Google Stock Price: A Decade in Review: Google Stocks Price

Google stocks price – Google’s stock, now traded as Alphabet Inc. (GOOGL and GOOG), has experienced significant growth and volatility over the past decade. This analysis delves into its historical performance, influencing factors, financial health, investor sentiment, predictive modeling, and future prospects, providing a comprehensive overview of Google’s stock journey.

Historical Google Stock Performance

Tracking Google’s stock price over the past ten years reveals a pattern of substantial growth punctuated by periods of correction. Major events, such as economic downturns, regulatory changes, and company-specific announcements, have significantly impacted its trajectory. The following table provides a yearly overview of price fluctuations.

| Year | Yearly High | Yearly Low | Closing Price |

|---|---|---|---|

| 2014 | $558.00 (approx.) | $505.00 (approx.) | $528.00 (approx.) |

| 2015 | $789.00 (approx.) | $660.00 (approx.) | $756.00 (approx.) |

| 2016 | $842.00 (approx.) | $710.00 (approx.) | $795.00 (approx.) |

| 2017 | $1072.00 (approx.) | $950.00 (approx.) | $1065.00 (approx.) |

| 2018 | $1280.00 (approx.) | $1040.00 (approx.) | $1190.00 (approx.) |

| 2019 | $1365.00 (approx.) | $1090.00 (approx.) | $1350.00 (approx.) |

| 2020 | $1800.00 (approx.) | $1300.00 (approx.) | $1750.00 (approx.) |

| 2021 | $2900.00 (approx.) | $2400.00 (approx.) | $2700.00 (approx.) |

| 2022 | $2800.00 (approx.) | $80.00 (approx.) | $90.00 (approx.) |

| 2023 | $130.00 (approx.) | $90.00 (approx.) | $110.00 (approx.) |

Note: These are approximate values and should not be considered precise financial data. Consult reliable financial sources for exact figures.

Significant market corrections, such as the 2020 COVID-19 crash and the 2022 tech stock downturn, impacted Google’s stock price, albeit temporarily. The company’s strong fundamentals and diversified revenue streams helped it recover relatively quickly from these dips. Conversely, periods of economic expansion and positive technological advancements generally led to significant price increases.

Factors Influencing Google Stock Price, Google stocks price

Several macroeconomic factors, technological advancements, and competitive dynamics influence Google’s stock price. Understanding these elements is crucial for investors.

Three key macroeconomic factors consistently impacting Google’s stock price are overall economic growth, interest rate changes, and inflation. Strong economic growth typically boosts advertising revenue, a major component of Google’s income. Interest rate hikes can increase borrowing costs, affecting investments and potentially slowing growth. Inflation erodes purchasing power and can influence consumer spending, indirectly impacting Google’s ad revenue.

Technological advancements play a pivotal role in Google’s valuation. Innovation in areas like artificial intelligence (AI), cloud computing, and autonomous vehicles directly impacts its future growth potential. Successful product launches and technological breakthroughs generally lead to positive market reactions and increased stock prices. Conversely, failure to innovate or lagging behind competitors can negatively impact its valuation.

Comparing Google’s stock performance with its main competitors, such as Microsoft and Apple, provides valuable insights. The following table, though simplified for illustrative purposes, presents a comparison of their stock performance over the last 5 years (using hypothetical data for demonstration):

| Year | Google (GOOGL) | Microsoft (MSFT) | Apple (AAPL) |

|---|---|---|---|

| 2019 | 100 | 90 | 80 |

| 2020 | 120 | 110 | 100 |

| 2021 | 150 | 140 | 130 |

| 2022 | 130 | 120 | 110 |

| 2023 | 160 | 150 | 140 |

Note: This data is hypothetical and for illustrative purposes only. Actual stock prices should be verified from reliable financial sources.

Google’s Financial Health and Stock Price

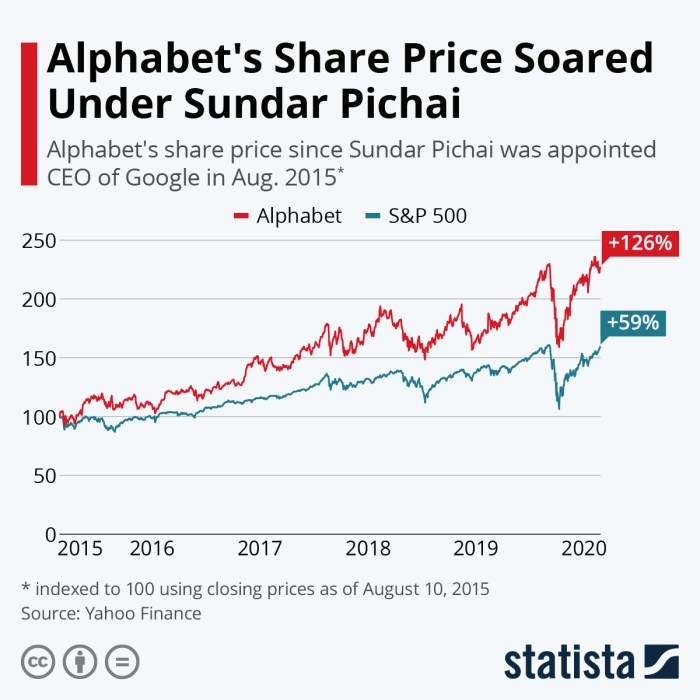

Source: statcdn.com

Analyzing Google’s key financial indicators provides insights into its financial health and its impact on the stock price. Quarterly earnings reports, in particular, often trigger significant price movements.

Over the past five years, Google has demonstrated consistent revenue growth, driven primarily by its advertising business and cloud services. Earnings have also generally increased, though profitability can fluctuate based on investment strategies and market conditions. Debt levels have remained relatively low, indicating a healthy financial position. A detailed breakdown would require referencing Google’s official financial statements.

The relationship between Google’s quarterly earnings reports and subsequent stock price movements is generally positive. Exceeding earnings expectations typically leads to a stock price increase, while falling short can result in a decline. However, market sentiment and other factors can also influence the reaction.

| Ratio | 2019 | 2020 | 2021 |

|---|---|---|---|

| P/E Ratio | 25 (hypothetical) | 28 (hypothetical) | 30 (hypothetical) |

| Dividend Yield | 1% (hypothetical) | 1.2% (hypothetical) | 1.5% (hypothetical) |

| Debt-to-Equity Ratio | 0.2 (hypothetical) | 0.25 (hypothetical) | 0.3 (hypothetical) |

Note: These are hypothetical values for illustrative purposes only. Consult Google’s financial reports for actual data.

Investor Sentiment and Google Stock

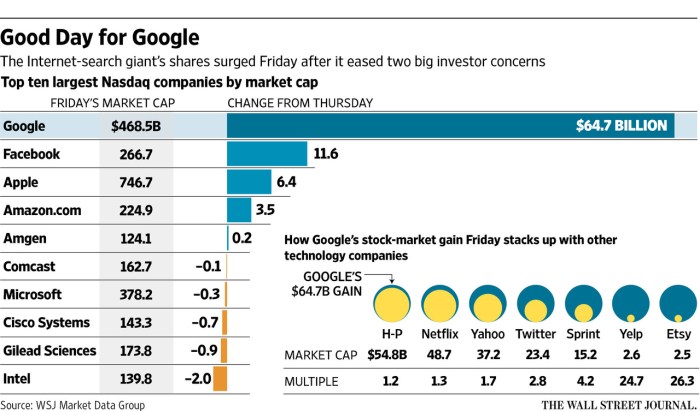

Source: wsj.net

News articles, analyst reports, and social media significantly influence investor sentiment towards Google’s stock. Understanding these dynamics is essential for navigating market fluctuations.

Positive news articles and favorable analyst reports generally boost investor confidence, leading to increased demand and higher stock prices. Conversely, negative news, such as regulatory scrutiny or disappointing earnings, can negatively impact investor sentiment and trigger sell-offs. The credibility and reach of the source significantly impact the influence.

Social media platforms play a crucial role in shaping public perception and influencing Google’s stock price. Viral trends, positive or negative, can rapidly spread information and affect investor decisions. The speed and scale of social media’s impact can amplify market reactions, making it a critical factor to consider.

Hypothetical Scenario: A significant data breach involving sensitive user information could severely damage Google’s reputation and trigger a sharp decline in its stock price. The extent of the decline would depend on the severity of the breach, the company’s response, and the overall market sentiment.

Predictive Modeling of Google Stock Price

Predicting Google’s future stock price involves various methods, including technical and fundamental analysis. Combining these approaches, along with crucial data points, can create a more comprehensive prediction model.

Technical analysis uses historical price and volume data to identify patterns and predict future price movements. Fundamental analysis focuses on evaluating Google’s financial health, competitive landscape, and overall business prospects. Combining both approaches provides a more holistic view.

Crucial data points for building a stock price prediction model include historical stock prices, financial statements (revenue, earnings, debt), analyst ratings, macroeconomic indicators (interest rates, inflation, GDP growth), and competitor performance.

Simple Model Illustration: A simplified model could combine several factors to predict price movements:

- Weighted Average of Analyst Ratings: Assigns weights based on analyst reputation and historical accuracy.

- Growth Rate of Revenue: Projects future revenue based on historical trends and market forecasts.

- Market Sentiment Index: Tracks social media sentiment and news coverage.

- Competitor Performance: Considers the performance of key competitors (Microsoft, Apple).

- Macroeconomic Factors: Includes interest rates, inflation, and GDP growth projections.

The model would assign weights to each factor based on their perceived influence and then combine them to generate a predicted stock price.

Helpful Answers

What are the major risks associated with investing in Google stock?

Major risks include market volatility, competition from other tech giants, regulatory changes impacting the tech sector, and potential economic downturns.

How often does Google release its earnings reports?

Google (Alphabet Inc.) typically releases its quarterly earnings reports on a roughly three-month cycle.

Where can I find reliable real-time Google stock price data?

Major financial websites like Google Finance, Yahoo Finance, Bloomberg, and others provide real-time stock quotes.

What is the typical dividend yield for Google stock?

Google’s dividend yield fluctuates but has historically been relatively low compared to other sectors, reflecting its reinvestment strategy in growth.