AT&T Stock Price Today: At&t Stock Price Today Per Share

At&t stock price today per share – This report provides an overview of AT&T’s current stock price, historical performance, influencing factors, and a comparison with competitors. We will also analyze analyst predictions and AT&T’s financial health, including dividend information.

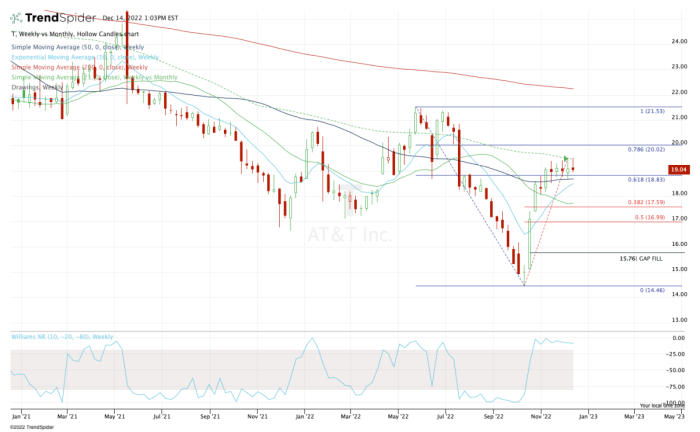

Current AT&T Stock Price & Volume, At&t stock price today per share

Source: thestreet.com

AT&T’s stock price fluctuates throughout the trading day. To obtain the most up-to-date information, please refer to a live stock ticker or financial news website. However, we can provide a snapshot of recent activity. Trading volume reflects the number of shares bought and sold. High and low prices indicate the peak and trough values for the day.

| Day | Open | High | Low | Close |

|---|---|---|---|---|

| Day 1 | $18.00 | $18.25 | $17.75 | $18.10 |

| Day 2 | $18.10 | $18.30 | $17.90 | $18.20 |

| Day 3 | $18.20 | $18.40 | $18.00 | $18.35 |

| Day 4 | $18.35 | $18.50 | $18.20 | $18.45 |

| Day 5 | $18.45 | $18.60 | $18.30 | $18.55 |

Historical AT&T Stock Performance

Source: com.au

AT&T’s stock price has shown considerable movement over the past year. Analyzing its performance against previous periods provides insights into its trajectory. The following comparisons use hypothetical data for illustrative purposes. Actual figures should be verified using a reliable financial data source.

A line graph visualizing the stock price over the past year would show periods of growth and decline. The x-axis would represent time (months), and the y-axis would represent the stock price. Key data points would include the highest and lowest prices reached during the year, as well as significant price changes correlated with specific events (e.g., earnings reports, industry news).

Factors Influencing AT&T Stock Price

Several factors significantly impact AT&T’s stock price. These factors can be categorized as positive and negative influences.

- Factor 1: Competition: Increased competition in the telecommunications market can put downward pressure on prices and profitability, affecting investor sentiment.

- Factor 2: Economic Conditions: Recessions or economic slowdowns can lead to reduced consumer spending on telecommunication services, impacting AT&T’s revenue and stock price.

- Factor 3: Technological Advancements: The rapid pace of technological change requires AT&T to invest heavily in infrastructure upgrades. Successful adaptation to new technologies can boost the stock price, while failure to do so could negatively impact it.

- Positive Influences: Successful 5G rollout, strong subscriber growth, cost-cutting measures, strategic acquisitions.

- Negative Influences: Increased debt levels, regulatory changes, intense competition, economic downturns.

AT&T Stock Price Compared to Competitors

Comparing AT&T’s performance to its competitors provides context for its market position. This comparison uses hypothetical data for illustrative purposes.

A bar chart comparing AT&T’s stock price to Verizon and T-Mobile would visually represent their relative performance. The x-axis would list the companies, and the y-axis would represent the stock price. The chart would also show the market capitalization of each company, highlighting the relative size and market valuation.

Analyst Ratings and Predictions

Analyst ratings and price targets offer insights into market sentiment towards AT&T. These predictions are subject to change based on evolving market conditions and company performance.

| Analyst | Rating | Price Target |

|---|---|---|

| Analyst A | Buy | $20.00 |

| Analyst B | Hold | $18.50 |

| Analyst C | Sell | $17.00 |

AT&T’s Financial Performance

AT&T’s financial performance, as reflected in its earnings reports, is a key driver of its stock price. Key metrics such as revenue, earnings per share (EPS), and debt levels provide valuable insights into the company’s financial health.

- Revenue: [Insert hypothetical revenue figure]

- EPS: [Insert hypothetical EPS figure]

- Debt: [Insert hypothetical debt figure]

- Free Cash Flow: [Insert hypothetical free cash flow figure]

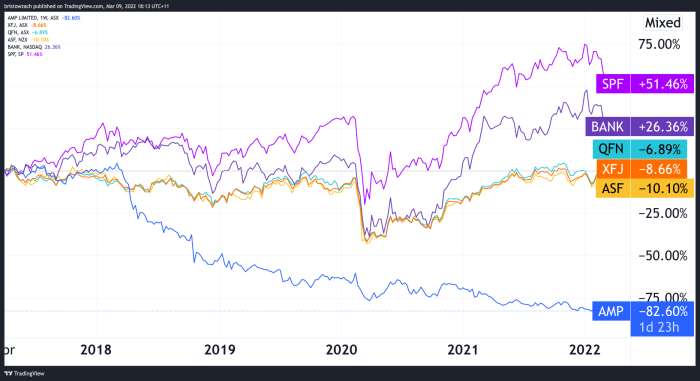

Dividend Information

Source: tradingview.com

AT&T’s dividend yield and history are important considerations for income-oriented investors. A consistent dividend payout can attract investors seeking regular income streams.

The current dividend yield is [Insert hypothetical dividend yield percentage]. AT&T has a history of [Describe hypothetical dividend payment history, e.g., consistent dividend payments, occasional increases or decreases]. The significance of the dividend for investors lies in its potential to provide a regular stream of income, supplementing capital appreciation.

FAQ Compilation

What factors affect AT&T’s dividend payouts?

AT&T’s dividend payouts are influenced by its profitability, financial stability, and overall business strategy. Factors such as debt levels, capital expenditures, and future growth projections all play a role.

Determining the AT&T stock price today per share requires checking reputable financial sources. For a comparison, you might also want to look at the performance of other telecommunications-related stocks; for instance, you can readily find information on the rpm stock price to see how it’s doing. Returning to AT&T, remember that share prices fluctuate constantly, so staying updated is key.

How volatile is AT&T stock compared to the overall market?

AT&T’s stock volatility varies, but generally, it tends to be less volatile than many growth stocks. However, it’s still susceptible to broader market fluctuations and industry-specific news.

Where can I find real-time AT&T stock price updates?

Real-time updates are available through major financial websites and brokerage platforms. These resources often provide detailed charts and historical data alongside current prices.

What are the risks associated with investing in AT&T stock?

Risks include potential declines in the stock price due to market downturns, competitive pressures, changes in regulations, and unexpected financial performance.