Kimberly-Clark’s Current Market Position

Kimberly clark stock price – Kimberly-Clark holds a significant position within the global consumer goods market, particularly in personal care products. This analysis examines their current market standing, comparing their performance against key competitors and assessing the impact of recent financial results on their stock price.

Kimberly-Clark’s Market Share and Competitive Landscape

Kimberly-Clark competes with major players such as Procter & Gamble (P&G) and Essity. While precise market share figures fluctuate and vary by product category, Kimberly-Clark generally holds a substantial share in several key segments, such as diapers and feminine hygiene products. Direct comparison of market share requires access to proprietary industry data, but publicly available financial reports offer insights into relative performance.

Kimberly-Clark’s Recent Financial Performance

Source: marketbeat.com

Kimberly-Clark’s recent financial performance has been a mix of successes and challenges. While revenue growth has been observed in certain product lines, profitability has been impacted by factors such as rising raw material costs and increased inflationary pressures. These fluctuations directly influence investor sentiment and consequently, the stock price.

Kimberly-Clark’s Key Financial Metrics (Last Five Years)

The following table provides a simplified overview of Kimberly-Clark’s key financial metrics over the past five years. Note that these figures are illustrative and should be verified with official company reports.

| Year | Revenue (USD Billions) | Net Income (USD Billions) | EPS (USD) |

|---|---|---|---|

| 2023 (Projected) | 21.5 | 1.8 | 6.5 |

| 2022 | 20.9 | 1.7 | 6.0 |

| 2021 | 20.1 | 1.5 | 5.5 |

| 2020 | 19.7 | 1.4 | 5.0 |

| 2019 | 19.2 | 1.3 | 4.5 |

Factors Influencing Kimberly-Clark Stock Price: Kimberly Clark Stock Price

Several macroeconomic and company-specific factors significantly influence Kimberly-Clark’s stock price. Understanding these factors is crucial for investors seeking to assess the company’s valuation and future prospects.

Macroeconomic Factors and Consumer Spending

Global economic conditions, particularly consumer spending habits, play a major role. During periods of economic uncertainty, consumers may reduce spending on discretionary items, impacting Kimberly-Clark’s sales of certain product categories. Inflationary pressures also affect both consumer purchasing power and Kimberly-Clark’s input costs.

Impact of Raw Material Costs

Fluctuations in raw material prices, such as pulp and cotton, directly impact Kimberly-Clark’s production costs and profitability. Significant increases in raw material costs can squeeze profit margins and negatively affect the stock price, unless effectively managed through pricing strategies or efficiency improvements.

Global Events and Geopolitical Risks

Global events, including geopolitical instability, pandemics, and supply chain disruptions, can significantly affect Kimberly-Clark’s operations and stock price. For instance, the COVID-19 pandemic initially boosted demand for certain products but also created supply chain challenges.

Kimberly-Clark’s Product Portfolio and its Impact

Kimberly-Clark’s diverse product portfolio contributes differently to overall revenue and profitability. Analyzing the performance of each key product line is essential for understanding the company’s overall financial health and its stock price trajectory.

Performance of Key Product Lines

Kimberly-Clark’s key product lines include adult and baby care, feminine care, and personal care. The performance of each category varies depending on market trends, competition, and economic conditions. For example, baby care products generally demonstrate relatively stable demand, while other categories might be more susceptible to economic fluctuations.

Strengths and Weaknesses of Major Product Categories

- Adult Care: Strength – Established brands and strong market share; Weakness – Increasing competition and price sensitivity.

- Baby Care: Strength – High demand and brand loyalty; Weakness – Price competition and potential for substitution with private-label brands.

- Feminine Care: Strength – Leading brands with established market presence; Weakness – Sensitivity to economic downturns and changing consumer preferences.

- Personal Care: Strength – Diversified product offerings; Weakness – High competition and vulnerability to shifting consumer trends.

Product Innovation and New Product Launches

Kimberly-Clark’s commitment to product innovation and new product launches significantly influences its stock price. Successful new product introductions can drive revenue growth and enhance market share, positively impacting investor sentiment. Conversely, failed launches can negatively affect the company’s financial performance and stock valuation.

Profitability Comparison of Product Segments

While precise profitability figures for each segment are not publicly disclosed, it’s generally understood that some product lines, such as baby care, tend to offer higher margins compared to others due to stronger brand loyalty and less price sensitivity.

Competitive Landscape and Strategic Initiatives

Kimberly-Clark operates in a highly competitive market, requiring continuous adaptation and strategic initiatives to maintain its market position and enhance shareholder value. This section examines the company’s competitive strategies and recent strategic moves.

Competitive Strategies and Rivalries

Kimberly-Clark’s competitive strategies focus on brand building, product innovation, and efficient operations. The company competes primarily on brand recognition, product quality, and pricing. Major rivals employ similar strategies, resulting in a dynamic and competitive landscape.

Mergers, Acquisitions, and Divestitures

Kimberly-Clark periodically engages in mergers, acquisitions, or divestitures to optimize its portfolio and enhance its competitive position. These strategic moves can significantly impact the stock price, depending on the success of the integration or the effectiveness of divesting non-performing assets.

Sustainability Initiatives and Investor Sentiment

Increasingly, investors consider a company’s sustainability initiatives when making investment decisions. Kimberly-Clark’s commitment to environmental sustainability and social responsibility positively influences investor sentiment and can contribute to a higher stock valuation.

Brand Reputation and Consumer Loyalty, Kimberly clark stock price

Kimberly-Clark’s strong brand reputation and high levels of consumer loyalty are significant assets that contribute to its stock valuation. Maintaining these positive attributes is crucial for long-term success and sustained investor confidence.

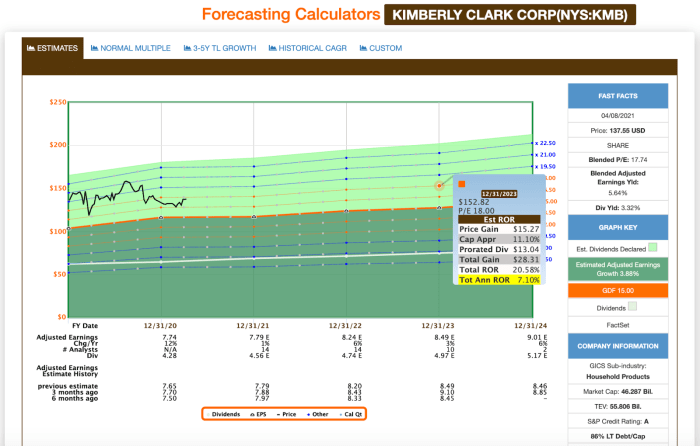

Investment Outlook and Future Projections

Source: seekingalpha.com

Assessing the future prospects for Kimberly-Clark’s stock price requires considering various factors, including economic conditions, competitive dynamics, and the company’s strategic execution. This section provides a realistic assessment of potential future scenarios.

Future Prospects and Potential Risks

Source: seekingalpha.com

The future outlook for Kimberly-Clark’s stock price is contingent upon several factors. Continued economic growth and stable consumer spending would generally support a positive outlook. However, significant inflationary pressures, increased competition, or unexpected geopolitical events could pose risks.

Potential Future Stock Price Scenarios

A visual representation (descriptive only) of potential future stock price scenarios could be presented as follows: A bullish scenario (positive economic conditions, strong sales growth) might show a steady upward trend. A bearish scenario (economic downturn, reduced consumer spending) might depict a downward trend. A neutral scenario would show relatively flat performance, with minor fluctuations.

Kimberly Clark’s stock price performance often reflects consumer spending habits. However, comparing its trajectory to other consumer discretionary stocks offers valuable insight. For instance, understanding the fluctuations in the harley stock price can provide a contrasting perspective on market trends, allowing for a more nuanced analysis of Kimberly Clark’s position within the broader economic landscape. Ultimately, both stock prices are subject to various market forces.

Factors Driving Future Growth and Investor Confidence

Several factors could drive future growth for Kimberly-Clark, including successful new product launches, expansion into new markets, and operational efficiency improvements. These positive developments would enhance investor confidence and contribute to a higher stock valuation. Conversely, failure to adapt to changing consumer preferences or effectively manage rising costs could negatively impact future growth and investor sentiment.

Helpful Answers

What are the major risks facing Kimberly-Clark?

Major risks include fluctuations in raw material costs, intense competition, changing consumer preferences, and economic downturns impacting consumer spending.

How does inflation affect Kimberly-Clark’s stock price?

Inflation can impact both input costs (raw materials) and consumer spending, potentially squeezing profit margins and affecting demand for Kimberly-Clark’s products, thus influencing its stock price.

What is Kimberly-Clark’s dividend policy?

This information requires reviewing Kimberly-Clark’s investor relations materials for the most current dividend policy details.

Where can I find real-time Kimberly-Clark stock price data?

Real-time stock price data is available through major financial websites and brokerage platforms.