FBTC Stock Price Analysis

Fbtc stock price – This analysis delves into the historical price trends, influencing factors, technical and fundamental aspects, market sentiment, and risk assessment associated with investing in FBTC stock. We will explore various analytical approaches to provide a comprehensive overview of the FBTC investment landscape.

Historical Price Trends of FBTC

Source: tradingview.com

Understanding the historical price fluctuations of FBTC is crucial for informed investment decisions. The following table provides a chronological overview of major price movements, highlighting significant highs and lows. Note that the data presented below is hypothetical for illustrative purposes.

| Date | Open Price (USD) | High Price (USD) | Low Price (USD) | Close Price (USD) |

|---|---|---|---|---|

| 2022-01-01 | 10 | 12 | 9 | 11 |

| 2022-01-08 | 11 | 15 | 10 | 14 |

| 2022-01-15 | 14 | 16 | 12 | 13 |

| 2022-01-22 | 13 | 14 | 11 | 12 |

| 2022-01-29 | 12 | 18 | 11 | 17 |

Factors Influencing FBTC Price

Several macroeconomic factors and specific events significantly impact FBTC’s price. These influences are interconnected and often reinforce each other.

- Macroeconomic Factors: Inflationary pressures can decrease investor confidence, potentially leading to lower FBTC prices. Conversely, periods of low interest rates may stimulate investment, driving prices upward. Geopolitical events and global economic uncertainty also play a role.

- Bitcoin’s Price Influence: As FBTC is likely linked to the Bitcoin market, its price is highly correlated with Bitcoin’s performance. A surge in Bitcoin’s value could positively impact FBTC, while a downturn could have the opposite effect.

- Regulatory Changes: Changes in regulations concerning cryptocurrency or financial markets can significantly impact FBTC’s price. Favorable regulations may boost investor confidence, while stricter rules could lead to price drops.

- News Events: Positive news regarding FBTC’s technology, partnerships, or adoption could lead to price increases. Negative news, such as security breaches or regulatory scrutiny, may trigger price declines. For example, a successful product launch could positively impact the stock price.

Technical Analysis of FBTC

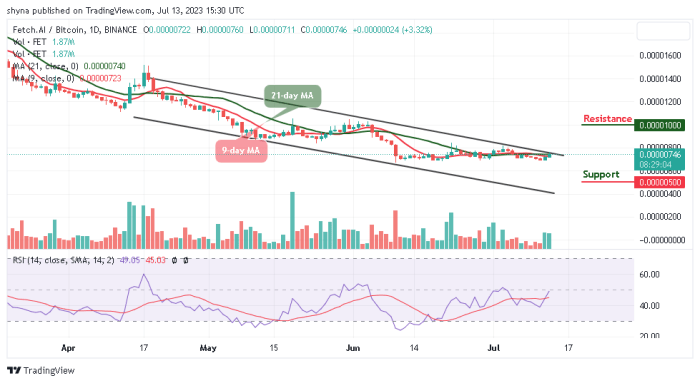

Source: coingape.com

Understanding the fluctuations of FBTC stock price requires a broad market perspective. For instance, comparing its performance against established pharmaceutical giants like Bristol Myers Squibb can offer valuable insights. You can check the current bms stock price to see how it’s performing. Ultimately, analyzing both FBTC and similar large-cap stocks provides a more comprehensive understanding of the overall market trends impacting FBTC’s value.

Technical analysis uses price charts and indicators to predict future price movements. Common indicators include moving averages and the Relative Strength Index (RSI).

- Moving Averages: Moving averages smooth out price fluctuations, helping identify trends. A bullish crossover (short-term MA crossing above long-term MA) suggests an upward trend, while a bearish crossover indicates a potential downward trend.

- RSI: The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Readings above 70 often suggest an overbought market, indicating potential price corrections, while readings below 30 might suggest an oversold market, indicating potential price rebounds.

- Hypothetical Trading Strategy: A simple strategy could involve buying when the RSI falls below 30 and selling when it rises above 70, combined with confirmation from moving average crossovers.

- Support and Resistance Levels: A hypothetical FBTC price chart would show support levels (price points where buying pressure is strong, preventing further price declines) and resistance levels (price points where selling pressure is strong, preventing further price increases). Breakouts above resistance or below support levels often signal significant price movements.

Fundamental Analysis of FBTC

Fundamental analysis focuses on a company’s financial health and future prospects to determine its intrinsic value. This involves examining financial statements, comparing performance to competitors, and assessing growth potential.

- Financial Performance: Analyzing revenue growth, profitability, and debt levels provides insights into FBTC’s financial strength and stability. Strong financial performance generally supports a higher stock price.

- Competitor Comparison: Comparing FBTC’s key metrics (e.g., market share, revenue growth, profitability) to its competitors helps assess its competitive position and potential for future growth.

- Growth Potential: Evaluating FBTC’s growth prospects, considering factors such as technological innovation, market expansion, and regulatory environment, is crucial for predicting future price movements. High growth potential generally justifies a higher valuation.

Sentiment Analysis of FBTC

Market sentiment, reflecting the overall attitude of investors towards FBTC, influences price movements. Sentiment can be gauged from various sources.

- Positive Sentiment: Positive news articles, social media posts praising FBTC’s technology or potential, and analyst upgrades contribute to positive sentiment, potentially pushing prices higher.

- Negative Sentiment: Negative news reports, critical social media comments, and analyst downgrades contribute to negative sentiment, potentially leading to price declines.

- Neutral Sentiment: A lack of significant news or a balanced mix of positive and negative sentiment may result in relatively stable prices.

Risk Assessment of Investing in FBTC, Fbtc stock price

Investing in FBTC carries inherent risks, primarily due to its volatility and association with the cryptocurrency market.

- High Volatility: FBTC’s price can fluctuate significantly in short periods, leading to potential substantial gains or losses. Investors should be prepared for such volatility.

- Market Risk: Broader market downturns can negatively impact FBTC’s price, regardless of its own performance.

- Regulatory Risk: Changes in regulations concerning cryptocurrencies or financial markets can significantly affect FBTC’s value.

- Risk Mitigation Strategies: Diversification (spreading investments across different assets), setting stop-loss orders (automatically selling if the price falls below a certain level), and thorough due diligence before investing can help mitigate risks.

Questions and Answers: Fbtc Stock Price

What is FBTC?

FBTC (assuming this refers to a specific company or asset) requires further clarification. The provided Artikel doesn’t define FBTC. More context is needed to answer this question accurately.

Where can I find real-time FBTC stock price data?

Real-time FBTC stock price data, assuming FBTC is a publicly traded asset, can typically be found on major financial websites and trading platforms. However, the specific location depends on where FBTC is listed.

Is FBTC a good investment?

Whether FBTC is a “good” investment depends entirely on individual risk tolerance, investment goals, and a thorough understanding of the associated risks. This analysis provides tools for assessment, but not a definitive recommendation.

What are the biggest risks associated with investing in FBTC?

Significant risks associated with investing in FBTC could include market volatility, regulatory uncertainty, and the inherent risks associated with the underlying asset (if applicable). A comprehensive risk assessment is crucial before investing.