Understanding BJ’s Wholesale Stock Price

Bj’s wholesale stock price – BJ’s Wholesale Club Holdings, Inc. (BJ) stock price is influenced by a complex interplay of factors, reflecting the company’s financial performance, industry trends, and broader economic conditions. Analyzing these factors provides a clearer understanding of the stock’s volatility and potential for future growth.

Factors Influencing BJ’s Wholesale Stock Price Fluctuations

Several key factors contribute to the fluctuation of BJ’s Wholesale stock price. These include macroeconomic conditions (inflation, interest rates, consumer spending), competitive pressures from Costco and Sam’s Club, the success of BJ’s membership program, the company’s financial performance (revenue growth, profitability, and debt levels), and investor sentiment regarding the future prospects of the company and the overall retail sector.

Historical Performance of BJ’s Wholesale Stock Price

Source: companieslogo.com

BJ’s Wholesale has experienced periods of both growth and decline in its stock price. A detailed analysis would require reviewing historical stock charts and financial reports, revealing trends related to specific events such as economic recessions, successful marketing campaigns, or changes in company strategy. For instance, the stock price likely saw increased volatility during the COVID-19 pandemic, reflecting both increased demand for grocery staples and broader market uncertainty.

Understanding BJ’s wholesale stock price requires considering broader market trends. For instance, comparing its performance against established players like the motorcycle industry, where you can find current information on the harley stock price , offers valuable context. Ultimately, a comprehensive analysis of BJ’s requires examining both its internal strategies and external economic factors.

Comparison of BJ’s Wholesale Stock Price to Competitors

Comparing BJ’s stock price to its main competitors, Costco (COST) and Sam’s Club (Walmart’s subsidiary), requires a comprehensive analysis of their respective financial performance, market share, and growth strategies. Factors such as price-to-earnings ratios, revenue growth rates, and market capitalization provide a basis for comparison. Generally, the relative performance of BJ’s stock will be influenced by its ability to differentiate itself from these larger competitors.

Key Financial Metrics Impacting the Stock Price

Several key financial metrics significantly impact BJ’s stock price. These include revenue growth, gross margin, operating income, net income, earnings per share (EPS), and free cash flow. Strong revenue growth, coupled with improved profitability, generally leads to a positive impact on the stock price. Conversely, declining revenue or profit margins often exert downward pressure.

Timeline of Significant Events Affecting BJ’s Wholesale Stock Price

A timeline illustrating significant events impacting BJ’s stock price would include key dates such as IPOs, mergers and acquisitions, major financial announcements (earnings reports, guidance updates), significant changes in management, and impactful macroeconomic events. Each event would be analyzed for its influence on investor sentiment and subsequent stock price movements.

Market Analysis of BJ’s Wholesale

Source: seekingalpha.com

Understanding the current market conditions and their impact on BJ’s Wholesale is crucial for assessing its stock price prospects. This includes analyzing consumer spending patterns, competitive dynamics, and overall economic trends.

Current Market Conditions Impacting BJ’s Wholesale

The current market environment for BJ’s Wholesale is shaped by factors such as inflation, consumer confidence, and the ongoing competition within the wholesale club industry. High inflation may impact consumer spending, potentially affecting BJ’s sales volume. The competitive landscape necessitates continuous innovation and strategic adaptation to maintain market share.

Risks and Opportunities for BJ’s Wholesale’s Stock Price

Potential risks include increased competition, changing consumer preferences, economic downturns, and supply chain disruptions. Opportunities include expansion into new markets, the development of new products and services, and improvements in operational efficiency. A detailed risk assessment would be necessary to quantify these factors and their potential impact.

Competitive Advantages and Disadvantages of BJ’s Wholesale

BJ’s Wholesale possesses certain competitive advantages, such as its established brand recognition and loyal customer base. However, it also faces disadvantages, including its smaller scale compared to Costco and Sam’s Club, which may limit its bargaining power with suppliers. A thorough competitive analysis would highlight these strengths and weaknesses.

Potential Growth Areas for BJ’s Wholesale

Potential growth areas for BJ’s Wholesale include expanding its online presence, enhancing its private label offerings, and exploring new membership tiers or loyalty programs. Investing in technology and data analytics could also significantly improve efficiency and customer experience, leading to growth.

SWOT Analysis of BJ’s Wholesale, Bj’s wholesale stock price

A SWOT analysis provides a structured framework for assessing BJ’s Wholesale’s strengths, weaknesses, opportunities, and threats. This analysis would highlight internal factors (strengths and weaknesses) and external factors (opportunities and threats) that influence its stock price prospects.

Financial Performance and Stock Valuation: Bj’s Wholesale Stock Price

BJ’s Wholesale’s financial statements provide crucial insights into its financial health and profitability, directly impacting its stock valuation. Analyzing key ratios and applying valuation methods helps determine the intrinsic value of the stock.

Relationship Between BJ’s Wholesale Financial Statements and Stock Price

BJ’s financial statements – including the income statement, balance sheet, and cash flow statement – directly influence investor perceptions of the company’s financial health and future prospects. Strong financial performance, reflected in higher revenues, profits, and cash flows, typically leads to a higher stock price.

Key Financial Ratios and Their Impact on Stock Price

Several key financial ratios provide insights into BJ’s financial health and help assess its stock valuation. These include:

| Ratio | Description | Impact on Stock Price | Example (Hypothetical) |

|---|---|---|---|

| Price-to-Earnings Ratio (P/E) | Market price per share divided by earnings per share | Higher P/E ratios often indicate higher growth expectations. | 25 |

| Return on Equity (ROE) | Net income divided by shareholder equity | Measures profitability relative to shareholder investment. | 15% |

| Debt-to-Equity Ratio | Total debt divided by total equity | High ratios indicate higher financial risk. | 0.5 |

| Gross Profit Margin | Gross profit divided by revenue | Reflects pricing power and efficiency. | 28% |

Explanation of BJ’s Wholesale’s Earnings Per Share (EPS)

Earnings per share (EPS) represents the portion of a company’s profit allocated to each outstanding share. A higher EPS generally indicates improved profitability and can positively influence the stock price. Consistent EPS growth is a strong indicator of a healthy and growing company.

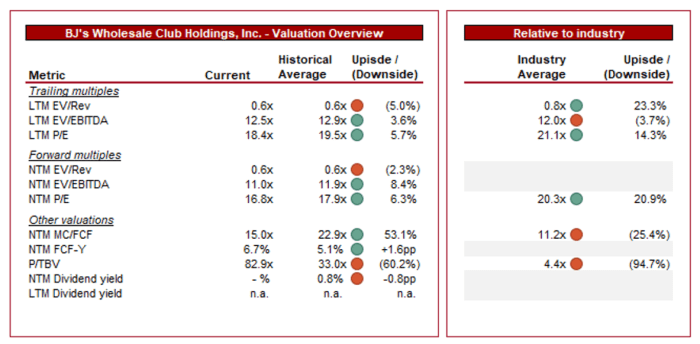

Valuation Methods Applied to BJ’s Wholesale

Various valuation methods, including the price-to-earnings ratio (P/E), discounted cash flow (DCF) analysis, and comparable company analysis, can be used to estimate the intrinsic value of BJ’s Wholesale stock. Each method provides a different perspective on the stock’s fair value.

Impact of Investor Sentiment on BJ’s Wholesale Stock Price

Investor sentiment, encompassing market confidence, news reports, and analyst recommendations, significantly impacts BJ’s stock price. Positive sentiment tends to drive the price upwards, while negative sentiment can lead to price declines. News about company performance, industry trends, and the overall economy all contribute to this sentiment.

Question Bank

What are the major risks associated with investing in BJ’s Wholesale stock?

Major risks include general economic downturns impacting consumer spending, increased competition from other wholesale clubs and retailers, and potential supply chain disruptions.

How often does BJ’s Wholesale release its financial reports?

BJ’s Wholesale typically releases quarterly and annual financial reports, adhering to standard reporting schedules for publicly traded companies. Specific dates are available on their investor relations website.

Where can I find real-time BJ’s Wholesale stock price data?

Real-time stock price data is readily available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is the dividend payout history of BJ’s Wholesale?

Information on BJ’s Wholesale’s dividend payout history, including past dividend amounts and payment dates, can be found on their investor relations website and financial news sources.