Facebook Stock Price Analysis: A Comprehensive Overview

Facebook share stock price – This analysis delves into the historical performance, influencing factors, investor sentiment, and future predictions surrounding Facebook’s (now Meta) stock price. We will examine key metrics, compare it to competitors, and explore potential scenarios based on various economic and technological developments.

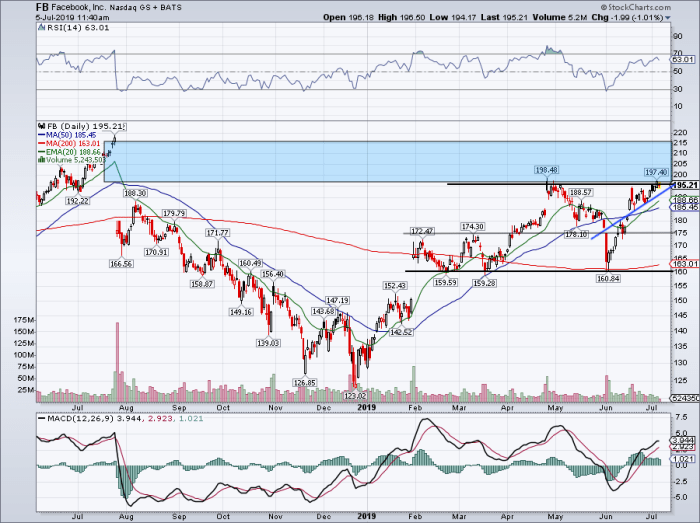

Historical Stock Price Performance

Source: businessinsider.com

Facebook’s share stock price fluctuates constantly, reflecting market sentiment and company performance. Understanding these shifts often involves comparing it to other tech stocks; for instance, one might consider the performance of a smaller player like the dode stock price to gain perspective on broader market trends. Ultimately, though, the Facebook share price remains a key indicator of the overall health of the social media sector.

A line graph visualizing Facebook’s stock price fluctuations over the past five years would reveal significant volatility. The graph would show periods of sharp increases, often correlated with successful product launches or positive financial reports, and periods of decline, sometimes linked to regulatory scrutiny or broader market downturns. Key events like the Cambridge Analytica scandal and the ongoing antitrust investigations would be clearly marked on the graph, illustrating their immediate impact on share price.

During this five-year period, Facebook’s stock reached its highest point in [Insert Date and Price] and its lowest point in [Insert Date and Price]. The high point likely reflects positive investor sentiment driven by [Explain contributing factors, e.g., strong user growth, successful advertising revenue]. Conversely, the low point might be attributed to [Explain contributing factors, e.g., negative publicity, regulatory concerns].

A comparative analysis against major competitors like Google (Alphabet) and Twitter, presented in a four-column responsive HTML table, would provide a valuable context. The table would display yearly performance metrics (percentage change, average price, etc.) for each company, allowing for a direct comparison of their respective stock price trajectories.

| Year | Google (Alphabet) | ||

|---|---|---|---|

| 2023 | [Insert Data – % Change] | [Insert Data – % Change] | [Insert Data – % Change] |

| 2022 | [Insert Data – % Change] | [Insert Data – % Change] | [Insert Data – % Change] |

| 2021 | [Insert Data – % Change] | [Insert Data – % Change] | [Insert Data – % Change] |

| 2020 | [Insert Data – % Change] | [Insert Data – % Change] | [Insert Data – % Change] |

| 2019 | [Insert Data – % Change] | [Insert Data – % Change] | [Insert Data – % Change] |

Factors Influencing Facebook’s Stock Price

Several internal and external factors significantly impact Facebook’s stock price. Understanding these influences is crucial for accurate forecasting and informed investment decisions.

- Internal Factors: The launch of new products (e.g., Reels, Instagram Shopping), strong quarterly financial reports exceeding expectations, and successful integration of acquired companies all positively contribute to the stock price. Conversely, delays in product development, missed earnings targets, or negative user feedback can lead to declines.

- External Factors: Regulatory changes concerning data privacy (e.g., GDPR, CCPA), macroeconomic conditions (e.g., inflation, recession), and evolving competitive landscapes (e.g., the rise of TikTok) are significant external factors influencing the company’s valuation.

- User Growth and Advertising Revenue: Facebook’s share valuation is intrinsically linked to its user base and advertising revenue. Increased user engagement and higher advertising revenue directly translate into higher profits, positively influencing investor sentiment and driving up the stock price. Conversely, a decline in user engagement or advertising revenue would negatively impact the stock price.

Investor Sentiment and Market Analysis, Facebook share stock price

Current investor sentiment towards Facebook’s stock is [Insert Description of Current Sentiment, e.g., cautiously optimistic, bearish, etc.]. This sentiment is shaped by various factors, including recent financial performance, regulatory developments, and the overall market climate. News articles highlighting [mention specific news or reports] provide further insights into the prevailing sentiment.

Analyst ratings and predictions play a substantial role in shaping trading volume and price. Positive ratings and upward revisions of price targets generally lead to increased buying pressure, driving up the stock price. Conversely, negative ratings or downward revisions can trigger selling, resulting in price declines. The impact is amplified by the weight and reputation of the analyst issuing the rating.

A hypothetical scenario involving a major data breach or privacy scandal could significantly impact Facebook’s stock price. Similar to the Cambridge Analytica scandal, a major breach could erode investor confidence, trigger negative media coverage, and lead to regulatory penalties, resulting in a sharp and sustained decline in the share price. The severity of the decline would depend on the scale of the breach, the nature of the compromised data, and the company’s response to the crisis.

Future Predictions and Potential Scenarios

Source: thestreet.com

Predicting Facebook’s stock price in the next 12 months requires considering various economic and market conditions. Three potential scenarios are Artikeld below:

- Scenario 1 (Bullish): Strong user growth, successful metaverse integration, and positive regulatory developments could lead to a significant increase in the stock price, exceeding [Insert Percentage] increase.

- Scenario 2 (Neutral): Moderate user growth, challenges in metaverse adoption, and stable regulatory environment could result in a relatively flat stock price, with minor fluctuations within a [Insert Percentage] range.

- Scenario 3 (Bearish): Significant decline in user engagement, failure to capitalize on metaverse opportunities, and increased regulatory pressure could lead to a decline in stock price, potentially falling by [Insert Percentage].

Emerging technologies like the metaverse and AI will significantly impact Facebook’s future stock performance. Successful integration of these technologies into its core offerings could drive substantial growth, while failure to adapt could lead to stagnation or decline. The extent of the impact will depend on the company’s ability to innovate and effectively leverage these technologies.

Financial Statements and Key Metrics

Investors use key financial metrics to evaluate Facebook’s stock. These include Earnings Per Share (EPS), Price-to-Earnings Ratio (P/E), Revenue Growth, and User Growth. Analyzing these metrics in Facebook’s quarterly earnings reports helps assess the company’s financial health and growth potential.

Interpreting Facebook’s recent quarterly earnings reports involves comparing key metrics against previous quarters and industry benchmarks. A positive trend in EPS, increasing revenue growth, and robust user growth generally indicate a healthy and growing company, positively impacting the stock price. Conversely, negative trends in these metrics could trigger negative investor sentiment and lead to price declines.

A comparison of key financial metrics between Facebook and a competitor (e.g., Google) in a four-column responsive HTML table provides valuable insights into their relative financial performance and market positioning.

| Metric | Google (Alphabet) | |

|---|---|---|

| EPS (latest quarter) | [Insert Data] | [Insert Data] |

| P/E Ratio | [Insert Data] | [Insert Data] |

| Revenue Growth (YoY) | [Insert Data] | [Insert Data] |

| User Growth (YoY) | [Insert Data] | [Insert Data] |

FAQ Overview: Facebook Share Stock Price

What is the current Facebook (Meta) share price?

The current Facebook (Meta) share price fluctuates constantly and can be found on major financial websites like Google Finance, Yahoo Finance, or Bloomberg.

Where can I buy Facebook (Meta) stock?

Facebook (Meta) stock can be purchased through most online brokerage accounts.

How often does Facebook release its earnings reports?

Facebook (Meta) typically releases its quarterly earnings reports on a roughly three-month cycle.

What are the major risks associated with investing in Facebook (Meta) stock?

Risks include changes in user engagement, increased competition, regulatory scrutiny, and overall economic downturns.