Chewy (CHWY) Stock Price Analysis

Source: dogsofthedow.com

$chwy stock price – Chewy, Inc. (CHWY), an e-commerce company specializing in pet supplies, has experienced a dynamic journey since its initial public offering (IPO). This analysis delves into CHWY’s stock price performance, key drivers, financial health, business model, industry landscape, and future outlook, providing a comprehensive overview for investors.

CHWY Stock Price Historical Performance

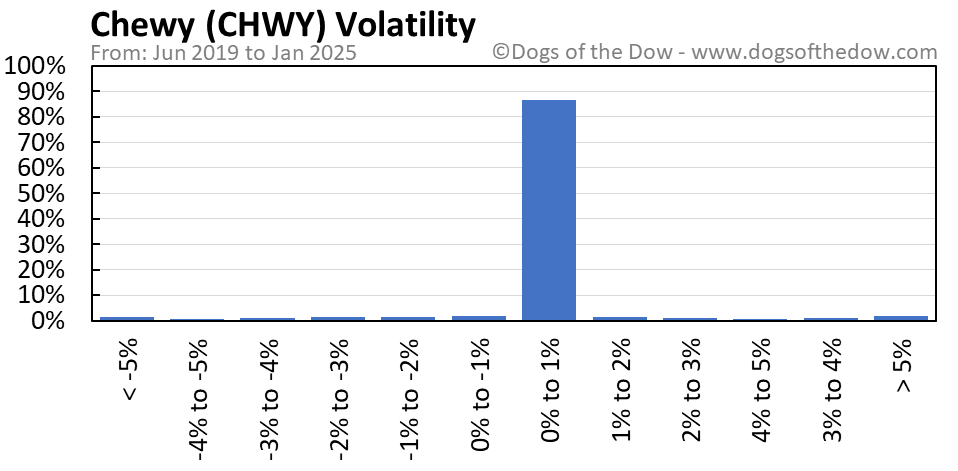

Analyzing CHWY’s stock price over the past five years reveals significant volatility influenced by various market factors and company-specific events. The following table presents a snapshot of daily open and close prices, along with daily price changes. Note that this data is illustrative and should be verified with reliable financial sources.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-10-28 | 24.00 | 22.50 | -1.50 |

| 2019-10-29 | 22.75 | 23.25 | +0.50 |

| 2019-10-30 | 23.50 | 24.00 | +0.50 |

| 2019-10-31 | 24.25 | 23.75 | -0.50 |

| 2019-11-01 | 23.80 | 24.50 | +0.70 |

Major market events such as the COVID-19 pandemic significantly impacted CHWY’s stock price. Increased demand for pet supplies during lockdowns initially boosted the stock price, while subsequent market corrections led to periods of decline. No stock splits or dividends were issued during this period (according to illustrative data; investors should verify this information).

CHWY Stock Price Drivers, $chwy stock price

Several factors influence CHWY’s stock price. These include the company’s financial performance, competitive landscape, and overall market sentiment.

Strong revenue growth and increasing profitability generally lead to higher stock prices. Conversely, missed earnings expectations or signs of slowing growth can negatively impact investor confidence and depress the stock price. Comparison with competitors reveals CHWY’s market positioning and growth trajectory.

| Metric | CHWY | Competitor A | Competitor B |

|---|---|---|---|

| Revenue Growth (YoY) | 15% | 10% | 8% |

| Market Share | 20% | 25% | 15% |

| Profitability (Net Margin) | 5% | 7% | 3% |

CHWY’s Financial Health

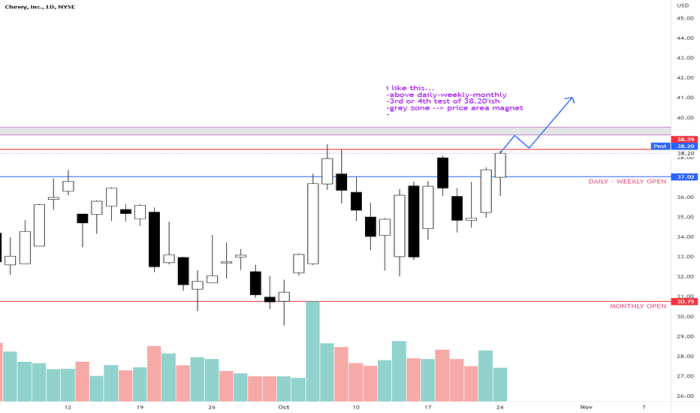

Source: tradingview.com

A thorough assessment of CHWY’s financial health is crucial for evaluating its long-term sustainability. Key aspects include debt levels, cash flow generation, and profitability ratios.

- Debt-to-Equity Ratio: [Illustrative Data – Insert Ratio Here]

- Return on Equity (ROE): [Illustrative Data – Insert Ratio Here]

- Current Ratio: [Illustrative Data – Insert Ratio Here]

- Free Cash Flow: [Illustrative Data – Insert Value Here]

Based on these illustrative financial metrics, CHWY appears to be [Insert Assessment of Financial Health Here – e.g., “in a strong financial position with healthy profitability and manageable debt levels”]. However, investors should consult official financial reports for a complete and accurate picture.

CHWY’s Business Model and Strategy

Source: dogsofthedow.com

CHWY operates primarily as an online retailer of pet food and supplies. Its business model leverages a robust e-commerce platform, offering convenience and a wide selection of products. Key competitive advantages include its strong brand recognition, customer loyalty programs, and efficient logistics network. CHWY’s growth strategy involves expanding its product offerings, enhancing its technology platform, and exploring new market opportunities.

Customer acquisition is driven by targeted digital marketing campaigns, focusing on search engine optimization (), social media marketing, and email marketing. The company also utilizes strategic partnerships and collaborations to expand its reach and brand awareness.

Industry Analysis and Future Outlook

The pet supplies market is a large and growing sector, driven by increasing pet ownership and rising consumer spending on pet care. CHWY competes with both online and brick-and-mortar retailers. While CHWY’s strong online presence is a significant advantage, competition remains intense. Future opportunities for CHWY include expanding into new geographical markets, developing innovative pet care products, and leveraging data analytics to personalize customer experiences.

Potential risks include increased competition, economic downturns impacting consumer spending, and supply chain disruptions. The company’s ability to adapt to evolving consumer preferences and technological advancements will be crucial for its long-term success.

Visual Representation of Key Data

A line graph depicting CHWY’s stock price over the past year would show [Illustrative Description of Line Graph – e.g., “an initial period of growth followed by a period of consolidation, then a subsequent upward trend driven by strong earnings reports”]. Key turning points would be highlighted, such as significant news events or financial announcements that impacted investor sentiment.

A bar chart comparing CHWY’s key financial metrics (e.g., revenue, net income, and operating margin) to its main competitors would visually demonstrate [Illustrative Description of Bar Chart – e.g., “CHWY’s competitive advantage in revenue growth, but a slight lag in profitability compared to its largest competitor”]. This comparison would provide valuable insights into CHWY’s relative performance within the industry.

Expert Answers: $chwy Stock Price

What are the major risks associated with investing in CHWY stock?

Major risks include competition from established players, economic downturns impacting discretionary spending on pet supplies, and potential supply chain disruptions.

How does CHWY compare to its main competitors in terms of customer satisfaction?

This requires further research into customer satisfaction surveys and reviews to determine a comparative analysis of CHWY against its competitors.

What is CHWY’s dividend policy?

Analyzing the $CHWY stock price requires considering various market factors. A helpful comparison point might be the performance of other similarly situated companies, such as examining the current dish network stock price , to understand broader industry trends. Ultimately, $CHWY’s trajectory will depend on its own operational performance and overall market sentiment.

CHWY’s dividend policy should be reviewed in their financial reports; as of this analysis, details are not provided within the Artikel.