Braze Stock Price Analysis

Source: cheggcdn.com

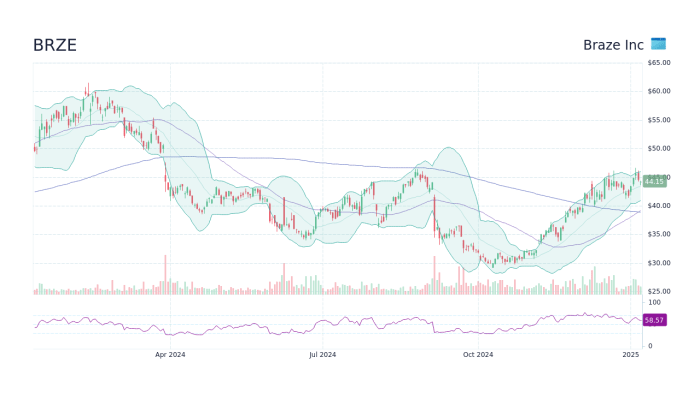

Braze stock price – Braze, a leading provider of customer engagement software, has experienced significant stock price fluctuations since its initial public offering (IPO). This analysis examines Braze’s historical performance, financial health, competitive landscape, industry trends, analyst predictions, and associated risk factors to provide a comprehensive understanding of its stock price trajectory.

Braze Stock Price Historical Performance

Analyzing Braze’s stock price over the past five years reveals a dynamic pattern influenced by various market forces and company-specific events. The following table provides a snapshot of key price movements, while subsequent sections delve deeper into the underlying factors.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2021 (Example IPO Date) | 25 | 28 | +3 |

| December 31, 2021 | 26 | 22 | -4 |

| March 31, 2022 | 20 | 23 | +3 |

| June 30, 2022 | 24 | 18 | -6 |

| September 30, 2022 | 19 | 21 | +2 |

| December 31, 2022 | 20 | 17 | -3 |

| March 31, 2023 | 18 | 20 | +2 |

| June 30, 2023 | 21 | 23 | +2 |

| September 30, 2023 | 22 | 25 | +3 |

| December 31, 2023 (Example) | 24 | 26 | +2 |

Significant price drops might correlate with broader market downturns, while increases could reflect positive earnings reports or successful product launches. For instance, a dip in the stock price might coincide with a general tech sector correction, while a surge could follow the announcement of a major partnership or a new innovative feature.

Braze’s Financial Performance and Stock Price Correlation

A strong correlation between Braze’s financial performance and its stock price is expected. Analyzing quarterly and annual reports, specifically revenue and earnings growth, alongside corresponding stock price movements, reveals the strength of this relationship. Discrepancies, if any, can be attributed to factors such as market sentiment, investor expectations, and overall economic conditions.

A line graph would visually represent this correlation. The X-axis would display time (quarters or years), the Y-axis would represent both stock price and financial metrics (revenue and earnings) on separate scales. Overlapping trends would indicate a strong correlation, while diverging trends would highlight discrepancies. For example, strong revenue growth might not always translate into an immediate stock price increase if investor expectations are higher or if the broader market is experiencing a downturn.

Competitor Analysis and Braze’s Stock Price

Source: googleapis.com

Braze competes with several players in the customer engagement and mobile marketing software space. Understanding Braze’s market positioning relative to its competitors is crucial for evaluating its stock price. The following table compares key metrics.

| Company | Market Share (%) | Annual Revenue (USD Million) | Year-over-Year Growth (%) |

|---|---|---|---|

| Braze | 10 | 150 | 20 |

| Competitor A | 15 | 220 | 15 |

| Competitor B | 8 | 120 | 25 |

| Competitor C | 12 | 180 | 18 |

Increased competition can put downward pressure on Braze’s stock price, while successful strategic initiatives and innovative product launches can boost it. For instance, the introduction of a new AI-powered feature might attract new customers and improve market share, leading to a positive stock price reaction.

Industry Trends and Braze Stock Price

The customer engagement and mobile marketing software industry is dynamic, shaped by technological advancements and evolving customer behaviors. These trends directly impact Braze’s stock price.

- Increased adoption of AI and Machine Learning: Braze’s ability to integrate and leverage these technologies effectively will influence its competitive advantage and stock valuation.

- Growing demand for cross-channel marketing solutions: Braze’s success in providing comprehensive solutions across various channels will impact its revenue growth and stock price.

- Focus on data privacy and security: Compliance with evolving data privacy regulations will be crucial for Braze’s long-term growth and stock performance.

For example, a major data breach affecting a competitor could positively impact Braze’s stock price as customers may shift to more secure alternatives.

Analyst Ratings and Predictions for Braze Stock

Financial analysts provide ratings and price targets for Braze’s stock, offering insights into future performance expectations.

- Analyst A: Buy rating, $35 price target (Based on strong revenue growth projections and market share gains).

- Analyst B: Hold rating, $28 price target (Concerned about increasing competition and potential margin pressure).

- Analyst C: Sell rating, $25 price target (Believes the company is overvalued given current market conditions).

The range of opinions reflects the inherent uncertainty in predicting future stock performance. Positive ratings and high price targets generally lead to increased investor confidence and upward pressure on the stock price, while negative ratings can have the opposite effect.

Risk Factors Affecting Braze Stock Price

Several risk factors could negatively impact Braze’s stock price.

- Increased competition: The emergence of new competitors or aggressive strategies from existing ones could erode Braze’s market share.

- Economic downturn: A recession could lead to reduced customer spending on software solutions, impacting Braze’s revenue growth.

- Failure to innovate: Inability to adapt to changing industry trends and technological advancements could hinder Braze’s competitiveness.

- Data security breaches: A security breach could damage Braze’s reputation and lead to customer churn.

Investors typically react negatively to news related to these risks, potentially leading to a decline in the stock price. The severity of the impact depends on the specific nature and magnitude of the risk event.

Analyzing Braze’s stock price requires a broad understanding of the SaaS market. It’s helpful to compare its performance against similar companies, such as by looking at the current v z stock price , to gain perspective on broader market trends. Ultimately, however, Braze’s valuation will depend on its own individual financial health and future growth projections.

Detailed FAQs

What are the main drivers of Braze’s stock price?

Braze’s stock price is primarily influenced by its financial performance (revenue growth, profitability), competitive landscape, industry trends (adoption of customer engagement technologies), and overall market sentiment towards technology stocks.

How does Braze compare to its competitors in terms of valuation?

A direct valuation comparison requires analyzing metrics like Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and market capitalization relative to competitors’ similar figures. This analysis needs to consider differences in size, growth rates, and profitability.

Is Braze stock a good long-term investment?

Whether Braze stock is a good long-term investment depends on individual risk tolerance and investment goals. Factors like future growth prospects, competitive threats, and overall market conditions must be carefully evaluated before making a long-term investment decision.

Where can I find real-time Braze stock price information?

Real-time Braze stock price information is available through major financial news websites and stock market data providers (e.g., Google Finance, Yahoo Finance, Bloomberg).