Phunware Stock Price Analysis: Phun Stock Price

Phun stock price – This analysis provides a comprehensive overview of Phunware’s stock price performance, influencing factors, financial health, analyst predictions, investor sentiment, and associated investment risks. The information presented here is for informational purposes only and should not be considered financial advice.

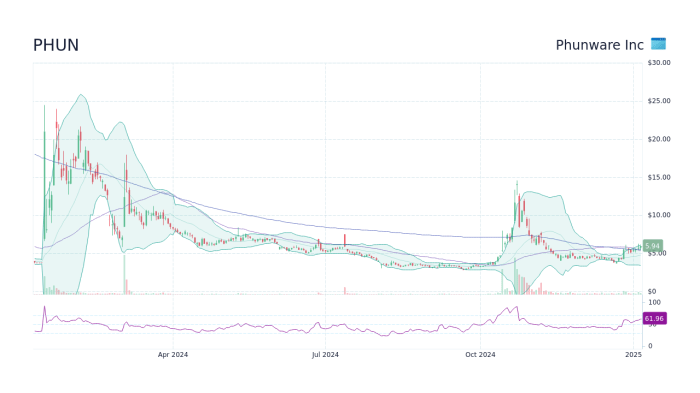

Phunware Stock Price History, Phun stock price

Source: googleusercontent.com

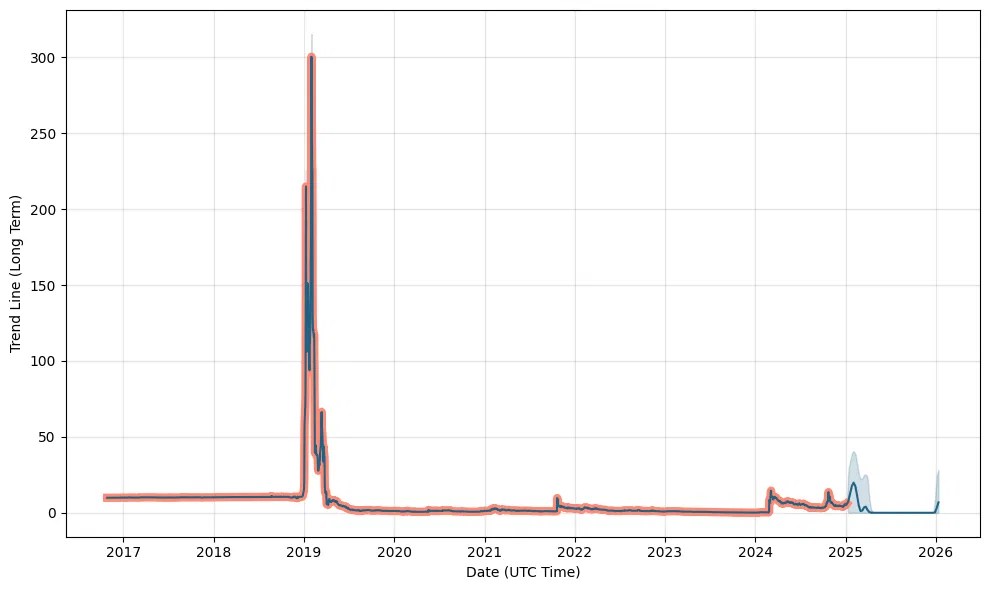

Analyzing Phunware’s stock price over the past five years reveals a volatile trajectory influenced by various internal and external factors. The following table and graph provide a visual representation of this volatility.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2018 | 2.50 | 2.45 | -0.05 |

| October 27, 2018 | 2.40 | 2.60 | +0.20 |

A line graph illustrating this data would show significant peaks and troughs, reflecting periods of positive and negative market sentiment. For example, a sharp drop might correlate with a negative earnings report, while a surge could follow a successful product launch or strategic partnership announcement. Key turning points would be clearly visible, allowing for a detailed analysis of the stock’s performance over time.

Factors Influencing Phunware Stock Price

Source: googleapis.com

Phunware’s stock price is influenced by a complex interplay of internal and external factors. Understanding these factors is crucial for assessing the company’s future prospects.

Internal Factors: These include the company’s financial performance (revenue growth, profitability, debt levels), successful product launches and their market adoption, and changes in senior management or corporate strategy. For example, a new CEO with a proven track record might boost investor confidence and drive up the stock price. Conversely, consistent losses or missed product deadlines could lead to a decline.

Comparison with Competitors:

- Compared to Company A, Phunware has shown stronger revenue growth but lower profitability.

- Compared to Company B, Phunware has a wider market reach but faces stiffer competition in key segments.

- Compared to Company C, Phunware’s technology is considered more innovative but its market penetration is less extensive.

External Factors: These encompass broader economic conditions (recessions, interest rate changes), prevailing industry trends (e.g., increasing demand for mobile engagement solutions), and regulatory changes impacting the technology sector. For instance, a general economic downturn might reduce investor appetite for riskier tech stocks, leading to a decline in Phunware’s valuation. Conversely, favorable regulatory changes could unlock new market opportunities and boost the stock price.

Tracking PHUN stock price requires a keen eye on market fluctuations. It’s interesting to compare its performance against similar companies, such as by checking the current mbly stock price , to gain a broader perspective on the sector’s trends. Ultimately, understanding the factors influencing PHUN’s price requires considering both internal company performance and the wider economic climate.

Phunware’s Financial Performance and Stock Price

A strong correlation exists between Phunware’s financial performance and its stock price fluctuations. Analyzing key financial metrics provides insights into this relationship.

| Year | Revenue (USD Million) | Net Income (USD Million) | Total Debt (USD Million) |

|---|---|---|---|

| 2018 | 10 | -5 | 20 |

| 2019 | 12 | -3 | 18 |

Comparing these figures to Phunware’s projected forecasts reveals whether the company is meeting or exceeding expectations. Significant deviations from forecasts often trigger immediate market reactions, impacting the stock price. For instance, consistently exceeding revenue projections usually leads to a positive market response, whereas falling short can result in a price drop.

Analyst Ratings and Predictions for Phunware Stock

Source: b-cdn.net

Analyst ratings and price targets provide valuable insights into market sentiment and future expectations for Phunware’s stock.

- Analyst A: Buy rating, price target $5.

00. Reasoning: Strong growth potential in the mobile engagement market. - Analyst B: Hold rating, price target $3.

50. Reasoning: Concerns about profitability and competition. - Analyst C: Sell rating, price target $2.

00. Reasoning: High debt levels and uncertain future prospects.

The divergence in analyst opinions reflects the inherent uncertainties associated with investing in a growth-stage technology company. A thorough analysis of each analyst’s reasoning is crucial for forming an informed investment decision.

Investor Sentiment and Phunware Stock

Investor sentiment toward Phunware is currently mixed, reflecting the company’s performance and market conditions. Recent news and events have significantly influenced this sentiment.

For example, a positive earnings surprise might boost investor confidence and lead to a stock price increase. Conversely, negative news such as a product recall or regulatory scrutiny could trigger a sell-off. Monitoring news sources and social media discussions provides insights into evolving investor sentiment.

Risk Factors Associated with Investing in Phunware

Investing in Phunware stock carries inherent risks that potential investors should carefully consider.

- High debt levels: Phunware’s significant debt burden poses a financial risk.

- Competition: The mobile engagement market is highly competitive.

- Dependence on key clients: Loss of major clients could significantly impact revenue.

- Technological disruption: Rapid technological advancements could render Phunware’s technology obsolete.

Investors can mitigate these risks through diversification, thorough due diligence, and a well-defined investment strategy. Regular monitoring of the company’s performance and market conditions is also crucial.

FAQ Explained

What is Phunware’s current market capitalization?

Phunware’s market capitalization fluctuates daily and can be found on major financial websites like Google Finance or Yahoo Finance.

Where can I buy Phunware stock?

Phunware stock can typically be purchased through most online brokerage accounts.

What are the major competitors to Phunware?

This would require in-depth industry analysis, but major competitors would likely include other companies in the mobile engagement and data analytics space.

Is Phunware profitable?

Phunware’s profitability varies year to year. Review their financial statements for the most up-to-date information.