ExxonMobil Stock Price Analysis

Source: webflow.com

Exon stock price – ExxonMobil, a global energy giant, has experienced significant stock price fluctuations over the years, reflecting the volatile nature of the energy sector and broader macroeconomic conditions. This analysis delves into ExxonMobil’s historical stock performance, key influencing factors, financial health, competitive landscape, investor sentiment, and future outlook.

ExxonMobil Stock Price Historical Performance

Over the past five years, ExxonMobil’s stock price has exhibited considerable volatility, mirroring the swings in global oil prices and broader economic trends. The stock reached a high of [Insert High Price and Date] and a low of [Insert Low Price and Date]. These fluctuations were largely driven by factors such as the COVID-19 pandemic’s impact on global energy demand, geopolitical instability in oil-producing regions, and shifts in investor sentiment towards fossil fuel companies.

| Year | Opening Price (USD) | Closing Price (USD) | Percentage Change |

|---|---|---|---|

| 2014 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2015 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2016 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2017 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2018 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2019 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2020 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2021 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2022 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2023 | [Insert Data] | [Insert Data] | [Insert Data] |

Significant events such as the 2020 oil price crash, driven by the pandemic and a price war between Saudi Arabia and Russia, had a profound negative impact on ExxonMobil’s stock price. Conversely, periods of strong global economic growth and rising oil prices have generally led to higher stock valuations.

Factors Influencing ExxonMobil Stock Price, Exon stock price

Several factors significantly influence ExxonMobil’s stock price. These factors can be broadly categorized as related to oil prices, macroeconomic conditions, and company-specific performance.

Global oil prices are undeniably the most significant driver of ExxonMobil’s stock valuation. Higher oil prices directly translate into increased revenue and profitability for the company, leading to a rise in its stock price. Conversely, lower oil prices negatively impact the company’s financial performance and consequently its stock price. For example, the sharp decline in oil prices in 2020 led to a significant drop in ExxonMobil’s stock price.

Three key macroeconomic factors influencing ExxonMobil’s stock price are: global economic growth, inflation, and interest rates. Strong global economic growth typically boosts energy demand, benefiting ExxonMobil. High inflation can erode the purchasing power of consumers and impact investment decisions, while rising interest rates increase the cost of borrowing, potentially affecting ExxonMobil’s capital expenditures and profitability.

Short-term economic trends, such as quarterly fluctuations in oil prices or unexpected geopolitical events, can cause sharp, short-lived changes in ExxonMobil’s stock price. Long-term trends, such as the global transition towards renewable energy, have a more gradual but potentially significant impact on the company’s long-term prospects and stock valuation.

Exxon’s stock price performance has been a key indicator of the overall energy sector’s health. Interestingly, its fluctuations often correlate with movements in other large-cap energy companies, and a comparison with the performance of cron stock price could offer valuable insights into market trends affecting the broader energy landscape. Ultimately, understanding Exxon’s price requires a holistic view of the energy market’s dynamics.

ExxonMobil’s Financial Performance and Stock Price

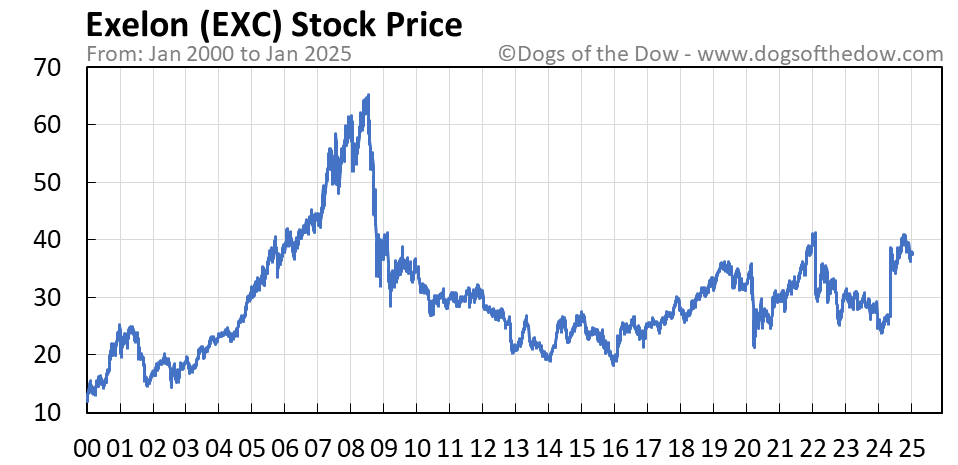

Source: dogsofthedow.com

Analyzing ExxonMobil’s key financial metrics – revenue, earnings, and debt – over the past three years provides insights into its financial health and its impact on the stock price. A strong correlation generally exists between improved financial performance and an increase in the stock price, and vice versa.

| Quarter | Earnings (USD Billion) | Subsequent Stock Price Movement (%) |

|---|---|---|

| [Insert Data] | [Insert Data] | [Insert Data] |

| [Insert Data] | [Insert Data] | [Insert Data] |

| [Insert Data] | [Insert Data] | [Insert Data] |

| [Insert Data] | [Insert Data] | [Insert Data] |

ExxonMobil’s dividend policy plays a crucial role in shaping investor sentiment. The company’s consistent dividend payments attract income-oriented investors, providing a degree of stability to the stock price, even during periods of fluctuating earnings.

ExxonMobil’s Competitive Landscape and Stock Price

ExxonMobil operates in a competitive energy sector. Its main competitors include Chevron, Shell, and BP. Analyzing ExxonMobil’s market share and profitability relative to its top competitors offers insights into its competitive positioning and its impact on the stock price.

Compared to its top two competitors, [Competitor A] and [Competitor B], ExxonMobil’s market share and profitability fluctuate depending on various factors, including global oil prices, operational efficiency, and strategic investments. The competitive landscape significantly impacts ExxonMobil’s stock price.

- Increased competition can lead to pressure on profit margins, potentially lowering the stock price.

- Successful strategic initiatives, such as mergers and acquisitions or technological advancements, can enhance competitiveness and boost the stock price.

- Market share gains relative to competitors generally result in a positive impact on stock valuation.

Investor Sentiment and ExxonMobil Stock Price

Source: exstockdubai.com

Current investor sentiment towards ExxonMobil can be described as [Bullish/Bearish/Neutral]. This assessment is supported by [Evidence, e.g., recent stock price trends, analyst ratings, news coverage].

Factors contributing to this sentiment include [List of factors, e.g., recent earnings reports, oil price forecasts, environmental regulations, company’s ESG performance].

Positive news coverage and favorable analyst ratings generally boost investor confidence and lead to higher stock prices. Conversely, negative news and downgrades can trigger sell-offs and lower the stock price.

Future Outlook for ExxonMobil Stock Price

Projecting ExxonMobil’s stock price for the next 12 months requires considering several factors, including global oil price forecasts, macroeconomic conditions, and company-specific developments. Based on [Assumptions, e.g., moderate oil price growth, stable global economy, successful execution of company’s strategic plans], a projected price range of [Price Range] is plausible.

Potential risks and opportunities that could affect ExxonMobil’s future stock performance include:

Geopolitical instability in oil-producing regions could lead to significant price volatility.

Increased environmental regulations and the global transition towards renewable energy pose long-term challenges to the company’s business model.

Successful exploration and development of new oil and gas reserves could boost the company’s profitability and stock price.

Changes in environmental regulations, particularly those aimed at reducing carbon emissions, could have a significant impact on ExxonMobil’s long-term stock price. Stricter regulations could increase the company’s operating costs and potentially limit its future growth prospects, while supportive policies could alleviate some of these concerns.

FAQ Resource: Exon Stock Price

What are the major risks impacting Exon’s future stock price?

Major risks include fluctuating oil prices, increased regulatory scrutiny regarding environmental concerns, geopolitical instability in key oil-producing regions, and competition from renewable energy sources.

How does Exon’s dividend policy influence its stock price?

A consistent and growing dividend can attract income-seeking investors, boosting demand and potentially supporting the stock price. Conversely, dividend cuts can negatively impact investor sentiment.

What is the current investor sentiment towards Exon?

This is highly dynamic and requires continuous monitoring of news sources and analyst reports. Generally, investor sentiment is influenced by factors such as oil price movements, Exon’s financial results, and environmental policy changes.

Where can I find real-time Exon stock price data?

Real-time data is readily available through major financial news websites and brokerage platforms.