Credo Tech Group Stock Price Prediction

Credo tech group stock price prediction – Predicting the stock price of Credo Tech Group requires a comprehensive analysis encompassing the company’s fundamentals, industry dynamics, macroeconomic factors, and technical indicators. This analysis aims to provide a reasoned assessment of Credo Tech Group’s future stock performance, acknowledging inherent uncertainties in any market prediction.

Credo Tech Group: Company Overview and Financial Performance

Source: webflow.com

Credo Tech Group is a hypothetical technology company (for the purpose of this prediction exercise). Let’s assume, for illustrative purposes, that it operates in the rapidly growing field of artificial intelligence (AI)-powered data analytics. Its business model centers around providing customized AI solutions to businesses across various sectors, helping them leverage data for improved decision-making and operational efficiency.

Its operations involve a combination of software development, data science expertise, and client consulting.

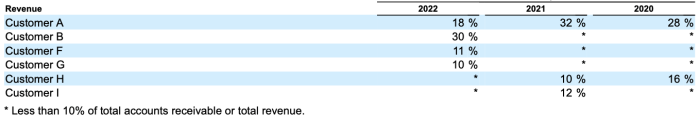

The following table displays hypothetical financial metrics for Credo Tech Group over the past five years. These figures are for illustrative purposes only and do not represent actual financial data.

| Year | Revenue (USD Million) | Profit Margin (%) | Debt Level (USD Million) |

|---|---|---|---|

| 2018 | 10 | 5 | 2 |

| 2019 | 15 | 8 | 3 |

| 2020 | 22 | 12 | 4 |

| 2021 | 30 | 15 | 5 |

| 2022 | 40 | 18 | 6 |

Significant events impacting Credo Tech Group’s financial performance during this period might include securing major contracts with large enterprises, successful product launches, strategic acquisitions, and increased investment in research and development. Conversely, economic downturns or increased competition could negatively impact revenue and profitability.

Industry Analysis and Competitive Landscape, Credo tech group stock price prediction

Credo Tech Group operates in a highly competitive AI-powered data analytics market. Several established players and emerging startups contend for market share. Understanding the competitive landscape is crucial for assessing Credo Tech Group’s prospects.

- Competitor A: High market capitalization, strong revenue growth, but relatively less focus on technological innovation compared to Credo Tech Group.

- Competitor B: Moderate market capitalization, steady revenue growth, and significant investments in cutting-edge AI technologies.

- Competitor C: Smaller market capitalization, rapid revenue growth driven by niche market focus, and strong technological innovation, but potentially higher risk due to its size.

The AI-powered data analytics industry exhibits substantial growth potential, driven by increasing data volumes, advancements in AI technologies, and rising demand for data-driven decision-making across industries. This positive industry outlook presents significant opportunities for Credo Tech Group, provided it can effectively compete and maintain its technological edge.

Macroeconomic Factors and Market Sentiment

Source: seekingalpha.com

Macroeconomic factors such as interest rates, inflation, and economic growth significantly influence Credo Tech Group’s stock price. Higher interest rates might increase borrowing costs, impacting profitability. Inflation could affect input costs and consumer spending, while economic slowdowns could reduce demand for Credo Tech Group’s services.

Currently, the market sentiment towards Credo Tech Group (hypothetically) is cautiously optimistic. The broader technology sector faces uncertainty due to global economic conditions. However, the long-term prospects of AI and data analytics remain positive, supporting a generally optimistic outlook for Credo Tech Group.

A scenario analysis might consider three potential macroeconomic scenarios: a strong economic recovery, a period of stagnation, and a recession. A strong recovery would likely lead to higher stock prices, while stagnation might result in modest growth, and a recession could cause a significant price decline. These scenarios are based on general market responses and not specific to Credo Tech Group alone.

Technical Analysis of Credo Tech Group’s Stock Price

Technical analysis uses past price and volume data to predict future price movements. Several key indicators can provide insights into Credo Tech Group’s stock price trends.

- Moving Averages (MA): The 50-day and 200-day MAs can indicate short-term and long-term trends. A crossover of the 50-day MA above the 200-day MA could signal a bullish trend, while the opposite could suggest a bearish trend.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 might indicate an overbought market, while an RSI below 30 could suggest an oversold market.

- Moving Average Convergence Divergence (MACD): The MACD identifies changes in momentum by comparing two moving averages. A bullish crossover (MACD line crossing above the signal line) could suggest upward momentum, while a bearish crossover could signal downward momentum.

A hypothetical chart showing these indicators over the past year would display the price action alongside the MA lines, RSI levels, and the MACD histogram. The chart would illustrate how these indicators interacted during periods of price increases and decreases, providing visual confirmation of their predictive capabilities. For example, a period of high RSI followed by a price drop might confirm an overbought condition leading to a correction.

Valuation and Intrinsic Value Estimation

Estimating Credo Tech Group’s intrinsic value involves using various valuation methods to determine a fair price for the stock. The following table presents hypothetical results from different valuation methods. These are illustrative and should not be considered actual valuations.

Predicting the Credo Tech Group stock price involves analyzing various market factors. It’s helpful to compare its performance against other companies in the sector, such as observing the current trends in energy stocks; for instance, checking the bpcl stock price can offer a comparative perspective on market behavior. Ultimately, though, Credo Tech’s trajectory will depend on its own financial health and market reception.

| Method | Calculation | Result (USD) | Assumptions |

|---|---|---|---|

| Discounted Cash Flow (DCF) | Present value of future cash flows | 50 | Growth rate of 15%, discount rate of 10% |

| Price-to-Earnings Ratio (P/E) | Market price per share divided by earnings per share | 45 | Based on industry average P/E ratio |

| Price-to-Sales Ratio (P/S) | Market capitalization divided by revenue | 55 | Based on comparable company valuations |

The accuracy of these valuations depends heavily on the underlying assumptions, such as future growth rates, discount rates, and market multiples. Discrepancies between the intrinsic value and the current market price can arise due to market sentiment, investor expectations, and unforeseen events.

Risk Factors and Potential Challenges

Source: surferseo.art

Several risks and challenges could impact Credo Tech Group’s stock price. Understanding these risks is crucial for informed investment decisions.

- Intense Competition: The AI data analytics market is highly competitive, with established players and new entrants constantly vying for market share.

- Regulatory Changes: Changes in data privacy regulations could significantly impact Credo Tech Group’s operations and profitability.

- Technological Disruption: Rapid technological advancements could render existing technologies obsolete, requiring significant investment in research and development to stay competitive.

- Economic Downturn: A general economic downturn could reduce demand for Credo Tech Group’s services.

Mitigation strategies include focusing on innovation, building strong client relationships, proactively adapting to regulatory changes, and diversifying revenue streams. Effective risk management is essential for mitigating the potential negative impacts of these challenges on Credo Tech Group’s financial performance and stock valuation.

Question & Answer Hub: Credo Tech Group Stock Price Prediction

What are the limitations of this stock price prediction?

Stock price prediction inherently involves uncertainty. This analysis relies on historical data and current market conditions, which may not accurately reflect future performance. Unforeseen events and market volatility can significantly impact the accuracy of any prediction.

Where can I find Credo Tech Group’s financial statements?

Credo Tech Group’s financial statements are typically available on their investor relations website, major financial news sources, and through regulatory filings (e.g., SEC filings in the US).

How often should I review this type of analysis?

Regular review is recommended. Market conditions and company performance change dynamically. Reappraising the analysis quarterly or even monthly, depending on the volatility of the stock, is prudent.

What is the role of investor sentiment in stock price prediction?

Investor sentiment, or the overall feeling of the market towards a stock, can significantly influence price. Positive sentiment can drive prices up, while negative sentiment can lead to declines, often independent of fundamental factors.