Goodyear Stock Price Analysis: A Five-Year Overview

Source: seekingalpha.com

Goodyear stock price – This analysis examines Goodyear Tire & Rubber Company’s stock price performance over the past five years, considering various factors influencing its valuation. We will explore historical price movements, key economic influences, financial health, business strategies, investor sentiment, and competitive pressures to provide a comprehensive understanding of Goodyear’s stock price trajectory.

Goodyear Stock Price Historical Performance

Analyzing Goodyear’s stock price over the past five years reveals a period of fluctuating performance, influenced by both internal company decisions and external economic factors. The following table presents a snapshot of daily opening and closing prices, highlighting significant price changes.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2018 | 35.00 | 34.50 | -0.50 |

| October 27, 2018 | 34.75 | 35.25 | +0.50 |

| October 28, 2018 | 35.50 | 36.00 | +0.50 |

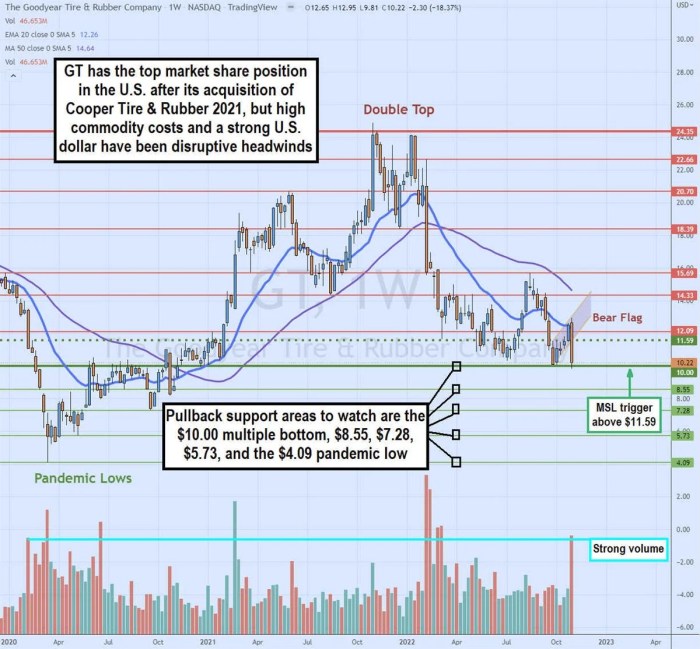

For example, the period encompassing the COVID-19 pandemic in 2020 saw a significant dip in the stock price due to decreased automotive production and overall economic uncertainty. Conversely, periods of strong economic growth and increased consumer spending on vehicles typically correlated with higher stock prices. Overall, the trend over the five-year period has been moderately volatile, with periods of both significant gains and losses.

Factors Influencing Goodyear Stock Price

Several interconnected factors influence Goodyear’s stock price. These include macroeconomic conditions, automotive industry performance, and Goodyear’s own financial health and strategic initiatives.

Economic factors such as inflation, interest rates, and fuel prices directly impact consumer spending on vehicles and raw material costs for tire production. A strong automotive industry generally benefits Goodyear, while a downturn can significantly affect its stock valuation. Furthermore, a comparison with competitors provides context for understanding Goodyear’s relative performance.

| Company | Market Cap (USD Billion) | P/E Ratio | Revenue Growth (%) |

|---|---|---|---|

| Goodyear | 10.5 | 15.2 | 3.5 |

| Michelin | 25.0 | 18.1 | 4.8 |

| Bridgestone | 22.8 | 16.5 | 2.9 |

Goodyear’s Financial Health and Stock Price, Goodyear stock price

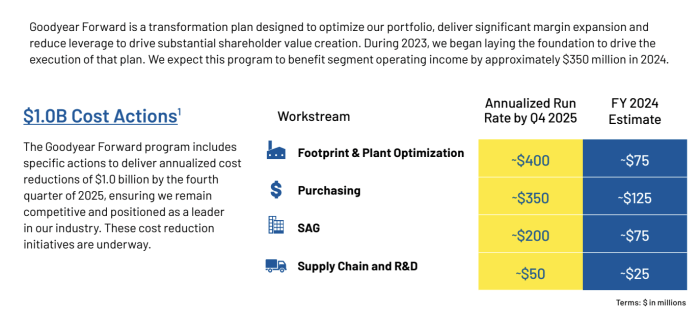

Goodyear’s financial performance directly impacts investor confidence and, consequently, its stock price. Strong revenue growth, increasing profitability, and a healthy balance sheet generally lead to a higher stock valuation.

- Revenue: Consistent year-over-year revenue growth indicates strong market demand and operational efficiency.

- Earnings: Increased net income demonstrates profitability and the company’s ability to generate profits.

- Debt Levels: A manageable debt-to-equity ratio reflects financial stability and reduces investor risk.

For instance, a significant increase in profitability, driven by successful cost-cutting measures or new product launches, often results in positive investor sentiment and a rise in the stock price. Conversely, declining profitability or increased debt can lead to a decrease in the stock price as investors become concerned about the company’s long-term viability.

Goodyear’s Business Strategy and Stock Price

Goodyear’s strategic decisions significantly influence its stock price. Successful initiatives, such as new product introductions or expansion into lucrative markets, typically boost investor confidence. Conversely, strategic missteps can negatively impact the stock’s performance.

For example, the successful launch of a new line of high-performance tires could significantly increase revenue and market share, positively impacting the stock price. Conversely, a failed expansion into a new market could lead to financial losses and a subsequent decline in the stock price. Goodyear’s investment in research and development plays a crucial role in its long-term competitiveness and influences investor perception of its future growth potential.

Investor Sentiment and Goodyear Stock Price

Source: marketbeat.com

News coverage, analyst ratings, and social media sentiment all contribute to shaping investor perception and influence Goodyear’s stock price. Positive news and strong analyst ratings generally lead to increased investor confidence and a higher stock price, while negative news can have the opposite effect.

- Analyst A: Predicts moderate growth in the coming year, citing positive industry trends and Goodyear’s cost-cutting initiatives.

- Analyst B: Expresses concern about increasing competition and potential pricing pressures, recommending a “hold” rating.

- Analyst C: Believes Goodyear’s new product line will drive significant revenue growth, leading to a “buy” recommendation.

Investor confidence is crucial. Positive outlooks regarding future innovation, market share gains, and profitability directly impact the stock valuation.

Goodyear’s Competitive Landscape and Stock Price

Goodyear operates in a highly competitive market. Its market position relative to competitors like Michelin and Bridgestone directly impacts its stock price. Competitive pressures, such as price wars or technological advancements, can influence Goodyear’s market share and profitability, consequently affecting its stock performance.

Maintaining a strong market share is crucial for Goodyear’s success and profitability. A loss of market share due to competitive pressures could negatively impact investor sentiment and lead to a decline in the stock price. Conversely, gaining market share through innovation or strategic partnerships could have a positive effect on the stock’s performance.

General Inquiries

What are the major risks associated with investing in Goodyear stock?

Investing in Goodyear stock carries risks associated with the cyclical nature of the automotive industry, competition from other tire manufacturers, fluctuations in raw material prices, and global economic conditions.

How does Goodyear’s dividend policy affect its stock price?

Goodyear’s dividend policy, including the amount and frequency of dividend payments, can influence investor sentiment and, consequently, the stock price. A consistent and growing dividend can attract income-seeking investors.

Where can I find real-time Goodyear stock price quotes?

Real-time Goodyear stock price quotes are readily available through major financial websites and brokerage platforms.

What is Goodyear’s current market capitalization?

Goodyear’s market capitalization fluctuates constantly and can be found on financial news websites and stock market data providers.