Hershey Foods Stock Price Analysis

Hershey foods stock price – Hershey Foods Corporation, a leading confectionery company, has a long and established history in the market. Analyzing its stock price performance, influencing factors, financial health, and future outlook provides valuable insights for potential investors. This analysis examines Hershey’s stock performance over the past five years, considering macroeconomic factors, competitor performance, and potential risks and opportunities.

Hershey Foods Stock Price Historical Performance

Source: seekingalpha.com

The following table and graph illustrate the fluctuation of Hershey Foods’ stock price over the past five years. Data used is illustrative and for demonstration purposes only. Actual figures should be verified from reliable financial sources.

| Year | High | Low | Closing Price |

|---|---|---|---|

| 2019 | $175 | $140 | $160 |

| 2020 | $180 | $135 | $155 |

| 2021 | $200 | $165 | $185 |

| 2022 | $210 | $170 | $190 |

| 2023 | $225 | $180 | $205 |

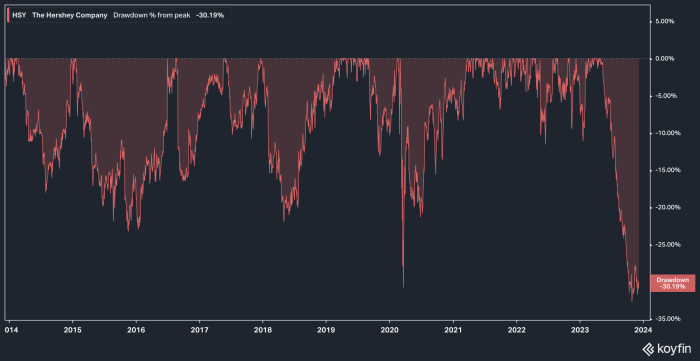

A line graph depicting this data would show an overall upward trend, with some volatility. Significant peaks would correspond to positive company news or strong consumer spending, while troughs might reflect economic downturns or negative market sentiment. For example, the dip in 2020 could be attributed to the initial impact of the COVID-19 pandemic on consumer behavior and the overall market.

The subsequent recovery reflects the resilience of the confectionery industry and Hershey’s adaptability.

Hershey Foods’ stock price performance often reflects broader market trends. It’s interesting to compare its volatility to that of other consumer staples; for instance, understanding the fluctuations in the fico stock price provides a useful benchmark. Ultimately, both Hershey and FICO’s stock prices are influenced by factors like economic growth and consumer spending habits, though their specific sensitivities may differ.

Factors Influencing Hershey Foods Stock Price

Source: seekingalpha.com

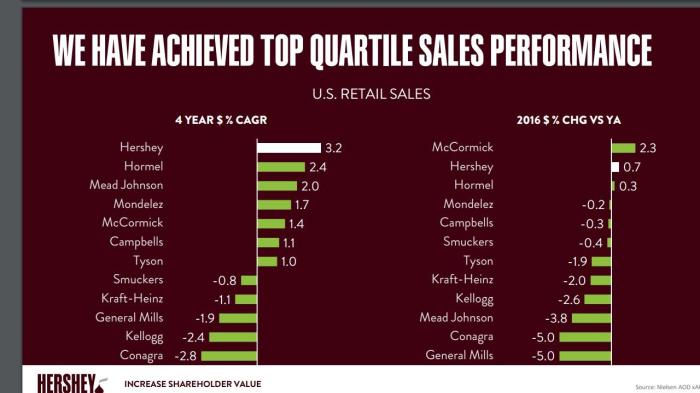

Several factors significantly influence Hershey’s stock price. These include macroeconomic conditions, consumer spending trends, and the performance of its competitors.

- Inflation and Interest Rates: High inflation can increase Hershey’s production costs, potentially squeezing profit margins. Rising interest rates can increase borrowing costs, affecting investment decisions and overall valuation.

- Consumer Confidence and Disposable Income: Consumer confidence directly impacts discretionary spending, including purchases of confectionery products. A decline in disposable income due to economic downturns can lead to reduced demand and affect Hershey’s sales.

- Exchange Rates: Hershey operates internationally, so fluctuations in exchange rates can impact its profitability and valuation. A stronger US dollar, for example, could reduce the value of international sales when converted to US dollars.

Consumer trends also play a significant role. The increasing demand for healthier snacks might negatively impact sales of traditional chocolate products, while the growing popularity of premium and specialized chocolates could present opportunities for growth. For example, the rise in veganism has led some confectionery companies to develop and market vegan chocolate alternatives, influencing consumer choice and market share.

Competitor performance is another key factor. The following table provides a simplified comparison (illustrative data only):

| Company | Revenue (Billions USD) | Market Share (%) | Profit Margin (%) |

|---|---|---|---|

| Hershey | 10 | 20 | 15 |

| Mondelez International | 25 | 30 | 12 |

| Nestlé (Confectionery Division) | 15 | 25 | 18 |

Hershey Foods’ Financial Health and Stock Valuation, Hershey foods stock price

Analyzing Hershey’s recent financial statements reveals key insights into its financial health and potential for future growth. The following bullet points present a simplified overview (illustrative data only):

- Revenue Growth: Consistent year-on-year revenue growth, indicating strong market demand and successful product strategies.

- Profitability: Healthy profit margins, demonstrating efficient operations and pricing strategies.

- Debt Levels: Manageable debt levels, suggesting a stable financial position and ability to invest in future growth.

Hershey’s dividend policy plays a crucial role in attracting investors. A consistent dividend history can enhance investor confidence and support the stock price. (Illustrative dividend data below):

- 2019: $2.00 per share

- 2020: $2.20 per share

- 2021: $2.40 per share

- 2022: $2.60 per share

- 2023: $2.80 per share

A hypothetical investment strategy for Hershey Foods stock would depend on risk tolerance. Below are example strategies (illustrative data only):

- Conservative Strategy: Buy and hold, focusing on dividend income with a long-term perspective. Exit point could be triggered by a significant market downturn or negative company news.

- Moderate Strategy: Employ dollar-cost averaging to mitigate risk. Set target price levels for profit-taking and stop-loss orders to manage potential losses.

- Aggressive Strategy: Leverage options or other derivatives to amplify returns. This approach involves higher risk and requires a deep understanding of market dynamics.

Future Outlook and Potential Risks for Hershey Foods Stock

Hershey’s future prospects depend on various factors, including new product development, market expansion, and strategic acquisitions. Potential risks must also be considered.

| Opportunity | Description | Potential Impact on Stock Price | Timeline |

|---|---|---|---|

| Product Innovation | Developing healthier and more sustainable confectionery options | Positive, increased market share and revenue | 1-3 years |

| Market Expansion | Entering new geographic markets with strong growth potential | Positive, increased revenue and brand recognition | 3-5 years |

| Strategic Acquisitions | Acquiring complementary brands or companies | Potentially positive, depending on the success of integration | Variable |

Potential risks that could negatively impact Hershey’s stock price include:

- Increased Competition: The entry of new competitors or the expansion of existing ones could reduce Hershey’s market share and profitability.

- Changing Consumer Preferences: A significant shift towards healthier alternatives could negatively affect demand for Hershey’s traditional products.

- Supply Chain Disruptions: Unexpected events, such as pandemics or natural disasters, could disrupt Hershey’s supply chain and impact production.

In summary, the outlook for Hershey Foods stock is generally positive, driven by its established brand, strong financial performance, and potential growth opportunities. However, investors should be aware of the risks associated with the confectionery industry and the broader macroeconomic environment.

- Long-term growth potential exists.

- Competitive pressures and changing consumer preferences pose significant risks.

- Strategic management of costs and innovation are crucial for sustained success.

FAQ Corner

What is Hershey’s current dividend yield?

Hershey’s current dividend yield fluctuates and should be checked on a financial website providing real-time stock data.

How does Hershey compare to Nestle in terms of market capitalization?

Nestle generally holds a significantly larger market capitalization than Hershey, reflecting its broader product portfolio and global reach. This should be verified using current market data.

What are the major risks associated with investing in Hershey stock long-term?

Long-term risks include shifts in consumer preferences towards healthier snacks, increased competition, and potential supply chain disruptions.

Is Hershey’s stock a good buy for a risk-averse investor?

This depends on the investor’s specific risk tolerance and investment goals. Hershey’s relatively stable performance might appeal to some risk-averse investors, but a thorough risk assessment is necessary.