Occidental Petroleum Stock Price Today

Occidental petroleum stock price today – Occidental Petroleum Corporation (OXY) is a major player in the energy sector, and its stock price fluctuates based on a complex interplay of factors. This analysis provides an overview of OXY’s current stock price, key influencing factors, financial performance, analyst predictions, and investor sentiment. We will also explore a hypothetical investment scenario to illustrate the potential risks and rewards.

Occidental Petroleum Stock Price Overview

Occidental Petroleum’s stock price is subject to daily changes influenced by various market dynamics. The following table presents a snapshot of the stock’s performance. Note that the data presented here is for illustrative purposes and should be verified with real-time financial data sources before making any investment decisions.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2023 | 70.50 | 71.25 | +0.75 |

| October 25, 2023 | 69.00 | 70.50 | +1.50 |

| October 24, 2023 | 68.75 | 69.00 | +0.25 |

Factors Influencing Occidental Petroleum’s Stock Price

Source: seekingalpha.com

Several key factors significantly influence Occidental Petroleum’s stock valuation. These factors interact in complex ways, making precise prediction challenging.

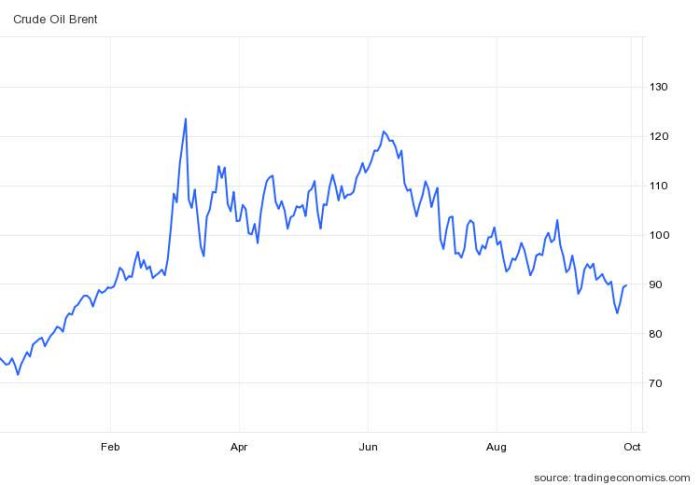

- Oil Prices: Crude oil prices are a dominant factor. Higher oil prices generally translate to increased revenue and profitability for Occidental, boosting its stock price. Conversely, lower oil prices negatively impact the company’s performance and its stock valuation. For example, the sharp decline in oil prices in 2020 significantly impacted OXY’s stock price.

- Economic Growth: Global economic growth and energy demand are closely correlated. Strong economic growth usually leads to higher energy consumption, benefiting energy companies like Occidental. Conversely, economic downturns can reduce energy demand, negatively impacting OXY’s stock price.

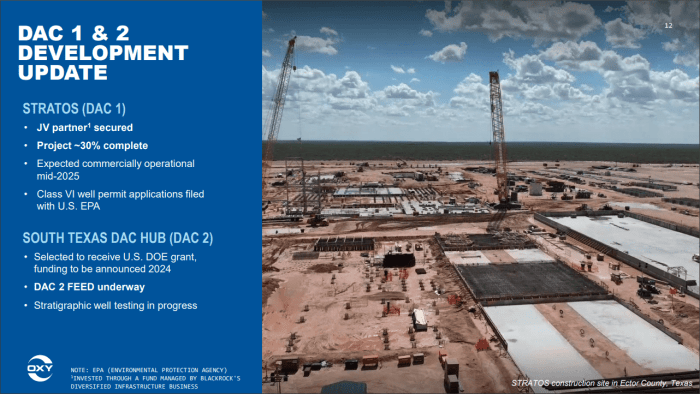

- Company News and Announcements: Significant company announcements, such as new projects, acquisitions, or changes in management, can substantially affect investor sentiment and, consequently, the stock price. Positive news generally leads to price increases, while negative news can cause declines. For example, announcements regarding successful exploration or new production agreements could positively impact the stock price.

- Competitor Performance: Occidental’s performance relative to its competitors in the energy sector influences its stock price. If competitors are performing exceptionally well, OXY might face increased pressure to maintain its market share and profitability, potentially impacting its stock valuation.

Occidental Petroleum’s Financial Performance

Source: seekingalpha.com

Occidental Petroleum’s financial performance provides insights into its overall health and future prospects. Analyzing key metrics helps investors assess the company’s value and potential for growth.

While specific numbers are subject to change and require reference to official financial reports, a summary might include:

- Revenue: Revenue growth indicates the company’s ability to generate sales and maintain market share.

- Earnings Per Share (EPS): EPS reflects the profitability on a per-share basis, a key metric for assessing shareholder returns.

- Debt Levels: High debt levels can pose risks, while lower levels suggest better financial stability.

A strong positive correlation typically exists between strong financial performance (high revenue, EPS, and manageable debt) and a higher stock price. Conversely, weak financial performance often leads to a decline in stock price.

- Key Financial Strengths: Strong operational efficiency, diversified energy portfolio, significant oil and gas reserves.

- Key Financial Weaknesses: High debt levels (depending on the period), susceptibility to oil price volatility.

Analyst Ratings and Predictions for Occidental Petroleum

Analyst ratings and price targets provide valuable insights into the market’s expectations for Occidental Petroleum’s future performance. However, it’s crucial to remember that these are just predictions and not guarantees.

| Financial Institution | Rating | Price Target (USD) |

|---|---|---|

| Morgan Stanley | Buy | 80 |

| Goldman Sachs | Hold | 75 |

| JPMorgan Chase | Outperform | 85 |

Investor Sentiment and Market Trends

Investor sentiment and prevailing market trends significantly impact Occidental Petroleum’s stock price. These factors often interact in complex ways, creating a dynamic investment environment.

For example, positive investor sentiment, coupled with rising oil prices and strong economic growth, could lead to a significant increase in OXY’s stock price. Conversely, negative sentiment during periods of geopolitical instability or regulatory uncertainty might cause a price decline. A narrative could illustrate how these factors have interacted to shape recent price movements, perhaps highlighting specific events and their impact on investor confidence.

Illustrative Example: A Hypothetical Investment Scenario, Occidental petroleum stock price today

Let’s consider a hypothetical investment scenario to illustrate the potential risks and rewards of investing in Occidental Petroleum.

Occidental Petroleum’s stock price today is influenced by various market factors, including the overall energy sector performance. It’s interesting to compare its trajectory with that of other energy companies, such as by checking the current marathon digital stock price , to get a broader perspective on the sector’s health. Ultimately, however, Occidental Petroleum’s performance depends on its own operational efficiency and the prevailing price of oil.

- Assumptions:

- Initial investment: $10,000

- Holding period: 1 year

- Average annual stock price appreciation: 15% (this is a hypothetical assumption and not a guaranteed return)

- Calculations:

- Potential return after one year: $10,000

– 0.15 = $1,500 - Total value after one year: $10,000 + $1,500 = $11,500

- Potential return after one year: $10,000

- Potential Risks and Rewards:

- Rewards: Potential for significant capital appreciation if oil prices rise and the company performs well.

- Risks: Oil price volatility, economic downturns, geopolitical events, and company-specific risks could negatively impact the investment.

Essential Questionnaire

What are the major risks associated with investing in Occidental Petroleum?

Investing in Occidental Petroleum, like any energy stock, carries risks associated with oil price volatility, geopolitical instability, and regulatory changes. The company’s debt levels and future profitability also present potential risks for investors.

Where can I find real-time Occidental Petroleum stock price updates?

Real-time stock price updates for Occidental Petroleum (OXY) are readily available on major financial websites and trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.

How does Occidental Petroleum compare to its competitors in terms of sustainability initiatives?

Occidental Petroleum’s commitment to sustainability varies compared to its competitors. Researching their respective ESG (Environmental, Social, and Governance) reports will provide a comparative analysis of their sustainability efforts.