Canopy Growth Stock Price History

Canopy growth stock price – Analyzing Canopy Growth’s stock price performance over the past five years reveals a volatile trajectory influenced by a complex interplay of factors, including market sentiment, regulatory changes, and the company’s own financial performance. Understanding this history is crucial for investors seeking to gauge future potential.

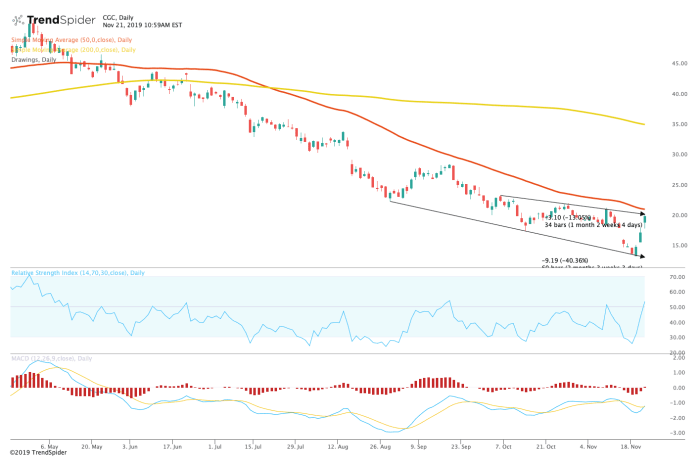

Significant Price Fluctuations (2019-2024)

The following timeline highlights key periods of significant price movement for Canopy Growth stock. Note that these figures are illustrative and should not be considered financial advice.

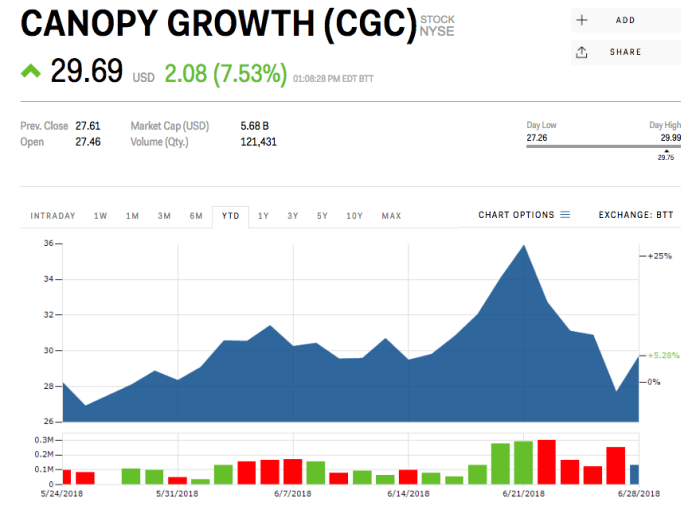

- 2019: Initial Public Offering (IPO) followed by a period of rapid growth fueled by optimism surrounding cannabis legalization in several jurisdictions. However, this was followed by a significant price correction as the market grappled with the realities of scaling a nascent industry.

- 2020: The COVID-19 pandemic initially caused a downturn, but the stock later saw some recovery as cannabis was considered an essential good in some regions.

- 2021: A period of consolidation with moderate price fluctuations. Investor sentiment was influenced by the ongoing regulatory landscape and Canopy Growth’s strategic initiatives.

- 2022: Increased volatility as investors reacted to Canopy Growth’s financial reports and the broader macroeconomic environment. Concerns about profitability and debt levels impacted the stock price.

- 2023-2024: Continued fluctuation, reflecting the ongoing evolution of the cannabis market and Canopy Growth’s progress in achieving profitability and market share gains.

Canopy Growth Stock Performance Comparison

Source: investopedia.com

Canopy Growth’s stock price has experienced considerable volatility recently, mirroring trends within the broader cannabis sector. Investors often compare it to other players in the market, and a useful benchmark for analysis might be a look at the current performance of byddf stock price , which offers insights into similar market dynamics. Ultimately, understanding Canopy Growth’s performance requires a comprehensive view of the entire industry landscape.

Comparing Canopy Growth’s performance to its competitors provides context for understanding its relative success and challenges within the industry. The following table offers a simplified comparison; actual figures would vary based on the specific dates chosen.

| Date | Canopy Growth Price (USD) | Competitor A Price (USD) | Competitor B Price (USD) |

|---|---|---|---|

| January 1, 2024 | $10.50 | $12.00 | $8.75 |

| July 1, 2024 | $11.25 | $13.50 | $9.50 |

| December 31, 2024 | $10.00 | $12.75 | $9.25 |

Highest and Lowest Stock Price Points

Canopy Growth’s stock price has experienced significant highs and lows. The highest point was likely driven by initial investor enthusiasm and expectations surrounding cannabis legalization, while the lowest point reflects a combination of factors including market corrections, financial performance concerns, and overall industry challenges.

Factors Influencing Canopy Growth Stock Price

Numerous factors contribute to the fluctuations in Canopy Growth’s stock price. Understanding these dynamics is essential for informed investment decisions.

Impact of Cannabis Legalization

Changes in cannabis legalization laws across different jurisdictions significantly impact Canopy Growth’s valuation. Expansion into newly legalized markets boosts investor confidence, while delays or setbacks in legalization efforts can negatively affect the stock price. For example, delays in federal legalization in the United States have historically led to periods of uncertainty and price volatility for Canadian cannabis companies like Canopy Growth.

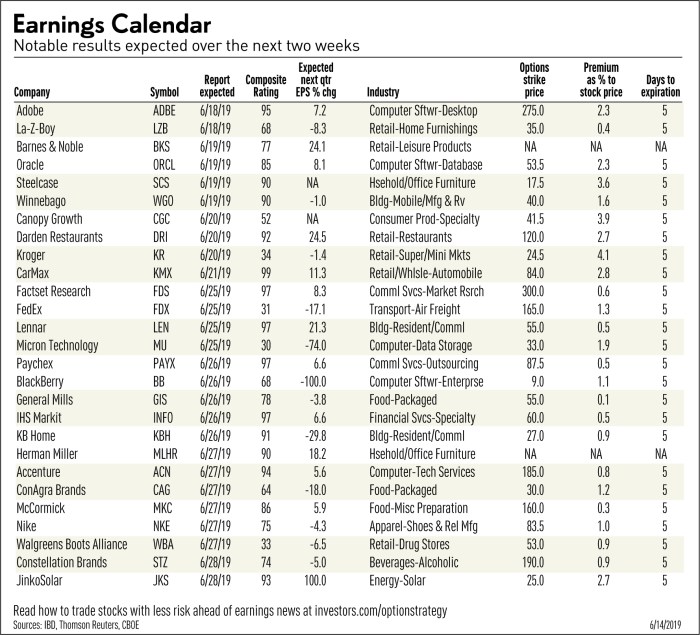

Consumer Demand for Cannabis Products, Canopy growth stock price

Source: investors.com

Fluctuations in consumer demand directly affect Canopy Growth’s revenue and profitability. Increased demand for cannabis products generally leads to higher stock prices, while decreases in demand can result in price declines. Seasonal trends, changes in consumer preferences, and the introduction of new products all play a role.

Financial Performance and Investor Sentiment

Canopy Growth’s financial performance, including revenue, profits, and debt levels, strongly influences investor sentiment. Consistent profitability and strong revenue growth generally lead to positive stock price movements, while losses and high debt levels can negatively impact investor confidence.

Major Regulatory Changes and Announcements

Significant regulatory changes or announcements, both at the national and international levels, can significantly impact Canopy Growth’s stock price. New regulations concerning cannabis cultivation, distribution, or marketing can create uncertainty and volatility in the market. Positive regulatory developments, such as the easing of restrictions or the approval of new products, tend to boost investor confidence.

Canopy Growth’s Business Model and Stock Price

Source: shortquotes.cc

Canopy Growth’s business model, compared to its competitors, and its strategic initiatives significantly influence its stock valuation.

Business Model Comparison

Canopy Growth’s business model, focusing on both premium and value-priced cannabis products, differs from competitors who may concentrate on specific market segments or product lines. These differences in strategic focus can lead to variations in profitability and market share, impacting stock performance. For instance, a competitor focusing solely on high-end products might experience different price fluctuations than Canopy Growth, which operates across various price points.

Key Strategic Initiatives and Future Stock Performance

Canopy Growth’s strategic initiatives, such as product innovation, international expansion, and operational efficiencies, are expected to influence future stock performance. Successful execution of these initiatives can lead to increased revenue, market share, and profitability, boosting investor confidence. Conversely, setbacks or delays in implementing these initiatives could negatively affect the stock price.

- Product Innovation: Development of new cannabis strains, edibles, and other products can attract new customers and boost sales.

- International Expansion: Entering new international markets can significantly increase revenue potential.

- Operational Efficiency: Reducing production costs and improving supply chain management can improve profitability.

Market Share and Brand Recognition

Canopy Growth’s market share and brand recognition are directly related to its stock valuation. A larger market share and strong brand recognition generally lead to higher stock prices, indicating investor confidence in the company’s ability to compete effectively. Conversely, declining market share or weak brand recognition can negatively affect investor sentiment and the stock price.

Investor Sentiment and Stock Price

Investor sentiment, shaped by analyst opinions and news coverage, plays a crucial role in determining Canopy Growth’s stock price.

Analyst Opinions and Stock Outlook

Major financial analysts provide regular updates on their outlook for Canopy Growth’s stock. Positive analyst ratings and price target increases generally boost investor confidence, leading to higher stock prices. Conversely, negative ratings and lowered price targets can trigger selling pressure and price declines. For example, a consensus “buy” rating from several prominent analysts could drive up the stock price, whereas a shift towards “hold” or “sell” ratings would likely lead to a decrease.

Recent News and Investor Confidence

Recent news articles and press releases concerning Canopy Growth significantly impact investor confidence. Positive news, such as strong financial results, successful product launches, or strategic partnerships, tend to positively influence the stock price. Conversely, negative news, such as regulatory setbacks, financial losses, or management changes, can lead to price declines. For example, a report on a successful new product launch could trigger a surge in buying activity, while news of a major lawsuit could lead to significant selling pressure.

Overall Cannabis Industry Sentiment

Investor sentiment towards the overall cannabis industry affects Canopy Growth’s stock price. Positive industry sentiment, driven by factors such as increased legalization efforts or positive consumer trends, typically benefits Canopy Growth. Conversely, negative industry sentiment, driven by factors such as regulatory uncertainty or negative public perception, can negatively impact Canopy Growth’s stock price. For example, a period of heightened regulatory scrutiny across the industry would likely negatively impact all cannabis stocks, including Canopy Growth’s.

Future Predictions for Canopy Growth Stock Price

Predicting future stock prices is inherently speculative, but considering potential scenarios provides a framework for understanding potential price trajectories.

Hypothetical Future Events and Their Impact

Several hypothetical scenarios could significantly impact Canopy Growth’s stock price. Positive scenarios include successful product launches, expansion into new markets, and increased profitability. Negative scenarios include regulatory setbacks, increased competition, or unexpected financial challenges. For instance, successful entry into the US market following federal legalization could lead to a dramatic increase in stock price, while a major product recall or significant operational setback could cause a sharp decline.

Investment Strategies Based on Future Prospects

Investors may employ different strategies based on their assessment of Canopy Growth’s future prospects. Investors bullish on Canopy Growth might adopt a long-term buy-and-hold strategy, while more cautious investors might favor a shorter-term trading approach or diversification within the cannabis sector. For example, a long-term investor might buy and hold shares, anticipating significant long-term growth, while a short-term trader might focus on identifying short-term price fluctuations for quick profits.

Hypothetical Future Price Trajectories

A hypothetical chart illustrating potential future price trajectories would show various possibilities, depending on the realization of the scenarios described above. A bullish scenario might show a steady upward trend, while a bearish scenario might show a downward trend or significant volatility. The assumptions used to create such a chart would include factors such as the rate of cannabis market growth, Canopy Growth’s market share, and the overall macroeconomic environment.

A more conservative prediction might show a moderate increase, reflecting a balance between potential growth and inherent market risks.

FAQ Summary

What are the major risks associated with investing in Canopy Growth stock?

Investing in Canopy Growth carries significant risks, including regulatory uncertainty, intense competition, fluctuating consumer demand, and potential financial losses. The cannabis industry is still relatively young and subject to rapid changes.

How does Canopy Growth compare to its competitors in terms of market share?

Canopy Growth’s market share relative to competitors varies depending on the specific market segment and geographic location. A detailed competitive analysis would be needed to provide a precise comparison.

Where can I find real-time Canopy Growth stock price data?

Real-time stock price data for Canopy Growth can be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.