Illumina Stock Price Analysis

Source: googleapis.com

Illumina stock price – Illumina, a leading developer of DNA sequencing and array-based technologies, holds a significant position in the genomics market. Understanding its stock price performance requires analyzing historical trends, influencing factors, financial health, analyst predictions, and inherent investment risks. This analysis provides a comprehensive overview of these aspects.

Illumina Stock Price History and Trends

Source: optimole.com

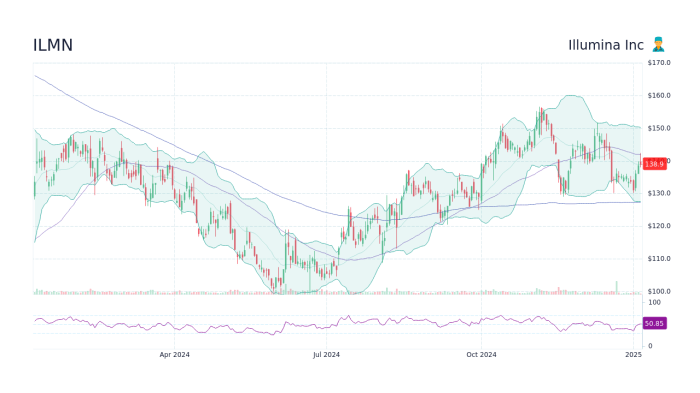

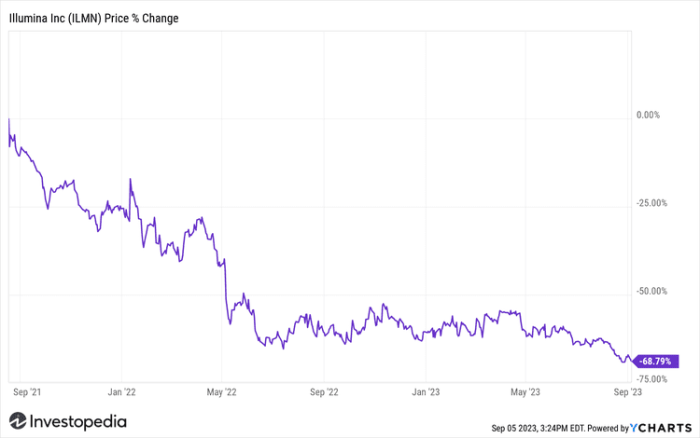

Illumina’s stock price has experienced considerable fluctuation over the past two decades. Analyzing its performance across different timeframes reveals significant trends and correlations with market events.

| Date | Opening Price (USD) | Closing Price (USD) | Volume |

|---|---|---|---|

| Example: 2023-10-27 | Example: 250 | Example: 255 | Example: 1,000,000 |

| Example: 2023-10-26 | Example: 248 | Example: 250 | Example: 900,000 |

While precise figures require referencing financial data providers, a general observation might show a long-term bullish trend over the past 20 years, punctuated by periods of bearish correction tied to broader market downturns and company-specific events such as regulatory hurdles or setbacks in product development. Comparing Illumina’s performance to competitors like Thermo Fisher Scientific or PacBio would necessitate a detailed comparative analysis of their respective stock price movements and market capitalization over the same periods, considering factors like market share and technological advancements.

Factors Influencing Illumina Stock Price

Several economic, company-specific, and industry-wide factors significantly influence Illumina’s stock price.

- Economic Factors: Interest rate hikes can impact investor sentiment and borrowing costs, potentially affecting Illumina’s valuation. Inflationary pressures can influence operational expenses and consumer demand for genetic testing services. Recessionary fears generally lead to decreased investment in research and development, impacting Illumina’s growth prospects.

- Company-Specific Factors: Strong earnings reports typically boost investor confidence and drive up the stock price. Conversely, disappointing financial results can lead to a decline. New product launches and successful regulatory approvals can significantly impact market share and revenue streams. Strategic partnerships and acquisitions can also positively influence the stock price, while legal disputes or internal challenges can negatively affect it.

- Industry-Wide Trends: Advancements in sequencing technology and the increasing demand for genetic testing are generally positive for Illumina. However, a highly competitive landscape with emerging players can create price pressure and limit market share growth.

Positive Factors: Strong R&D pipeline, increasing adoption of genomic technologies, strategic partnerships.

Negative Factors: Intense competition, regulatory uncertainties, economic downturns.

Illumina’s Financial Performance and Valuation

Analyzing Illumina’s key financial metrics provides insights into its financial health and valuation.

| Year | Revenue (USD millions) | EPS (USD) | Debt (USD millions) | Free Cash Flow (USD millions) |

|---|---|---|---|---|

| Example: 2022 | Example: 4,500 | Example: 5.00 | Example: 2,000 | Example: 1,000 |

| Example: 2021 | Example: 4,000 | Example: 4.50 | Example: 1,800 | Example: 900 |

Illumina’s P/E ratio should be compared to industry averages to assess its relative valuation. A higher P/E ratio might suggest investors expect higher future growth, while a lower ratio might indicate a more conservative valuation. The correlation between these metrics and stock price movements can be analyzed through regression analysis or other statistical methods.

For example, periods of strong revenue growth and increased free cash flow are often associated with increases in the stock price.

Analyst Ratings and Price Targets, Illumina stock price

Source: investopedia.com

Illumina’s stock price has seen some fluctuation recently, mirroring broader market trends. It’s interesting to compare its performance to tech giants; for instance, checking the current price of microsoft stock provides a useful benchmark against a more established player. Ultimately, Illumina’s future trajectory will depend on factors specific to its genomics sector.

Analyst ratings and price targets from reputable financial institutions offer valuable insights into market sentiment and future price expectations.

| Financial Institution | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Example: Goldman Sachs | Example: Buy | Example: 300 | Example: 2023-10-27 |

| Example: Morgan Stanley | Example: Hold | Example: 275 | Example: 2023-10-26 |

Discrepancies in price targets reflect varying perspectives on Illumina’s growth potential, competitive landscape, and risk profile. A consensus of positive ratings generally indicates a bullish outlook, potentially driving up the stock price. Conversely, a shift towards negative ratings can lead to decreased investor confidence and downward price pressure.

Risk Factors Associated with Investing in Illumina

Investing in Illumina stock carries several inherent risks.

| Risk Factor | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| Intense Competition | High | High | Diversify investments |

| Regulatory Changes | Medium | Medium | Monitor regulatory developments |

| Market Volatility | High | High | Employ risk management strategies |

These risks can significantly impact the stock price. For example, increased competition could lead to reduced market share and lower profitability, resulting in a decline in the stock price. Regulatory changes could impose additional costs or limit market access, similarly affecting the stock price negatively. Market volatility can lead to unpredictable price swings, regardless of the company’s performance.

FAQs

What are the main competitors to Illumina?

Illumina faces competition from companies like Thermo Fisher Scientific, BGI Group, and Oxford Nanopore Technologies, among others.

How often does Illumina release earnings reports?

Illumina typically releases its quarterly and annual earnings reports on a regular schedule, usually announced in advance.

Where can I find real-time Illumina stock price data?

Real-time stock price data for Illumina can be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is the typical trading volume for Illumina stock?

The daily trading volume for Illumina stock varies but can be found on financial websites that provide detailed stock information.