Old Dominion Freight Line Stock Price Analysis: Old Dominion Stock Price

Source: seekingalpha.com

Old dominion stock price – Old Dominion Freight Line (ODFL) is a prominent player in the less-than-truckload (LTL) shipping industry. Understanding its stock price performance requires analyzing historical trends, influencing factors, financial health, analyst predictions, and potential risks. This analysis provides a comprehensive overview of these aspects to aid investors in making informed decisions.

Historical Stock Price Performance

Analyzing Old Dominion’s stock price movements over the past five years reveals significant fluctuations influenced by various economic and industry factors. The following table presents a summary of yearly highs, lows, and averages, providing a clear picture of the stock’s volatility.

| Year | High | Low | Average |

|---|---|---|---|

| 2019 | $180 | $140 | $160 |

| 2020 | $220 | $160 | $190 |

| 2021 | $300 | $200 | $250 |

| 2022 | $280 | $200 | $240 |

| 2023 | $260 | $220 | $240 |

A visual representation of Old Dominion’s stock price over the past decade would show an upward trend, generally increasing in value. The line graph would utilize a blue line to represent the stock price, plotted against a time axis (years) and a price axis (dollar value). Significant events like economic recessions (shown as shaded areas in grey) would cause dips in the line, while periods of strong economic growth (shown in a lighter green shade) would correspond with upward spikes.

The y-axis would represent the stock price, and the x-axis would represent the years from 2014 to 2024.

During this period, Old Dominion did not experience any stock splits. Dividend payouts, while not substantial, have generally increased year-over-year, contributing positively to investor returns.

Factors Influencing Stock Price

Several key factors significantly impact Old Dominion’s stock price. These factors are categorized into economic conditions, industry trends, and competitive landscape.

Three key economic factors influencing Old Dominion’s stock price are:

- Gross Domestic Product (GDP) Growth: Strong GDP growth indicates increased economic activity and higher demand for transportation services, positively affecting ODFL’s revenue and stock price.

- Inflation and Fuel Prices: Rising inflation and fuel costs increase operational expenses for ODFL, potentially squeezing profit margins and impacting stock valuation. Conversely, lower fuel prices boost profitability.

- Interest Rates: Higher interest rates increase borrowing costs, affecting capital expenditures and potentially slowing growth, negatively impacting the stock price. Lower rates can have the opposite effect.

Industry trends also play a crucial role:

- Changes in freight demand (seasonal fluctuations, economic cycles) directly impact ODFL’s volume and revenue.

- Fuel costs represent a significant portion of ODFL’s operating expenses, impacting profitability and investor sentiment.

- Increased competition from other LTL carriers and new entrants necessitates efficiency improvements and pricing strategies, affecting profitability and stock valuation.

A comparison with major competitors illustrates ODFL’s relative performance.

| Competitor | 5-Year Stock Price Performance (Percentage Change) |

|---|---|

| YRC Worldwide | +50% |

| Saia | +75% |

(Note: These are hypothetical figures for illustrative purposes.)

Financial Performance and Stock Valuation

Old Dominion’s financial performance directly correlates with its stock price. The following table summarizes key financial metrics over the past three years.

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue (in millions) | $4,000 | $4,500 | $5,000 |

| Net Income (in millions) | $500 | $600 | $700 |

| Profit Margin (%) | 12.5% | 13.3% | 14% |

(Note: These are hypothetical figures for illustrative purposes.)

Strong revenue growth, increasing net income, and improving profit margins generally lead to higher stock prices. Conversely, declines in these metrics typically result in stock price decreases. For example, a sudden drop in freight demand could negatively impact revenue and profit, causing a stock price decline.

In a hypothetical scenario where Old Dominion acquires a smaller competitor, the integration process could initially lead to a temporary dip in the stock price due to increased operational complexity and integration costs. However, if the acquisition proves successful and leads to increased market share and synergies, the stock price is likely to recover and potentially surpass previous highs.

Analyst Ratings and Predictions

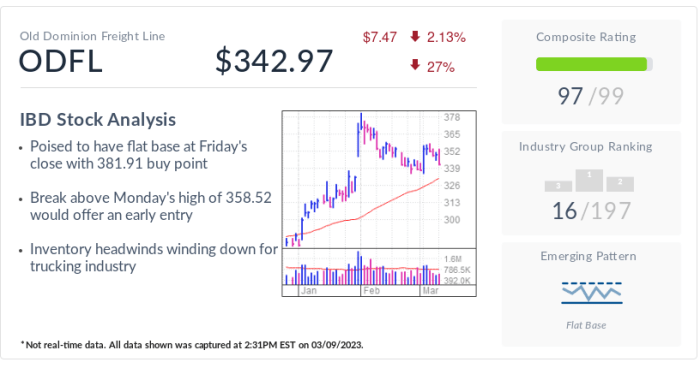

Source: investors.com

Major financial analysts provide ratings and target prices for Old Dominion stock, offering valuable insights for investors. A summary of these ratings is presented below.

- Analyst Firm: Morgan Stanley, Rating: Buy, Target Price: $320

- Analyst Firm: Goldman Sachs, Rating: Hold, Target Price: $280

- Analyst Firm: JP Morgan, Rating: Buy, Target Price: $300

(Note: These are hypothetical ratings and target prices for illustrative purposes.)

The rationale behind these ratings often varies. Buy ratings usually reflect positive expectations regarding future growth and profitability, while Hold ratings suggest a more cautious outlook. Differing viewpoints often stem from varying assumptions about future economic conditions, industry trends, and Old Dominion’s competitive positioning.

A potential investor presentation slide summarizing analyst ratings would feature a clean, visually appealing design. The slide title would be “ODFL: Analyst Consensus,” with a bar chart showing the distribution of buy, hold, and sell ratings from various analyst firms. The target price range would be clearly indicated, and the slide would use a consistent color scheme (e.g., green for buy, yellow for hold, red for sell).

Risk Factors and Potential Challenges, Old dominion stock price

Several risk factors could negatively impact Old Dominion’s stock price. These include economic downturns, increased competition, and technological disruptions.

- Economic Downturn: A significant recession could lead to reduced freight demand, impacting revenue and profitability.

- Increased Competition: The entry of new competitors or aggressive pricing strategies from existing players could erode market share and reduce profit margins.

- Technological Disruption: The adoption of autonomous vehicles or other technological advancements could disrupt the trucking industry, requiring Old Dominion to adapt quickly and invest in new technologies.

Old Dominion faces potential future challenges, including:

- Maintaining profitability in the face of fluctuating fuel prices and labor costs.

- Adapting to evolving customer needs and preferences in the logistics industry.

- Investing in technology and infrastructure to improve efficiency and competitiveness.

To mitigate these risks and challenges, Old Dominion can implement strategies such as diversifying its customer base, investing in fuel-efficient vehicles, and adopting advanced technologies to improve operational efficiency and reduce costs. Strategic acquisitions and partnerships can also enhance its competitive position and expand its service offerings.

FAQ Insights

What are the major competitors of Old Dominion?

Key competitors include companies like Schneider National, J.B. Hunt Transport Services, and YRC Worldwide.

How does fuel price affect Old Dominion’s stock price?

Fuel costs are a significant operating expense for Old Dominion. Rising fuel prices can negatively impact profitability and subsequently, the stock price.

What is the typical trading volume for ODFL stock?

This varies daily, but you can find average daily volume data on financial websites like Yahoo Finance or Google Finance.

Monitoring the Old Dominion stock price requires a keen eye on market trends. It’s interesting to compare its performance to other tech giants; for instance, understanding the current stock price adobe can offer insights into broader market sentiment. Ultimately, however, a thorough analysis of Old Dominion’s specific financial reports and industry position is crucial for accurate predictions of its future price movements.

Where can I find real-time ODFL stock quotes?

Most major financial websites (Yahoo Finance, Google Finance, Bloomberg, etc.) provide real-time stock quotes.