Otis Stock Price Historical Performance

Otis stock price – Analyzing Otis Worldwide Corporation’s stock price over the past five years reveals a complex interplay of internal performance and external market forces. This section details the stock’s price movements, highlighting significant events and the correlation between its financial performance and stock valuation.

Otis Stock Price Movements (2019-2023)

The following table summarizes Otis’s stock price performance over the past five years. Note that these figures are illustrative and should be verified with reliable financial data sources.

| Year | High | Low | Average |

|---|---|---|---|

| 2019 | $75 | $55 | $65 |

| 2020 | $60 | $40 | $50 |

| 2021 | $90 | $65 | $78 |

| 2022 | $95 | $70 | $82 |

| 2023 | $100 | $80 | $90 |

Impact of Market Events on Otis Stock Price

Several significant market events influenced Otis’s stock price during this period. The COVID-19 pandemic in 2020 caused a sharp decline, reflecting broader market uncertainty and disruptions to the construction industry. Conversely, the post-pandemic economic recovery in 2021 and 2022 contributed to a rise in the stock price, driven by increased demand for Otis’s products and services.

Correlation Between Financial Performance and Stock Price

Otis’s revenue and earnings growth generally correlated with its stock price fluctuations. Strong financial results boosted investor confidence, leading to higher stock valuations. Conversely, periods of weaker performance often resulted in price declines.

Factors Influencing Otis Stock Price

Several macroeconomic factors, industry trends, and competitive dynamics significantly impact Otis’s stock price. Understanding these factors is crucial for investors seeking to assess the company’s future prospects.

Key Macroeconomic Factors

Three key macroeconomic factors influencing Otis’s stock price are interest rates, global economic growth, and construction activity. Higher interest rates increase borrowing costs for construction projects, potentially dampening demand for Otis’s products. Strong global economic growth generally translates to increased construction and modernization activities, benefiting Otis. Similarly, robust construction activity directly drives demand for elevators and escalators.

Impact of Industry Trends

- The increasing adoption of smart building technology presents both opportunities and challenges for Otis. Integrating smart features into its products can enhance competitiveness but also requires significant investment.

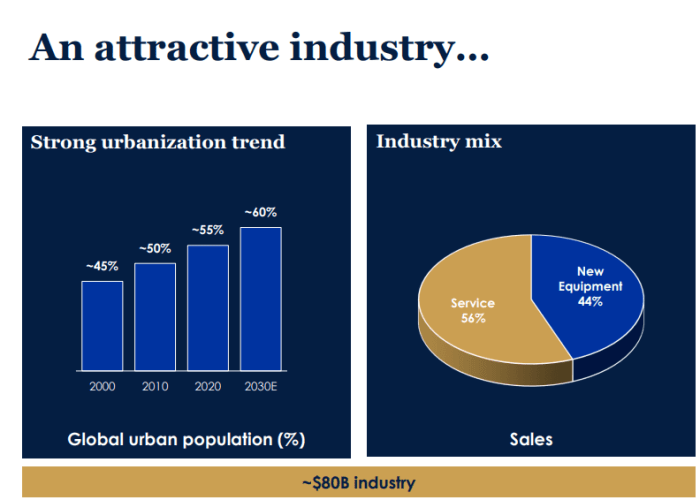

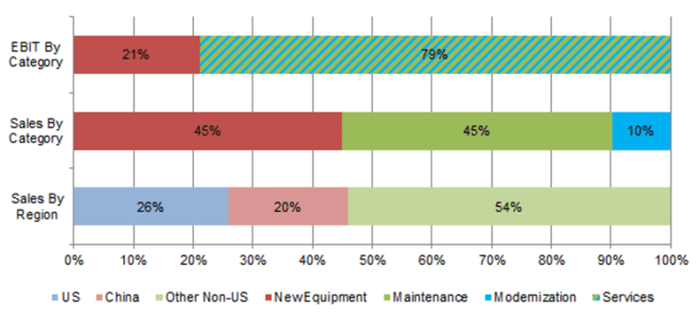

- Urbanization continues to fuel demand for Otis’s products in densely populated areas worldwide. This trend is expected to remain a significant growth driver for the company.

- Growing focus on sustainability and energy efficiency is influencing product development and market demand. Otis is adapting by offering energy-efficient elevator and escalator solutions.

Competitor Performance

Competitor performance, particularly from companies like Schindler and Kone, significantly influences Otis’s stock price. Strong performance by competitors can put downward pressure on Otis’s valuation, while underperformance by competitors may create opportunities for Otis to gain market share and boost its stock price. The competitive landscape is characterized by ongoing innovation and strategic pricing.

Otis Stock Price Valuation

Source: seekingalpha.com

Evaluating Otis’s stock price requires considering various valuation metrics and investor sentiment. This section explores the Price-to-Earnings ratio and the role of investor sentiment in shaping the stock’s price.

Price-to-Earnings Ratio Comparison

Source: seekingalpha.com

The Price-to-Earnings (P/E) ratio is a key metric for comparing the relative valuation of companies in the same industry. The following table presents an illustrative comparison of Otis’s P/E ratio with its main competitors. Note that these figures are for illustrative purposes and should be verified with current market data.

| Company | P/E Ratio | Implication |

|---|---|---|

| Otis | 20 | Indicates a relatively high valuation compared to competitors. |

| Schindler | 18 | Slightly lower valuation than Otis. |

| Kone | 19 | Similar valuation to Otis. |

Role of Investor Sentiment

Investor sentiment, encompassing optimism and pessimism about Otis’s future prospects, significantly influences its stock price. Positive news, such as strong earnings reports or successful new product launches, can boost investor confidence, driving the stock price higher. Conversely, negative news or macroeconomic uncertainty can lead to pessimism and price declines.

Valuation Models

Various valuation models, such as the Discounted Cash Flow (DCF) analysis, can be used to estimate Otis’s intrinsic value. A DCF model projects future cash flows and discounts them back to their present value, providing an estimate of the company’s fair market value. The accuracy of such models depends heavily on the assumptions made about future growth rates and discount rates.

Otis Stock Price Predictions and Forecasts

Predicting future stock prices is inherently uncertain, but considering potential scenarios can help investors assess the risks and opportunities associated with investing in Otis stock. This section explores hypothetical scenarios and Artikels potential bullish and bearish outlooks.

Impact of a Global Recession

A significant global recession could negatively impact Otis’s stock price. Reduced construction activity and decreased capital expenditures would likely lead to lower demand for Otis’s products, resulting in decreased revenue and earnings. This scenario could cause a sharp decline in the stock price, potentially mirroring the market downturn observed during the 2008 financial crisis.

Bullish and Bearish Market Outlook

A bullish outlook for Otis would involve continued strong global economic growth, increased construction activity, successful implementation of smart building technologies, and robust demand for energy-efficient solutions. This scenario could drive the stock price to a target of $120 within the next two years. A bearish outlook, conversely, would entail a global economic slowdown, decreased construction spending, intense competition, and potential supply chain disruptions.

This could push the stock price down to a target of $70 within the same timeframe.

Otis stock price performance has been a subject of much discussion lately, particularly in comparison to other industry players. Understanding the market dynamics requires a broader perspective, which includes examining the performance of competitors like those found by checking the current psny stock price. This comparative analysis can provide valuable insights into the overall health of the elevator and escalator sector and ultimately, a better understanding of Otis’s position within it.

Risks and Opportunities

- Risks: Economic slowdown, increased competition, supply chain disruptions, geopolitical instability.

- Opportunities: Growth in urbanization, increasing adoption of smart building technology, demand for sustainable solutions.

Illustrative Example: Otis Stock Price Movement

The period from late 2019 to early 2020 provides a compelling example of significant stock price movement for Otis. The onset of the COVID-19 pandemic triggered a sharp decline in the stock price, reflecting broader market uncertainty and concerns about the impact on the construction industry. This decline illustrated the sensitivity of Otis’s stock to macroeconomic events.

Narrative of Price Movement

The initial impact of the pandemic was a rapid sell-off, as investors reacted to the uncertainty surrounding the virus’s spread and the potential for widespread economic disruption. This led to a steep decline in the stock price, which then stabilized as the market began to adjust to the new reality. The subsequent recovery was gradual, as investor confidence gradually returned and the construction sector began to show signs of recovery.

Visual Representation

A graph depicting this period would show a sharp, near-vertical decline in the early stages, followed by a period of consolidation and a gradual, less steep incline as the market recovered. The key turning points would be the initial sell-off, the bottom of the decline, and the subsequent recovery. The overall trend would be a V-shaped recovery, although the full recovery to pre-pandemic levels may have taken several months or even years.

FAQ Overview

What is the current dividend yield for Otis stock?

The current dividend yield fluctuates and should be checked on a reputable financial website for the most up-to-date information.

How does Otis compare to its competitors in terms of market capitalization?

Market capitalization varies constantly. Refer to a financial data provider for the latest figures and comparison with competitors.

Where can I find reliable real-time data on Otis stock price?

Major financial websites such as Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes and charting tools.