Defining “Closure” and “Price” in the Stock Market: Is Closure The Same Thing As Price For Stocks

Source: ifunny.co

Is closure the same thing as price for stocks – Understanding the difference between a stock’s closing price and its overall price throughout the trading day is crucial for investors. This article clarifies the concepts of “closure” and “price” in the stock market context, highlighting their similarities, differences, and roles in investment strategies.

Defining “Closure” in the Stock Market Context

In the stock market, “closure” refers to the final price of a stock at the end of a trading session. This price represents the culmination of all buying and selling activity during that session. Several factors influence the closing price, including overall market sentiment, news events, and order flow in the final minutes of trading. The closing price differs from the opening price (the price at the start of the session), the high (the highest price reached during the session), and the low (the lowest price reached during the session).

Financial analysts frequently use the closing price to calculate daily returns, track long-term performance, and assess the overall health of a company.

Defining “Price” in the Stock Market Context

The term “price” in the stock market encompasses various price points. The bid price is the highest price a buyer is willing to pay for a stock, while the ask price is the lowest price a seller is willing to accept. The last traded price is the price at which the most recent trade occurred. Supply and demand are the primary forces determining these prices.

Increased demand, with limited supply, pushes prices upward, while increased supply with less demand leads to price decreases. Macroeconomic factors, industry trends, company performance, and investor sentiment all influence the interplay of supply and demand and ultimately, the stock’s price.

Comparing Closure and Price: Similarities and Differences

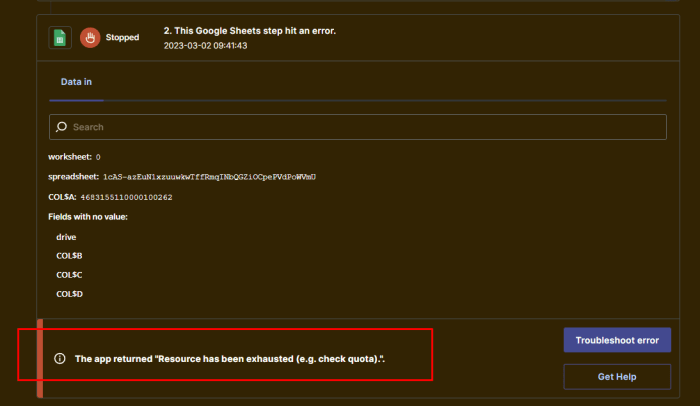

Source: insided.com

The closing price is a single data point within the broader context of a stock’s price throughout the day. While the closing price summarizes the day’s trading activity, it doesn’t fully represent the intraday price fluctuations. The significance of the closing price lies in its use for daily performance calculations and its role in longer-term trend analysis.

| Day | Opening Price | High | Low | Closing Price |

|---|---|---|---|---|

| Monday | $100 | $102 | $98 | $101 |

| Tuesday | $101 | $105 | $100 | $103 |

| Wednesday | $103 | $104 | $101 | $102 |

| Thursday | $102 | $106 | $101 | $105 |

| Friday | $105 | $107 | $104 | $106 |

Daily price changes are calculated by subtracting the previous day’s closing price from the current day’s closing price.

The Role of Closure in Investment Strategies, Is closure the same thing as price for stocks

Investors utilize the closing price for various investment decisions. Day traders, for example, focus on short-term price movements and often close their positions before the market closes. Swing traders, on the other hand, hold positions for a few days or weeks, using the closing price to identify potential entry and exit points. However, relying solely on the closing price is risky.

Investors should consider other factors like volume, price patterns, and fundamental analysis.

- Volume traded

- Technical indicators

- Company fundamentals

- Overall market conditions

- News and events

Impact of Market Events on Closing Price

Significant news events, such as earnings announcements or economic data releases, can significantly impact the closing price. Unexpected events can cause dramatic price swings. For example, a surprise profit warning might lead to a sharp decline in the closing price, while positive news could result in a surge. Market sentiment plays a vital role, with positive sentiment generally pushing prices higher and negative sentiment leading to lower prices.

Hypothetical Scenario: A company announces unexpectedly strong quarterly earnings. Before the announcement, the stock price trades in a range of $50-$52. Upon the announcement, the price immediately jumps to $55, and continues to rise throughout the day, closing at $57. The following day, the price consolidates around $56-$58, reflecting the positive market reaction.

Visual Representation of Closing Price vs. Price

Source: sstatic.net

A stock’s intraday price chart might show a fluctuating line, with highs and lows throughout the day. The closing price would be represented by a distinct point at the end of the line, indicating the final price for that trading session. The shape of the line might indicate trends (upward, downward, or sideways movement). A sharp drop in the line could signal a significant negative event.

A chart illustrating closing prices over a month might show a trend line, either upward (bullish), downward (bearish), or sideways (consolidating). Significant price movements, such as sharp increases or decreases, could be highlighted to show periods of volatility or significant market events.

Commonly Asked Questions

What is the difference between the bid and ask price?

The bid price is the highest price a buyer is willing to pay for a stock, while the ask price is the lowest price a seller is willing to accept.

How does after-hours trading affect the closing price?

After-hours trading can sometimes influence the opening price of the next trading day but doesn’t directly change the official closing price of the previous day.

What is a limit order?

A limit order is an instruction to buy or sell a stock at a specified price or better.

How does volume affect the closing price?

High volume generally indicates strong market interest, which can impact the closing price, but the direction of the impact (up or down) depends on the balance of buying and selling pressure.