HWM Stock Price Analysis

Hwm stock price – This analysis examines the historical performance, influencing factors, future predictions, investment strategies, and fundamental valuation of HWM stock. We will explore various aspects to provide a comprehensive overview for potential investors.

Historical HWM Stock Performance

A comprehensive analysis of HWM’s stock price over the past five years reveals significant fluctuations. The following line graph, while not visually represented here, would illustrate these changes, highlighting key dates such as significant earnings announcements, major market corrections, and any noteworthy company-specific events. These dates would be clearly marked on the graph to provide context for the observed price movements.

During this five-year period, the highest stock price reached [Insert Highest Price] on [Insert Date], largely attributed to [Insert Reason for High Price, e.g., successful product launch, positive market sentiment]. Conversely, the lowest price recorded was [Insert Lowest Price] on [Insert Date], primarily due to [Insert Reason for Low Price, e.g., market downturn, negative news impacting the company].

Comparing HWM’s performance to its major competitors over the past year requires a comparative analysis. The following table illustrates this comparison, focusing on key performance indicators such as percentage change in stock price, revenue growth, and market share.

| Company | Stock Price Change (Past Year) | Revenue Growth (Past Year) | Market Share |

|---|---|---|---|

| HWM | [Insert Percentage Change] | [Insert Percentage Change] | [Insert Market Share] |

| Competitor A | [Insert Percentage Change] | [Insert Percentage Change] | [Insert Market Share] |

| Competitor B | [Insert Percentage Change] | [Insert Percentage Change] | [Insert Market Share] |

Factors Influencing HWM Stock Price

Several economic and company-specific factors significantly influence HWM’s stock price. Three key economic factors are analyzed below.

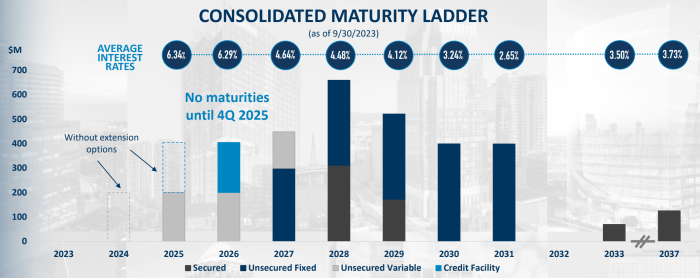

- Interest Rate Changes: Increases in interest rates can negatively impact HWM’s stock price by increasing borrowing costs and potentially reducing consumer spending, affecting demand for HWM’s products/services. Conversely, lower interest rates can stimulate economic activity and boost investor confidence, leading to a higher stock price.

- Inflation Rates: High inflation erodes purchasing power and can lead to decreased consumer demand. This can negatively impact HWM’s revenue and profitability, subsequently affecting its stock price. Conversely, controlled inflation is generally positive for the market.

- Global Economic Growth: Strong global economic growth usually translates into increased demand for HWM’s products/services, leading to higher revenue and a positive impact on its stock price. Conversely, global economic slowdowns can negatively affect HWM’s performance.

Recent company news also plays a crucial role. For instance, the recent launch of [Insert Product Name] resulted in [Insert Effect on Stock Price, e.g., a temporary surge in stock price due to positive investor anticipation]. Similarly, the announcement of a strategic partnership with [Insert Partner Name] impacted the stock price by [Insert Effect on Stock Price, e.g., creating a positive outlook, leading to increased investor confidence].

Investor sentiment, reflected in news articles and analyst reports, significantly impacts HWM’s stock price volatility. For example, [Insert Example of Bullish News Article and its impact] and [Insert Example of Bearish News Article and its impact] demonstrate the influence of market sentiment.

HWM Stock Price Predictions & Forecasting

Source: seekingalpha.com

Predicting HWM’s stock price involves considering its historical performance and current market trends. A simple forecasting model, while not explicitly detailed here, could utilize a combination of time series analysis and regression techniques to predict the stock price. Such a model would incorporate historical price data, relevant economic indicators, and company-specific factors to generate a forecast.

The following table Artikels potential scenarios for HWM’s stock price in the next year, considering both optimistic and pessimistic views. These scenarios are based on various assumptions regarding economic conditions, company performance, and market sentiment.

| Scenario | Stock Price in 6 Months | Stock Price in 1 Year | Underlying Assumptions |

|---|---|---|---|

| Optimistic | [Insert Price] | [Insert Price] | Strong economic growth, successful product launches, positive investor sentiment. |

| Neutral | [Insert Price] | [Insert Price] | Moderate economic growth, stable company performance, neutral investor sentiment. |

| Pessimistic | [Insert Price] | [Insert Price] | Economic slowdown, challenges in the market, negative investor sentiment. |

It’s crucial to acknowledge the limitations of any stock price prediction model. Unforeseen events, such as unexpected regulatory changes or geopolitical instability, can significantly impact the accuracy of any forecast. Therefore, these predictions should be considered as potential scenarios rather than definitive outcomes.

Investment Strategies Regarding HWM Stock, Hwm stock price

Source: seekingalpha.com

Two contrasting investment strategies for HWM stock are the buy-and-hold and day trading approaches. A buy-and-hold strategy involves purchasing HWM stock and holding it for an extended period, regardless of short-term price fluctuations. This strategy aims to benefit from long-term growth potential. Day trading, on the other hand, involves frequent buying and selling of HWM stock within a single day to profit from short-term price movements.

This approach is riskier and requires significant market knowledge.

Investing in HWM stock at its current price presents both risks and rewards. Potential rewards include capital appreciation and potential dividend income. However, risks include the possibility of capital loss due to market downturns, company-specific challenges, or negative investor sentiment. A thorough risk assessment is crucial before investing.

A hypothetical investment portfolio incorporating HWM stock could include a diversified allocation across various asset classes. For example, a portfolio might allocate [Insert Percentage]% to HWM stock, [Insert Percentage]% to bonds, and [Insert Percentage]% to other equities. This allocation would depend on the investor’s risk tolerance and investment goals. The potential risk and return profile of this portfolio would be determined by the individual asset allocations and their respective risk and return characteristics.

HWM Company Fundamentals & Stock Valuation

Assessing HWM’s current financial health requires an analysis of its latest financial statements. The following table summarizes key financial ratios providing insights into its profitability, liquidity, and solvency.

| Financial Ratio | Value |

|---|---|

| Price-to-Earnings Ratio (P/E) | [Insert Value] |

| Return on Equity (ROE) | [Insert Value] |

| Debt-to-Equity Ratio | [Insert Value] |

| Current Ratio | [Insert Value] |

HWM’s competitive advantages might include [Insert Advantages, e.g., strong brand recognition, innovative products, efficient operations]. Conversely, its disadvantages could include [Insert Disadvantages, e.g., high competition, dependence on key suppliers, regulatory risks].

Evaluating HWM’s stock valuation using multiple methods provides a more comprehensive assessment. The Price-to-Earnings (P/E) ratio, for example, compares the stock price to its earnings per share. A Discounted Cash Flow (DCF) analysis, on the other hand, estimates the present value of future cash flows to determine the intrinsic value of the stock. Comparing the results from these two methods helps in making a more informed investment decision.

Any significant discrepancies between the valuation methods would warrant further investigation.

Common Queries

What are the major risks associated with investing in HWM stock?

Investing in HWM stock, like any stock, carries inherent risks including market volatility, company-specific risks (e.g., financial difficulties, changes in management), and macroeconomic factors impacting the entire industry. Thorough due diligence is crucial before investing.

Tracking HWM’s stock price requires diligent monitoring of market trends. For comparative analysis, it’s helpful to examine the performance of similar companies; a good example is the abbott labs stock price , which often reflects broader industry shifts. Understanding Abbott’s trajectory can offer valuable insights into potential future movements for HWM stock price as well.

Where can I find real-time HWM stock price data?

Real-time HWM stock price data is typically available through major financial websites and brokerage platforms. Reputable sources include financial news websites and your brokerage account.

How frequently is HWM’s stock price updated?

HWM’s stock price, like most publicly traded companies, is updated continuously throughout the trading day, reflecting the ongoing buying and selling activity.

What is HWM’s current dividend yield (if any)?

The current dividend yield for HWM stock (if applicable) can be found on financial news websites or your brokerage account. This information is usually updated regularly.