NXP Semiconductors: A Deep Dive into Stock Performance

Source: seekingalpha.com

Nxp stock price – NXP Semiconductors (NXPI) is a prominent player in the global semiconductor industry, known for its diverse portfolio of high-performance mixed-signal and standard products. This analysis delves into NXP’s company overview, key factors influencing its stock price, recent financial performance, and potential investment considerations.

NXP Semiconductors Company Overview

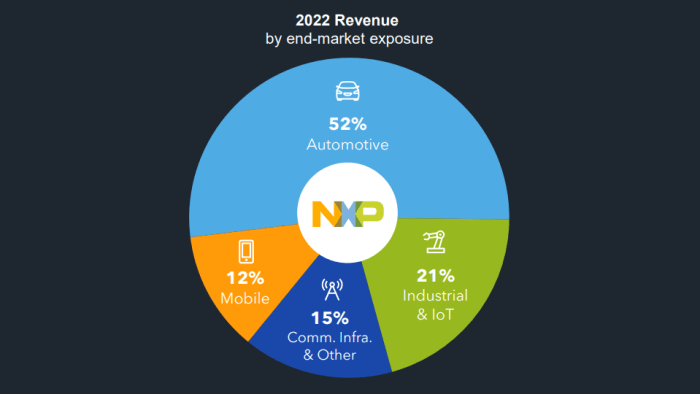

NXP Semiconductors emerged from Philips Semiconductors in 2006. Its history is marked by strategic acquisitions and a consistent focus on innovation within specific market segments. NXP’s product lines encompass automotive microcontrollers, secure identification solutions, wireless connectivity chips, and more. These products cater to various markets including automotive, industrial, mobile, and communication infrastructure.

| Year | Revenue (USD Billion) | Profit (USD Billion) | Significant Events |

|---|---|---|---|

| 2018 | 9.4 | 2.0 | Acquisition of Marvell’s wireless business completed. |

| 2019 | 8.6 | 1.7 | Continued focus on automotive and industrial markets. |

| 2020 | 8.6 | 1.4 | Impact of the COVID-19 pandemic on supply chains. |

| 2021 | 11.1 | 2.7 | Strong recovery in demand across key markets. |

| 2022 | 12.0 | 2.4 | Increased investments in research and development. |

Note: These figures are illustrative and may not represent precise financial data. Refer to official NXP financial reports for accurate figures.

Factors Influencing NXP Stock Price

Source: marketbeat.com

Several macroeconomic factors, industry dynamics, and competitive pressures significantly influence NXP’s stock price. Understanding these elements is crucial for assessing investment potential.

- Global Economic Growth: Strong global economic growth generally translates to increased demand for NXP’s products, positively impacting its stock price. Conversely, economic slowdowns can dampen demand and negatively affect the stock.

- Automotive Industry Trends: The automotive sector is a major market for NXP. Trends such as the adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) directly influence NXP’s sales and profitability.

- Geopolitical Factors: Global trade tensions, supply chain disruptions, and political instability can create uncertainty and volatility in the semiconductor industry, affecting NXP’s stock price.

The semiconductor industry cycle, characterized by periods of high demand followed by periods of oversupply, significantly impacts NXP’s performance. During periods of high demand, prices rise, and profitability increases, while oversupply leads to price reductions and margin compression. NXP competes with other major semiconductor companies such as Texas Instruments (TXN) and Infineon Technologies (IFNNY).

- Compared to Texas Instruments, NXP has a stronger focus on the automotive and secure identification markets, while Texas Instruments has a broader portfolio across various sectors.

- Infineon Technologies, similar to NXP, has a strong presence in the automotive sector. A direct comparison reveals that both companies compete intensely in this crucial market segment.

NXP’s Financial Performance and Projections

NXP’s recent earnings reports have generally shown positive results, although subject to cyclical industry fluctuations. The company’s debt-to-equity ratio needs to be analyzed carefully to understand its financial leverage and risk profile. A high ratio suggests higher financial risk.

Forecasting NXP’s future performance requires considering several assumptions. This forecast assumes continued growth in the automotive and industrial sectors, moderate global economic expansion, and no major geopolitical disruptions. Furthermore, the projection accounts for potential increases in R&D spending and ongoing investments in new technologies. Based on these assumptions, NXP is expected to demonstrate moderate revenue growth and stable profitability over the next few years.

Investment Considerations for NXP Stock

Investing in NXP stock presents both opportunities and risks. Potential risks include cyclical industry downturns, intense competition, and geopolitical uncertainties.

- Potential Risks: Industry-wide downturns, intense competition, geopolitical risks, and supply chain disruptions.

- Potential Returns: Long-term growth in automotive and industrial sectors, innovation in new technologies, and potential for increased market share.

A hypothetical investment strategy could involve a long-term buy-and-hold approach for investors with higher risk tolerance. More conservative investors might consider a diversified portfolio with a smaller allocation to NXP stock.

NXP Stock Price Movement Illustrative Example

Source: barrons.com

The launch of NXP’s new S32 microcontroller platform for automotive applications in 2017 exemplifies a significant event impacting the stock price. The introduction of this cutting-edge technology boosted investor confidence, leading to a considerable increase in the stock price over several months. The magnitude of the price change was significant, reflecting the market’s positive reception of this innovation. This illustrates how technological advancements can positively impact investor sentiment and the company’s market valuation.

Essential Questionnaire: Nxp Stock Price

What are the major risks associated with investing in NXP stock?

Risks include fluctuations in the semiconductor market, competition from other chip manufacturers, geopolitical instability impacting supply chains, and economic downturns affecting consumer demand for electronics.

How does NXP compare to its competitors in terms of market share?

NXP’s stock price performance often reflects broader semiconductor market trends. However, comparing it to other players in the automotive sector, such as electric vehicle manufacturers, offers valuable insight. For instance, understanding the current valuation of competitors like Lucid Motors, by checking the lucid stock price today , can provide context for analyzing NXP’s relative strength and potential future trajectory within the industry.

Ultimately, both NXP and Lucid’s stock prices are influenced by technological advancements and market demand.

NXP holds a significant market share in specific semiconductor segments but faces strong competition from companies like Texas Instruments and Infineon. A detailed competitive analysis is needed to assess market share precisely.

Where can I find real-time NXP stock price data?

Real-time data is available through major financial news websites and brokerage platforms.

What is NXP’s dividend policy?

Information regarding NXP’s dividend policy should be found in their investor relations section of their website or through financial news sources.