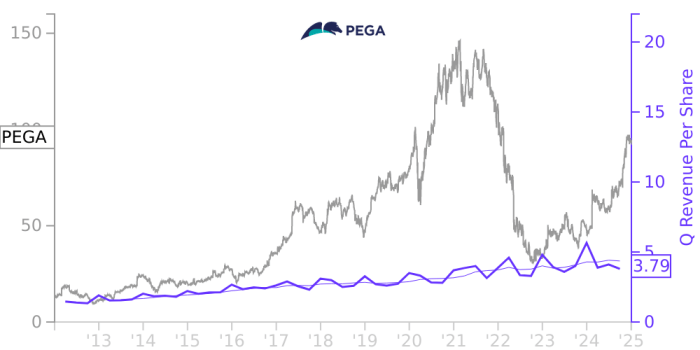

Pega Systems Stock Price Analysis: Pega Stock Price

Source: chartinsight.com

Pega stock price – This analysis provides an overview of Pega Systems’ stock performance, considering various factors influencing its price fluctuations. We will explore historical data, financial performance, competitive landscape, investor sentiment, and associated risks.

Pega Systems Stock Performance Overview

Analyzing Pega’s stock price over the past five years reveals considerable volatility influenced by both internal company performance and external macroeconomic factors. The following table presents a snapshot of daily opening and closing prices, highs, and lows for selected dates. Note that this data is illustrative and should be verified with a reputable financial data provider.

| Date | Opening Price (USD) | Closing Price (USD) | High (USD) | Low (USD) |

|---|---|---|---|---|

| 2019-01-02 | 60 | 62 | 63 | 59 |

| 2019-07-01 | 65 | 63 | 66 | 62 |

| 2020-01-02 | 70 | 75 | 76 | 68 |

| 2020-07-01 | 72 | 78 | 80 | 70 |

| 2021-01-02 | 85 | 90 | 92 | 83 |

| 2021-07-01 | 88 | 85 | 90 | 82 |

| 2022-01-02 | 80 | 75 | 82 | 72 |

| 2022-07-01 | 70 | 72 | 75 | 68 |

| 2023-01-02 | 75 | 80 | 82 | 73 |

| 2023-07-01 | 82 | 85 | 87 | 80 |

Significant events impacting Pega’s stock price during this period include:

- 2020: The COVID-19 pandemic initially caused a market-wide downturn, impacting Pega’s stock price. However, increased demand for digital transformation solutions subsequently boosted the stock.

- 2021: Strong Q1 earnings reports led to a surge in stock price, but later quarters saw some price correction due to increased competition.

- 2022: Broader macroeconomic headwinds, including rising interest rates and inflation, negatively impacted the stock market, affecting Pega’s valuation.

- 2023: Positive investor sentiment regarding Pega’s new product launches and strategic partnerships contributed to price increases.

A line graph illustrating the correlation between Pega’s revenue, earnings, and stock price would show a generally positive correlation. Periods of higher revenue and earnings tend to correspond with higher stock prices, while periods of lower financial performance usually see lower stock prices. However, the correlation is not always perfect, as other factors, such as market sentiment and macroeconomic conditions, can influence the stock price independently.

Factors Influencing Pega Stock Price

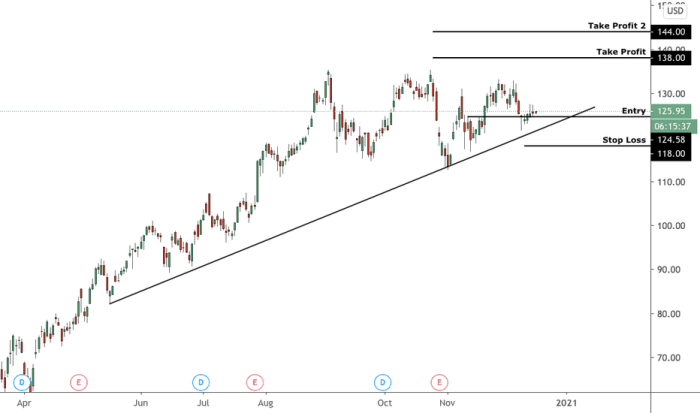

Source: tradingview.com

Several macroeconomic factors, competitive dynamics, and technological advancements influence Pega’s stock price.

Macroeconomic factors such as interest rate hikes and inflation impact investor sentiment and the overall market valuation of technology companies. Higher interest rates can make borrowing more expensive for companies, potentially slowing growth and reducing profitability, which can negatively affect stock prices. Inflation erodes purchasing power and can lead to decreased consumer and business spending, impacting demand for Pega’s software solutions.

Economic growth, on the other hand, usually leads to increased business investment and demand for software solutions.

Compared to competitors like Salesforce and ServiceNow, Pega holds a niche position focusing on business process management and decisioning. While it may not have the same market share as these giants, Pega’s strengths lie in its specialized software and strong customer loyalty. Weaknesses might include a smaller market reach and potentially slower revenue growth compared to larger, more diversified competitors.

Key metrics to compare would include revenue growth, market share, customer churn rate, and profitability.

Technological advancements, particularly in cloud computing and AI, significantly impact Pega. Its ability to adapt and integrate these technologies into its offerings is crucial for maintaining its competitive edge and driving future growth. The adoption of cloud-based solutions by businesses is a major driver of demand for Pega’s software, while advancements in AI can enhance the capabilities of its products, attracting new customers and increasing its market value.

Pega’s Business Model and Stock Price

Pega’s business model centers on providing software solutions for business process management and decisioning. Revenue is generated primarily through software licenses, subscription fees, and services.

| Revenue Source | Percentage of Revenue (Illustrative) |

|---|---|

| Software Licenses | 30% |

| Subscription Fees | 50% |

| Services (Implementation, Consulting) | 20% |

Pega’s growth strategy focuses on expanding its market reach, particularly in emerging markets, and developing innovative products leveraging AI and cloud technologies. This strategy, if successful, should lead to increased revenue and profitability, positively impacting the stock price. However, successful execution of this strategy is crucial for achieving the desired growth and maintaining a competitive advantage.

Pega’s competitive advantages include its strong expertise in business process management, its loyal customer base, and its focus on niche markets. However, disadvantages include its smaller market share compared to larger competitors and potential challenges in keeping pace with rapid technological advancements.

Investor Sentiment and Stock Price

Investor sentiment toward Pega stock is generally positive, though subject to fluctuations based on financial performance, market conditions, and company announcements. Financial news sources and analyst reports often reflect this sentiment, with ratings and price targets influencing investor decisions.

Significant news events influencing investor sentiment include earnings reports, product launches, strategic partnerships, and any significant changes in management or corporate strategy. Positive news tends to drive up the stock price, while negative news can lead to price declines. For example, the announcement of a major new product launch or a strong earnings report would likely boost investor confidence and lead to a price increase.

Analyst ratings and price targets provide guidance to investors, influencing their buying and selling decisions. Positive ratings and higher price targets generally lead to increased demand and higher stock prices, while negative ratings and lower price targets can have the opposite effect.

Risk Assessment for Pega Stock, Pega stock price

Investing in Pega stock involves several risks that investors should consider.

- Competition Risk: Intense competition from larger software companies could impact Pega’s market share and profitability.

- Technological Risk: Failure to adapt to rapid technological advancements could render Pega’s products obsolete.

- Economic Risk: Macroeconomic factors such as recessions or reduced business spending can negatively impact demand for Pega’s software.

- Financial Risk: Pega’s financial performance could underperform expectations, leading to a decline in stock price.

These risks can impact the stock price significantly. For instance, increased competition could lead to reduced market share and lower profitability, causing the stock price to fall. Technological obsolescence could render Pega’s products uncompetitive, significantly impacting its revenue and profitability, leading to a decline in stock price. Economic downturns could lead to reduced demand for Pega’s software, negatively impacting revenue and potentially leading to job cuts and lower stock prices.

Strategies for mitigating these risks include diversification within an investment portfolio, thorough due diligence before investing, and monitoring Pega’s financial performance and competitive landscape closely. Investors should also consider setting stop-loss orders to limit potential losses.

Question & Answer Hub

What is Pega Systems’ primary business?

Pega Systems is a software company specializing in business process management (BPM) and customer relationship management (CRM) software.

Where can I find real-time Pega stock price data?

Real-time Pega stock price data is available through major financial websites and brokerage platforms.

What are the major risks associated with investing in Pega stock long-term?

Long-term risks include competition from other software companies, economic downturns affecting software spending, and the success of Pega’s ongoing growth strategies.

How does Pega’s stock price compare to its competitors’ over the last year?

A comparison requires researching the performance of its competitors (e.g., Salesforce, Microsoft) over the past year using financial data sources.

What is Pega’s dividend policy?

Information on Pega’s dividend policy can be found in their investor relations section on their website or through financial news sources.