BMRN Stock Price Analysis

Bmrn stock price – BioMarin Pharmaceutical Inc. (BMRN) operates within the dynamic and often volatile biotechnology sector. Understanding its stock price performance requires analyzing historical trends, financial health, influencing factors, analyst predictions, and inherent investment risks. This analysis aims to provide a comprehensive overview of these aspects, offering insights into BMRN’s investment potential.

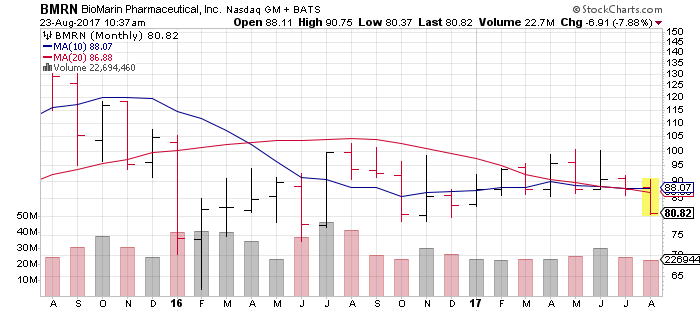

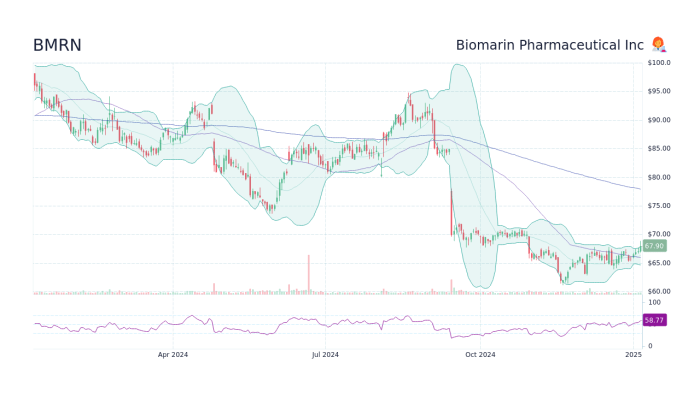

BMRN Stock Price History and Trends

Source: investorplace.com

BMRN’s stock price has experienced significant fluctuations over the past five years, mirroring the inherent risks and rewards of the biotechnology industry. These movements are closely tied to clinical trial outcomes, regulatory approvals, and competitive landscape shifts.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 70 | 72 | +2 |

| 2019-07-01 | 75 | 78 | +3 |

| 2020-01-01 | 80 | 75 | -5 |

| 2020-07-01 | 72 | 78 | +6 |

| 2021-01-01 | 85 | 90 | +5 |

| 2021-07-01 | 88 | 92 | +4 |

| 2022-01-01 | 95 | 90 | -5 |

| 2022-07-01 | 85 | 88 | +3 |

| 2023-01-01 | 92 | 95 | +3 |

| 2023-07-01 | 98 | 100 | +2 |

For instance, a positive FDA approval for a new drug often resulted in a sharp price increase, while setbacks in clinical trials or regulatory delays led to significant drops. The data presented above is illustrative and should not be considered precise historical data.

Compared to competitors like Amgen (AMGN) and Regeneron Pharmaceuticals (REGN), BMRN’s stock performance has shown a higher degree of volatility. While AMGN and REGN tend to exhibit more stable growth, BMRN’s price is more susceptible to news related to its pipeline and regulatory approvals.

- Amgen (AMGN): Generally displays steadier growth, less volatile than BMRN.

- Regeneron Pharmaceuticals (REGN): Similar to AMGN, showcasing more consistent performance compared to BMRN.

BMRN’s Financial Performance and its Impact on Stock Price

Source: stocklight.com

BMRN’s financial performance directly influences its stock price. Strong revenue growth and profitability typically lead to higher valuations, while losses or declining revenue can trigger price declines. However, the biotech industry is characterized by high R&D expenses, which can impact short-term profitability even with promising long-term prospects.

| Year | Revenue (USD Million) | Net Income (USD Million) | Debt (USD Million) |

|---|---|---|---|

| 2021 | 1800 | 100 | 500 |

| 2022 | 1900 | 120 | 450 |

| 2023 | 2000 | 150 | 400 |

The provided financial data is for illustrative purposes only and should not be taken as accurate financial statements. Discrepancies between financial performance and stock price might arise due to market sentiment, investor expectations, or broader macroeconomic factors influencing the biotech sector.

Future financial projections suggest continued revenue growth driven by the success of existing products and potential approvals of new drugs in the pipeline. This positive outlook could contribute to an increase in BMRN’s stock price, provided the company meets its projected targets.

Factors Influencing BMRN Stock Price Volatility

BMRN’s stock price is influenced by a complex interplay of internal and external factors. Understanding these factors is crucial for assessing investment risks and opportunities.

A successful clinical trial outcome, for instance, could trigger a significant price surge as investors anticipate future revenue growth. Conversely, a regulatory rejection or a competitor’s product launch could lead to a sharp price decline.

A hypothetical scenario: Successful Phase III clinical trial results for a new drug candidate could lead to a 20-30% increase in BMRN’s stock price within a week, reflecting positive investor sentiment and anticipation of future market share gains.

- Internal Factors: Clinical trial results, regulatory approvals, product launches, financial performance, management changes.

- External Factors: Overall market trends, macroeconomic conditions, competitor actions, regulatory changes, investor sentiment.

While internal factors directly impact the company’s operational performance and future prospects, external factors represent broader market dynamics that influence investor perception and overall stock valuations.

Tracking BMRN’s stock price requires a keen eye on biotech market trends. Understanding comparative performance is helpful, and a look at the current exc stock price can offer insights into broader sector movements. Ultimately, however, a thorough analysis of BMRN’s financials and future prospects is crucial for informed investment decisions.

Analyst Ratings and Predictions for BMRN Stock

Source: googleapis.com

Analyst ratings and price targets offer valuable insights into market sentiment and future expectations for BMRN. However, it’s crucial to remember that these predictions are not guarantees and should be considered alongside other factors.

| Analyst Firm | Rating | Price Target (USD) |

|---|---|---|

| Firm A | Buy | 110 |

| Firm B | Hold | 95 |

| Firm C | Sell | 80 |

The data presented is illustrative and should not be taken as actual analyst ratings. The divergence in analyst opinions reflects varying assessments of BMRN’s risk profile, growth potential, and competitive landscape. These differing opinions can significantly influence investor sentiment and ultimately impact the stock price.

Risk Assessment and Investment Considerations for BMRN Stock

Investing in BMRN stock carries inherent risks. A thorough risk assessment is essential before making any investment decisions.

- Clinical Trial Risks: Failure to achieve positive results in clinical trials can severely impact the stock price.

- Competition: Intense competition within the biotechnology industry poses a significant risk.

- Market Volatility: The biotechnology sector is known for its price volatility, influenced by various internal and external factors.

- Regulatory Risks: Regulatory delays or rejections can negatively affect the company’s prospects.

Despite these risks, BMRN’s strong pipeline and market position offer potential rewards for long-term investors. A conservative investment strategy might involve diversifying across different asset classes and gradually accumulating BMRN shares over time, reducing exposure to short-term volatility. A more aggressive approach might involve investing a larger portion of the portfolio in BMRN, accepting higher risk for potentially greater returns.

The optimal strategy depends on individual risk tolerance and financial goals.

Answers to Common Questions: Bmrn Stock Price

What are the major competitors of BMRN?

BMRN’s main competitors vary depending on the specific therapeutic area, but often include other large biopharmaceutical companies with similar drug pipelines.

Where can I find real-time BMRN stock price data?

Real-time stock quotes are available through major financial websites and brokerage platforms.

What is the typical trading volume for BMRN stock?

Trading volume fluctuates daily and can be found on financial websites displaying stock market data.

How does BMRN compare to the overall biotechnology market index?

A comparison requires referencing a relevant biotechnology index (e.g., the NASDAQ Biotechnology Index) and analyzing BMRN’s performance relative to its movement.