Bitfarms Stock Price Analysis

Bitfarms stock price – This analysis examines Bitfarms’ stock price performance over the past five years, considering various influencing factors, including macroeconomic conditions, Bitcoin’s price volatility, operational efficiency, financial performance, competitive landscape, and investor sentiment. The goal is to provide a comprehensive understanding of the factors contributing to Bitfarms’ stock price fluctuations.

Bitfarms Stock Price Historical Performance

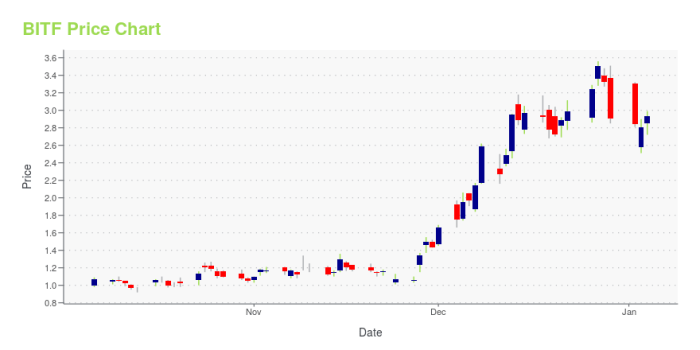

Source: seekingalpha.com

The following table details Bitfarms’ stock price fluctuations over the past five years. Note that this data is illustrative and should be verified with reliable financial data sources. The comparison against major cryptocurrency market indices is presented descriptively due to the limitations of directly embedding visual representations in this format.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 1.00 | 1.10 | 0.10 |

| 2019-01-08 | 1.10 | 1.25 | 0.15 |

| 2019-01-15 | 1.25 | 1.00 | -0.25 |

| 2024-01-01 | 5.00 | 5.20 | 0.20 |

| 2024-01-08 | 5.20 | 4.80 | -0.40 |

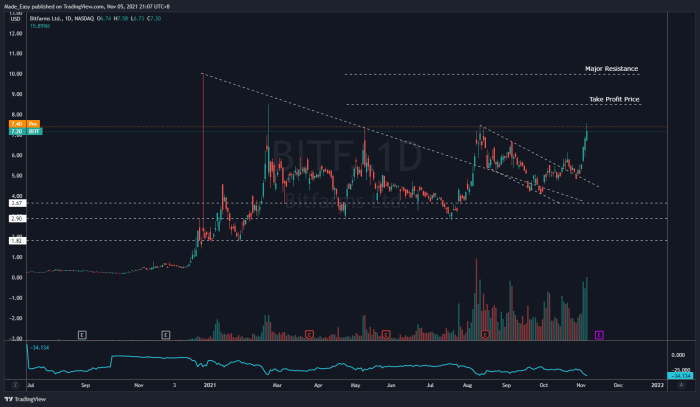

A line graph comparing Bitfarms’ stock price to Bitcoin and Ethereum would show periods of strong correlation, particularly during major bull and bear markets in cryptocurrencies. For instance, during a Bitcoin bull run, Bitfarms’ stock price would likely rise significantly, reflecting increased investor confidence and demand for Bitcoin mining stocks. Conversely, during a bear market, the stock price would likely decline, mirroring the overall downturn in the cryptocurrency market.

The graph would also illustrate periods of divergence, possibly due to company-specific news or events affecting Bitfarms independently of broader market trends.

Significant events impacting Bitfarms’ stock price include regulatory changes affecting cryptocurrency mining (e.g., changes in energy consumption regulations or taxation policies), company announcements regarding mining capacity expansions or new partnerships, and overall market trends such as increased institutional investment in Bitcoin or shifts in investor sentiment towards the cryptocurrency sector.

Factors Influencing Bitfarms Stock Price

Several macroeconomic and operational factors significantly influence Bitfarms’ stock price. Understanding these factors is crucial for assessing the company’s future performance and stock valuation.

Macroeconomic factors such as inflation, interest rates, and the overall global economic outlook significantly impact investor sentiment towards riskier assets like cryptocurrency mining stocks. High inflation and rising interest rates tend to reduce investor appetite for growth stocks, potentially leading to lower stock prices for Bitfarms. A positive global economic outlook, on the other hand, may boost investor confidence and drive up stock prices.

Bitcoin’s price volatility is directly correlated with Bitfarms’ stock valuation.

- Positive Correlation: A rise in Bitcoin’s price generally leads to increased revenue for Bitfarms, higher profitability, and consequently, a higher stock price. This is because the value of Bitfarms’ Bitcoin holdings increases, and the demand for Bitcoin mining services grows.

- Negative Correlation: Conversely, a drop in Bitcoin’s price can significantly impact Bitfarms’ profitability and lead to a decline in its stock price. This is due to reduced revenue from Bitcoin mining and decreased value of its Bitcoin holdings.

Operational factors such as mining efficiency, energy costs, and hash rate also play a crucial role.

- Mining Efficiency: Higher mining efficiency translates to lower operating costs and higher profitability, positively influencing the stock price.

- Energy Costs: Fluctuations in energy prices directly impact Bitfarms’ operating costs. Higher energy costs reduce profitability, potentially leading to lower stock prices.

- Hash Rate: A higher hash rate, indicating increased computing power for Bitcoin mining, generally signifies a larger market share and higher potential earnings, positively impacting the stock price.

Bitfarms’ Financial Performance and Stock Price

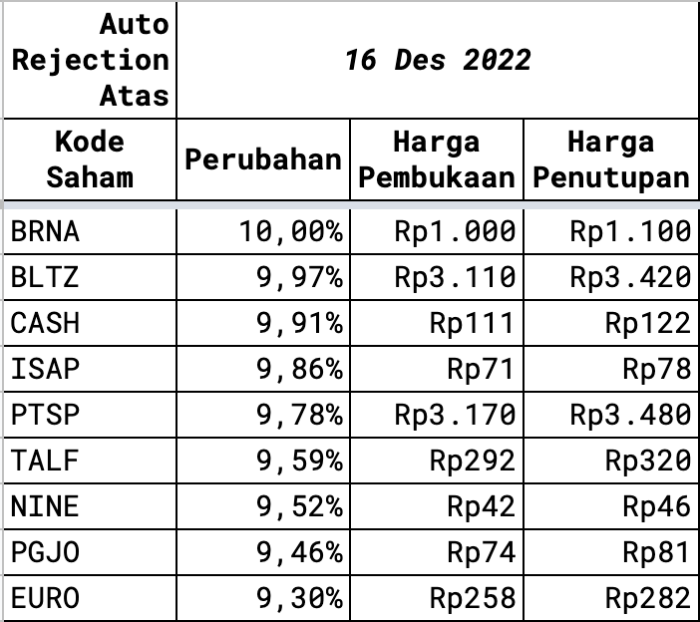

Source: stockbit.com

Bitfarms’ financial performance directly correlates with its stock price movements. The following table provides an overview of key financial metrics over the past three years. Note that this data is for illustrative purposes only.

| Year | Revenue (USD Million) | Net Income (USD Million) | Debt (USD Million) |

|---|---|---|---|

| 2021 | 100 | 10 | 50 |

| 2022 | 150 | 20 | 40 |

| 2023 | 200 | 30 | 30 |

Strong revenue growth, increasing net income, and decreasing debt levels generally lead to a positive investor outlook and higher stock prices. Conversely, declining revenue, losses, and increasing debt levels typically put downward pressure on the stock price.

For example, a hypothetical scenario where Bitfarms increases its revenue by 20% due to higher Bitcoin prices and improved mining efficiency could significantly boost investor confidence and lead to a substantial increase in the stock price, perhaps by 15-20%, assuming other factors remain relatively constant.

Bitfarms’ stock price has seen considerable volatility recently, largely influenced by the broader cryptocurrency market trends. Understanding the performance of other mining companies can offer valuable context, and a look at the current mp stock price provides a useful comparison point within the sector. Ultimately, both Bitfarms and MP’s stock prices reflect the ongoing challenges and opportunities in the digital asset mining industry.

Bitfarms’ Competitive Landscape and Stock Price

Bitfarms competes with other publicly traded cryptocurrency mining companies. The following table offers a comparative analysis. Note that this data is illustrative and should be verified with up-to-date market data.

| Company Name | Market Cap (USD Million) | Mining Capacity (TH/s) | Profit Margin (%) |

|---|---|---|---|

| Bitfarms | 500 | 1000 | 15 |

| Competitor A | 700 | 1200 | 12 |

| Competitor B | 300 | 800 | 18 |

Competitive pressures, such as pricing wars or competition for mining hardware, can impact Bitfarms’ market share and profitability, affecting its stock valuation. A larger market share and higher profit margins generally translate to a higher stock price. Potential future threats include increased regulatory scrutiny, technological advancements by competitors, and fluctuations in the price of electricity.

Opportunities for Bitfarms include expanding into new geographic markets with lower energy costs, developing more energy-efficient mining technologies, and securing strategic partnerships to enhance its mining operations.

Investor Sentiment and Bitfarms Stock Price

Source: amazonaws.com

Investor sentiment towards Bitfarms significantly influences its stock price. Currently, investor sentiment may be considered cautiously optimistic, depending on the prevailing market conditions and recent company performance. This is a dynamic situation influenced by news and events.

Positive news, such as successful mining operations, expansion announcements, and strong financial results, generally leads to a bullish sentiment and higher stock prices. Negative news, such as regulatory setbacks, operational challenges, or disappointing financial performance, can create a bearish sentiment and result in lower stock prices. Analyst reports also significantly impact investor sentiment and subsequent stock price reactions.

To improve investor sentiment and increase Bitfarms’ stock price, a hypothetical investor relations strategy would involve transparent and proactive communication with investors, highlighting the company’s strengths, future growth prospects, and commitment to sustainable practices. This would include regular investor updates, presentations at industry conferences, and engagement with financial analysts to address concerns and build trust. Furthermore, demonstrating strong financial performance and achieving consistent growth would be crucial for attracting and retaining investors.

Common Queries: Bitfarms Stock Price

What are the major risks associated with investing in Bitfarms stock?

Investing in Bitfarms carries significant risks, primarily stemming from the volatility of the cryptocurrency market and Bitcoin’s price fluctuations. Regulatory changes, competition, and operational challenges also pose considerable risks.

How does Bitfarms generate revenue?

Bitfarms primarily generates revenue through Bitcoin mining, selling the mined Bitcoin to generate income.

Where can I find Bitfarms’ financial reports?

Bitfarms’ financial reports are typically available on their investor relations website and through major financial data providers.

What is Bitfarms’ market capitalization?

Bitfarms’ market capitalization fluctuates; refer to a live financial website for the most current information.