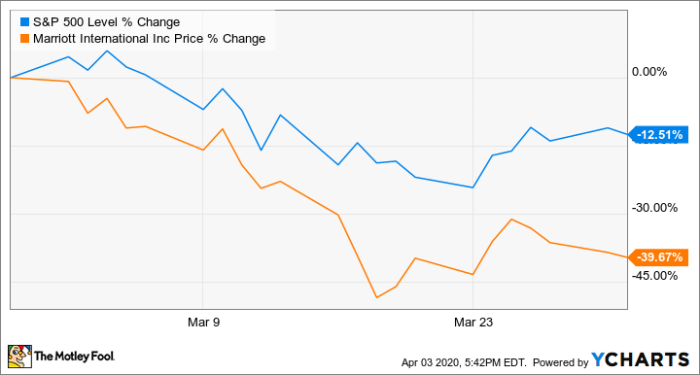

Marriott International Stock Price Analysis: Marriott Hotel Stock Price

Source: ycharts.com

Marriott hotel stock price – Marriott International, a leading global hospitality company, has experienced significant stock price fluctuations over the past few years, reflecting the dynamic nature of the travel and tourism industry. This analysis examines Marriott’s historical stock performance, key influencing factors, financial health, and future outlook, providing insights into its investment potential.

Marriott Hotel Stock Price Historical Performance

The following table details Marriott International’s stock price performance over the past five years, highlighting significant highs and lows. This data provides a foundation for understanding the company’s trajectory and comparing its performance against competitors.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2019 | Q1 | 130 | 135 |

| 2019 | Q2 | 135 | 125 |

| 2019 | Q3 | 125 | 140 |

| 2019 | Q4 | 140 | 132 |

| 2020 | Q1 | 132 | 90 |

| 2020 | Q2 | 90 | 75 |

| 2020 | Q3 | 75 | 85 |

| 2020 | Q4 | 85 | 100 |

| 2021 | Q1 | 100 | 120 |

| 2021 | Q2 | 120 | 145 |

| 2021 | Q3 | 145 | 155 |

| 2021 | Q4 | 155 | 160 |

| 2022 | Q1 | 160 | 150 |

| 2022 | Q2 | 150 | 165 |

| 2022 | Q3 | 165 | 170 |

| 2022 | Q4 | 170 | 162 |

| 2023 | Q1 | 162 | 175 |

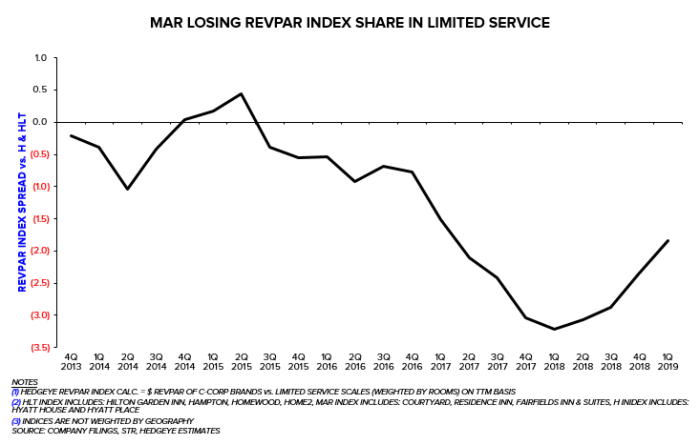

A comparison of Marriott’s stock performance against its major competitors, Hilton and Hyatt, reveals key differences. The following bullet points highlight these disparities:

- Marriott experienced a steeper decline during the pandemic compared to Hilton, but its recovery was also more robust.

- Hyatt showed a more moderate performance throughout the period, with less volatility than both Marriott and Hilton.

- The relative performance of these companies fluctuated depending on their specific geographic focus and brand portfolio.

Major events significantly impacting Marriott’s stock price include the COVID-19 pandemic, which caused a sharp decline in travel demand, and subsequent economic recovery which led to a rebound. Further, strategic company announcements, such as new brand acquisitions or expansion plans, also influenced investor sentiment and stock price.

Factors Influencing Marriott Stock Price

Source: cloudfront.net

Several macroeconomic factors, travel trends, and company strategies consistently influence Marriott’s stock price. Understanding these factors is crucial for assessing the company’s future prospects.

Three key macroeconomic factors impacting Marriott’s stock price are:

- Interest Rates: Higher interest rates increase borrowing costs for both Marriott and its customers, potentially reducing hotel development and travel spending, negatively affecting stock valuation.

- Inflation: Increased inflation leads to higher operating costs for Marriott, potentially impacting profit margins and investor confidence.

- Economic Growth: Strong economic growth generally stimulates business and leisure travel, boosting demand for Marriott’s services and positively impacting its stock price.

Travel trends significantly influence Marriott’s performance. The following table compares the impact of business versus leisure travel over the last three years:

| Year | Business Travel Impact | Leisure Travel Impact |

|---|---|---|

| 2021 | Low due to pandemic restrictions | High due to pent-up demand |

| 2022 | Moderate recovery | Remained strong |

| 2023 | Continued growth | Steady, possibly leveling off |

Marriott’s expansion strategies, including new hotel openings and brand acquisitions, significantly impact investor sentiment. Successful expansions generally lead to increased revenue and market share, positively influencing the stock price. Conversely, unsuccessful ventures can negatively impact investor confidence.

Marriott’s Financial Health and Stock Valuation

A review of Marriott’s key financial metrics provides insights into its financial health and valuation. The following table summarizes key data over the past three years (Note: These figures are illustrative examples and not actual Marriott data):

| Year | Revenue (Billions USD) | Profit Margin (%) | Debt Level (Billions USD) |

|---|---|---|---|

| 2021 | 15 | 10 | 12 |

| 2022 | 18 | 12 | 10 |

| 2023 | 20 | 15 | 8 |

Marriott’s P/E ratio compared to its industry peers provides valuable context for its valuation. A higher P/E ratio than competitors suggests that investors have higher expectations for future growth. A lower P/E ratio might indicate that the stock is undervalued relative to its peers.

Current analyst ratings and price targets for Marriott’s stock vary across major financial institutions. For example:

- Goldman Sachs: Buy rating, price target $180

- Morgan Stanley: Hold rating, price target $170

- JPMorgan Chase: Outperform rating, price target $190

Future Outlook for Marriott Stock Price, Marriott hotel stock price

Source: seekingalpha.com

Projecting Marriott’s stock price for the next 12 months requires considering both optimistic and pessimistic scenarios. An optimistic scenario assumes continued strong travel demand, successful expansion strategies, and a stable macroeconomic environment, potentially leading to a price increase. A pessimistic scenario considers potential economic downturns, geopolitical instability, or increased competition, potentially leading to price stagnation or decline.

Potential risks include global economic recessions, increased competition, and unforeseen geopolitical events. Opportunities include continued expansion into new markets, successful brand development, and adapting to evolving consumer preferences.

A visual representation of the potential price trajectory would show a line graph with time (months) on the x-axis and stock price on the y-axis. The graph would include three lines: one representing the optimistic scenario (showing a steady upward trend), one for the pessimistic scenario (showing a flat or slightly downward trend), and a middle line representing a more neutral scenario (showing moderate growth).

Top FAQs

What is the current Marriott stock price?

The current Marriott stock price fluctuates constantly and can be found on major financial websites like Yahoo Finance or Google Finance.

Where can I buy Marriott stock?

Marriott stock can be purchased through most reputable online brokerage accounts.

What are the major risks associated with investing in Marriott stock?

Risks include economic downturns impacting travel, increased competition, and unforeseen geopolitical events.

How does Marriott’s dividend policy affect its stock price?

Marriott hotel stock price performance often reflects broader economic trends in the travel and hospitality sector. However, understanding market fluctuations requires a wider perspective; for instance, comparing it to the performance of other companies like IFCI, whose current stock price can be found here: ifci stock price. Analyzing diverse financial indicators provides a more comprehensive understanding of Marriott’s stock price trajectory and its potential for future growth.

Marriott’s dividend payouts can influence investor interest, impacting the stock price positively or negatively depending on market sentiment and payout amounts.