price fluctuations of other tech giants, such as by looking at price delta stock to understand volatility patterns. This comparative analysis can then provide a broader context for interpreting the current and future trajectory of the FB stock price, allowing for more informed investment decisions.

Where can I find reliable real-time data on FB stock price?

Major financial websites and brokerage platforms offer real-time stock quotes and charting tools. Always verify information from multiple reputable sources.