Dish Network Stock Price History and Trends

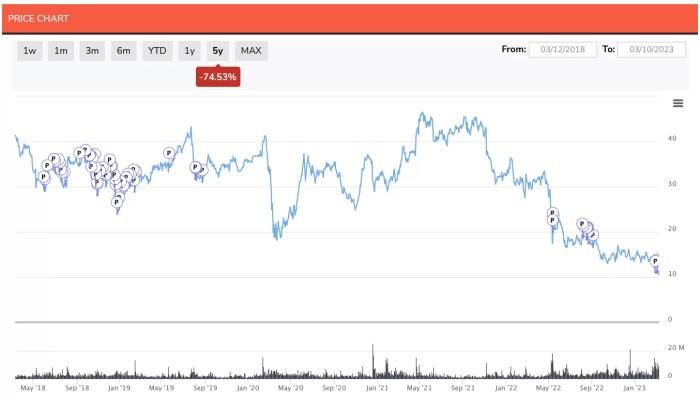

Dish network stock price – Dish Network’s stock price has experienced significant fluctuations over the past five years, reflecting the dynamic nature of the telecommunications industry and the company’s own strategic shifts. Analyzing these price movements reveals key factors influencing investor sentiment and the company’s overall valuation.

Dish Network Stock Price Performance (2019-2024): A Graphical Representation

A line graph illustrating Dish Network’s stock price from 2019 to 2024 would show a generally downward trend, punctuated by periods of volatility. Key dates to highlight would include any major announcements regarding mergers, acquisitions, regulatory changes, or significant financial results. For example, a sharp decline might coincide with the announcement of increased competition or a loss in subscribers.

Conversely, a period of growth might be linked to a successful product launch or a favorable regulatory decision. The graph would visually demonstrate the overall trend and highlight periods of substantial price change.

Factors Influencing Dish Network Stock Price Volatility

Several factors have contributed to the ups and downs of Dish Network’s stock price. These include shifts in consumer preferences towards streaming services, competition from established players and new entrants, and the company’s success (or lack thereof) in transitioning to 5G and other next-generation technologies. Regulatory changes and the overall economic climate also play a significant role.

Comparative Stock Performance Analysis

Comparing Dish Network’s stock performance to its competitors (e.g., AT&T, Verizon, Comcast) over the same period requires analyzing key performance indicators such as return on investment, revenue growth, and market share. This comparison should highlight Dish Network’s strengths and weaknesses relative to its competitors.

| Company | Average Annual Return (2019-2024) | Revenue Growth (2019-2024) | Market Share (2024) |

|---|---|---|---|

| Dish Network | [Insert Data]% | [Insert Data]% | [Insert Data]% |

| AT&T | [Insert Data]% | [Insert Data]% | [Insert Data]% |

| Verizon | [Insert Data]% | [Insert Data]% | [Insert Data]% |

| Comcast | [Insert Data]% | [Insert Data]% | [Insert Data]% |

Factors Affecting Dish Network Stock Price

Source: benzinga.com

Monitoring the Dish Network stock price requires a keen eye on the broader market trends. Understanding how other major players perform is crucial; for instance, observing the current carmax stock price can offer insights into consumer spending habits, which indirectly impacts Dish Network’s potential subscriber base and overall financial health. Ultimately, a comprehensive analysis of both these stocks, along with others, provides a more nuanced perspective on Dish Network’s future prospects.

Dish Network’s stock price is influenced by a complex interplay of economic indicators, regulatory changes, technological advancements, and industry competition. Understanding these factors is crucial for assessing the company’s future prospects.

Key Economic Indicators and Their Impact

Macroeconomic factors such as inflation, interest rates, and consumer spending significantly influence Dish Network’s stock price. High inflation can reduce consumer discretionary spending, affecting subscription rates. Interest rate hikes increase borrowing costs, impacting the company’s debt servicing and investment plans. Strong consumer spending, conversely, can positively impact subscriber acquisition.

Regulatory Changes and Their Influence

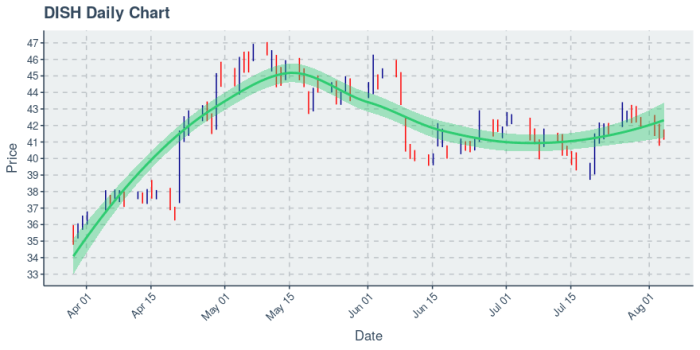

Source: googleapis.com

Regulatory changes related to telecommunications, spectrum allocation, and antitrust laws have a direct impact on Dish Network’s operations and valuation. Favorable regulatory decisions can lead to increased market access and growth opportunities, while unfavorable ones can stifle growth and negatively impact the stock price. For example, the approval or rejection of merger proposals or spectrum licenses could significantly impact the stock price.

Technological Advancements and Industry Competition

The telecommunications industry is characterized by rapid technological advancements and intense competition. Dish Network’s ability to adapt to these changes and compete effectively is crucial for its stock performance.

- The rise of streaming services and cord-cutting directly impacts Dish Network’s traditional satellite TV business.

- Advancements in 5G technology present both opportunities and challenges, requiring significant investments in infrastructure and network upgrades.

- Competition from established players with broader service offerings necessitates continuous innovation and strategic adjustments.

Dish Network’s Financial Performance and Stock Valuation

A thorough understanding of Dish Network’s financial health is essential for evaluating its stock valuation. This includes analyzing its revenue streams, profitability, and debt levels.

Revenue Streams and Financial Health

Dish Network’s revenue primarily comes from satellite TV subscriptions, broadband services, and potentially future revenue streams from 5G wireless services. The relative contribution of each revenue stream to the company’s overall financial health needs to be analyzed. A decline in satellite TV subscriptions, for instance, could negatively impact overall revenue and profitability.

Profitability Ratio Comparison

Comparing Dish Network’s profitability ratios (profit margin, return on equity, etc.) to industry peers provides insights into its relative financial performance and efficiency.

| Ratio | Dish Network | Industry Average |

|---|---|---|

| Profit Margin | [Insert Data]% | [Insert Data]% |

| Return on Equity | [Insert Data]% | [Insert Data]% |

Debt Levels and Capital Structure

Dish Network’s debt levels and capital structure significantly influence its stock valuation. High levels of debt can increase financial risk and reduce investor confidence, potentially leading to a lower stock price. Conversely, a healthy capital structure with a balanced mix of debt and equity can enhance investor confidence and support a higher valuation.

Investor Sentiment and Market Expectations: Dish Network Stock Price

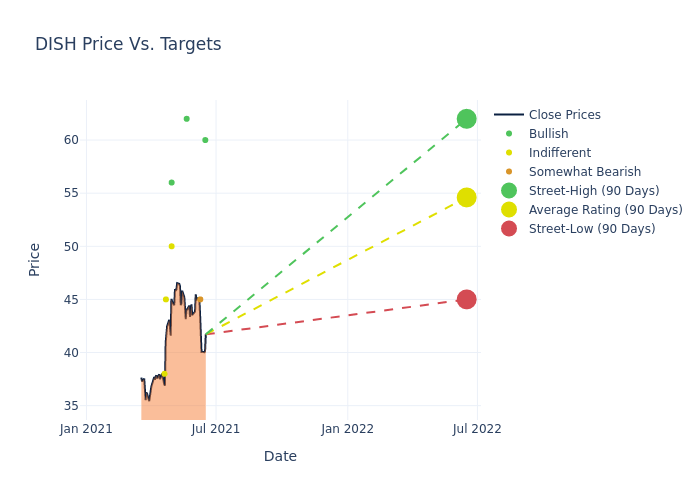

Source: insidearbitrage.com

Investor sentiment and market expectations play a critical role in shaping Dish Network’s stock price. Understanding these factors provides valuable insights into the market’s perception of the company’s future prospects.

Prevailing Investor Sentiment and its Causes

Investor sentiment towards Dish Network can range from optimistic to pessimistic, depending on factors such as the company’s financial performance, strategic initiatives, and industry trends. Negative news regarding subscriber losses or regulatory setbacks could lead to a decline in investor confidence, while positive announcements regarding new partnerships or technological advancements could boost sentiment.

Analyst Ratings and Price Targets

Analyst ratings and price targets influence investor decisions and consequently impact the stock price. Positive ratings and high price targets generally lead to increased buying pressure, while negative ratings and low price targets can result in selling pressure. The consensus among analysts regarding Dish Network’s future prospects can significantly affect its stock valuation.

Investor Types and Investment Strategies, Dish network stock price

Different types of investors hold Dish Network stock, each with their own investment strategies. Understanding these investor groups and their approaches provides a broader perspective on market dynamics.

- Institutional investors (e.g., mutual funds, hedge funds) typically conduct thorough due diligence and base their investment decisions on long-term growth potential.

- Retail investors (individual investors) may have shorter-term investment horizons and react more quickly to market news and sentiment.

Future Outlook and Potential Risks

Predicting Dish Network’s future stock price requires considering various scenarios and potential risks. A scenario analysis helps to understand the potential impact of different market conditions on the company’s stock performance.

Scenario Analysis: Potential Future Outcomes

A scenario analysis could consider various market conditions, such as continued growth in the streaming market, increased competition, and regulatory changes. Each scenario would project a different potential outcome for Dish Network’s stock price. For example, a scenario with strong 5G adoption and successful subscriber acquisition could lead to a significant increase in stock price, while a scenario with continued subscriber losses and intense competition could result in a further decline.

Major Risks and Uncertainties

Dish Network faces several risks and uncertainties that could significantly impact its stock performance. These include competition from established and emerging players, technological disruptions, regulatory hurdles, and economic downturns. The company’s ability to manage these risks and adapt to changing market conditions will be crucial for its future success.

Strategic Initiatives and Their Potential Impact

Dish Network’s strategic initiatives, such as its investments in 5G infrastructure and its efforts to expand its broadband services, will play a significant role in shaping its future stock price movements. Successful execution of these initiatives could lead to increased revenue, improved profitability, and a higher stock valuation. Conversely, failure to execute these strategies effectively could negatively impact the company’s performance and stock price.

Questions Often Asked

What are the main risks associated with investing in Dish Network stock?

Key risks include competition from other providers, regulatory changes affecting the telecommunications industry, technological disruptions, and the company’s debt levels.

How does Dish Network compare to its competitors in terms of profitability?

A detailed comparison requires analyzing specific financial data like profit margins and return on equity against competitors such as AT&T and Verizon. This analysis would highlight Dish Network’s relative strengths and weaknesses in terms of profitability.

What is the typical holding period for Dish Network stock among institutional investors?

This varies considerably depending on the specific investment strategy of each institution. Some may hold for the long term, while others might employ shorter-term trading strategies.