Apple Stock Price: A Comprehensive Analysis

Current stock price for apple – Understanding Apple’s stock price requires examining various data sources, influential factors, historical trends, and competitive landscapes. This analysis delves into these aspects, providing insights into the dynamics of Apple’s stock performance and offering a framework for informed decision-making.

Reliable Sources for Apple Stock Price Data

Source: thestreet.com

Accessing accurate and timely Apple stock price data is crucial for informed investment decisions. Several reputable sources provide this information, each with its strengths and limitations.

| Source Name | URL | Data Frequency | Data Reliability Rating |

|---|---|---|---|

| Yahoo Finance | finance.yahoo.com | Real-time and historical | ★★★★★ |

| Google Finance | google.com/finance | Real-time and historical | ★★★★☆ |

| Bloomberg | bloomberg.com | Real-time and historical | ★★★★★ |

| Nasdaq | nasdaq.com | Real-time and historical | ★★★★★ |

| TradingView | tradingview.com | Real-time and historical | ★★★★☆ |

Comparing Yahoo Finance, Google Finance, and Bloomberg reveals subtle differences. Yahoo Finance and Google Finance generally offer similar real-time accuracy, while Bloomberg often provides slightly more granular historical data. All three sources are considered highly reliable, but minor discrepancies can exist due to data aggregation methods and reporting lags.

- Yahoo Finance: Widely accessible, user-friendly interface, potentially slight delays in real-time updates.

- Google Finance: Clean interface, integrates well with other Google services, similar real-time accuracy to Yahoo Finance.

- Bloomberg: More comprehensive historical data, often used by professional traders, requires a subscription for full access.

Potential biases or limitations can include data delays, occasional inaccuracies in real-time feeds (though rare), and differences in data aggregation methodologies across providers. Free services might have limitations on historical data access.

Factors Influencing Apple’s Stock Price

Several macroeconomic factors and company-specific events significantly impact Apple’s stock price. Understanding these influences is vital for predicting future price movements.

Three macroeconomic factors impacting Apple’s stock price are global economic growth, currency exchange rates, and inflation. Strong global economic growth typically boosts consumer spending, increasing demand for Apple products and positively influencing the stock price. Fluctuations in currency exchange rates affect Apple’s revenue generated from international sales. High inflation can increase production costs, impacting profitability and potentially lowering the stock price.

Apple’s product releases, such as the iPhone and Mac, have consistently influenced its stock price. The launch of the iPhone in 2007, for example, marked a turning point for the company, significantly boosting its market valuation. Similarly, new iterations of the iPhone and other products often lead to short-term price volatility, with positive market reactions to successful launches and negative reactions to underwhelming releases or production delays.

Positive news, such as strong sales reports or positive analyst ratings, generally results in a rise in Apple’s stock price. Conversely, negative news, such as supply chain disruptions or product recalls, can lead to a decline in the stock price. For instance, the supply chain issues experienced during the COVID-19 pandemic caused temporary stock price dips.

Analyzing Apple’s Stock Price Trends, Current stock price for apple

Source: businessinsider.com

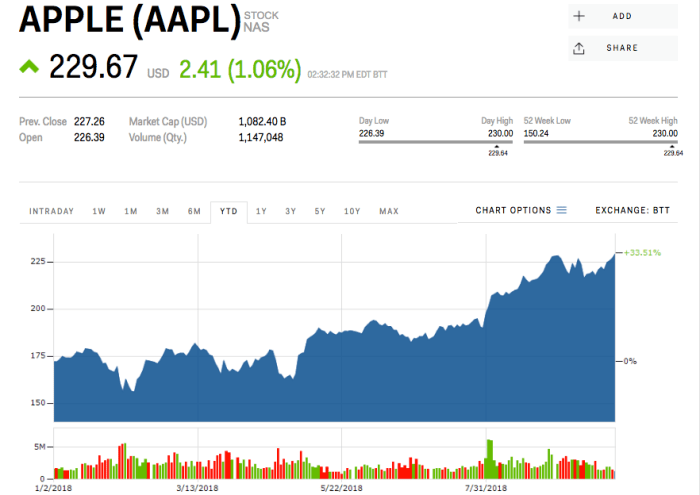

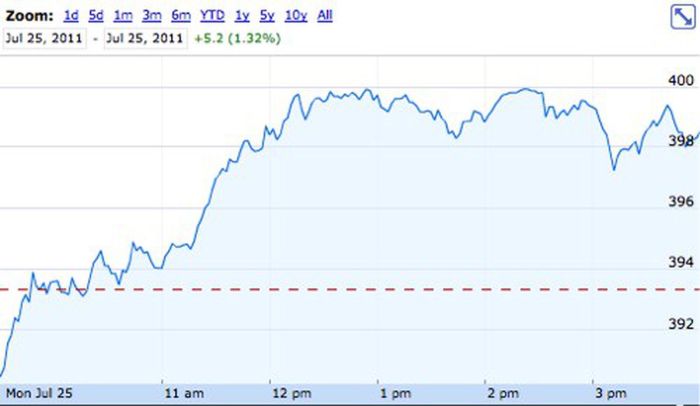

Visualizing Apple’s stock price over time reveals trends and patterns. A line graph depicting the past year’s price would show periods of growth and decline. Major price fluctuations can be linked to specific events like product launches, earnings reports, or significant news announcements. The graph’s y-axis represents the stock price, and the x-axis represents time (daily or weekly intervals).

Keeping an eye on the current stock price for Apple is crucial for many investors. However, understanding market trends often involves looking beyond single stocks; for instance, comparing Apple’s performance to that of other tech companies is insightful. A good example to consider alongside Apple is the current mvis stock price , which can offer a contrasting perspective on the tech sector’s overall health.

Ultimately, analyzing multiple stocks like Apple and MVIS provides a more comprehensive investment strategy.

Significant peaks and troughs should be clearly marked, and corresponding events should be noted beside the relevant points on the graph. For example, a peak might coincide with a successful product launch, while a trough could be linked to a negative news cycle.

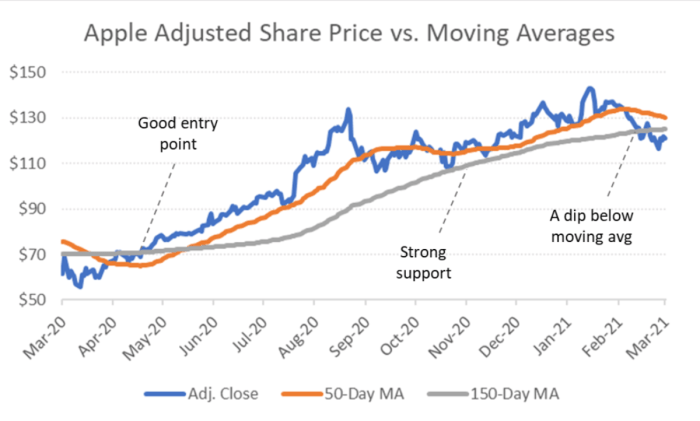

Calculating the Simple Moving Average (SMA) helps smooth out price fluctuations and identify trends. A 50-day SMA is calculated by summing the closing prices of the past 50 days and dividing by

50. A 200-day SMA follows the same principle but uses the past 200 days. These averages can be used to identify potential support and resistance levels.

For example: SMA50 = (Sum of closing prices over 50 days) / 50 and SMA200 = (Sum of closing prices over 200 days) / 200

A hypothetical trading strategy could involve buying Apple stock when the 50-day SMA crosses above the 200-day SMA (a bullish signal) and selling when the 50-day SMA crosses below the 200-day SMA (a bearish signal). Risk management would involve setting stop-loss orders to limit potential losses. Profit/loss scenarios would depend on the entry and exit points and the stock’s price movements.

Apple’s Stock Price Compared to Competitors

Source: macrumors.com

Comparing Apple’s stock price performance to competitors provides valuable context. Microsoft and Google are suitable benchmarks given their positions in the technology sector.

A five-year comparison would highlight growth percentages and key performance drivers. For example: Apple might show strong growth driven by consistent product innovation and a loyal customer base, while Microsoft might demonstrate growth fueled by its cloud computing services and enterprise software. Google’s growth might be attributed to its dominance in advertising and search.

| Company Name | Stock Price (current – hypothetical) | 5-Year Growth Percentage (hypothetical) | Key Performance Drivers |

|---|---|---|---|

| Apple | $175 | 150% | Product innovation, strong brand loyalty, services revenue growth |

| Microsoft | $270 | 120% | Cloud computing (Azure), enterprise software, strong market share |

| Google (Alphabet) | $120 | 180% | Advertising revenue, search dominance, diverse product portfolio |

Predicting Future Apple Stock Price (Speculative)

Predicting future stock prices is inherently speculative, but technical analysis methods can offer potential insights. Candlestick patterns, for example, can indicate potential price reversals or continuations. Support and resistance levels, identified through past price action, can provide potential areas where price might find support or face resistance. However, these are not guarantees.

Limitations of predicting stock prices include market volatility, unforeseen events (e.g., economic downturns, geopolitical instability), and the inherent complexity of market dynamics. No method guarantees accurate predictions. Technical analysis should be complemented by fundamental analysis, which involves evaluating the company’s financial health, competitive landscape, and long-term growth prospects. A strong fundamental outlook, combined with positive technical signals, can increase the probability of long-term price appreciation, but it is not a foolproof method.

FAQ Compilation: Current Stock Price For Apple

What are the typical trading hours for Apple stock?

Apple stock (AAPL) trades on the NASDAQ exchange, typically from 9:30 AM to 4:00 PM Eastern Time (ET), Monday through Friday, excluding holidays.

Where can I find Apple’s financial reports?

Apple’s financial reports, including quarterly earnings and annual reports, are available on their Investor Relations website.

How often is Apple’s stock price updated?

Real-time stock prices are updated constantly throughout trading hours. Many financial websites provide updates every few seconds.

What does it mean when Apple’s stock price “splits”?

A stock split increases the number of shares outstanding while reducing the price per share proportionally. It doesn’t change the overall value of your investment, but it can make the stock more affordable for smaller investors.