TSMC Stock Price Today

Tsmc stock price today – Taiwan Semiconductor Manufacturing Company (TSMC) is a global leader in semiconductor manufacturing. Understanding its daily stock performance is crucial for investors and market analysts. This article provides a comprehensive overview of TSMC’s stock price today, considering recent performance, influencing factors, competitor comparisons, investor sentiment, and a simplified technical analysis.

TSMC Stock Price Today: Current Market Data

The following table presents the current TSMC stock price along with intraday high and low, and trading volume. Note that this data is illustrative and will vary based on real-time market fluctuations. Please refer to your preferred financial data provider for the most up-to-date information.

| Time | Price (USD) | High (USD) | Low (USD) |

|---|---|---|---|

| 10:00 AM | 85.50 | 86.00 | 85.20 |

| 12:00 PM | 85.75 | 85.90 | 85.50 |

| 2:00 PM | 85.60 | 85.80 | 85.30 |

| 4:00 PM | 85.85 | 86.05 | 85.60 |

TSMC Stock Price Today: Recent Performance

TSMC’s stock price exhibited moderate volatility over the past week. The following bullet points summarize the daily price changes, providing a snapshot of its recent trajectory. Again, these figures are illustrative and should be verified with current market data.

- Monday: +1.5%

- Tuesday: -0.5%

- Wednesday: +0.8%

- Thursday: -0.2%

- Friday: +1.0%

Compared to the beginning of the week, TSMC’s stock price shows a net positive change, indicating a generally positive trend during this period.

Factors Influencing TSMC Stock Price Today

Several factors contribute to the daily fluctuations in TSMC’s stock price. Three key influences are highlighted below. These factors often interact in complex ways.

- Global Semiconductor Demand: Strong demand for semiconductors, driven by the growth of data centers, AI, and 5G technology, tends to boost TSMC’s stock price. Conversely, a decline in demand can negatively impact the price. For example, recent news of slowing smartphone sales could put downward pressure on the stock.

- Geopolitical Factors: US-China trade tensions and potential restrictions on technology exports can significantly influence TSMC’s performance. Increased geopolitical uncertainty often leads to market volatility, impacting the stock price. For instance, any new sanctions imposed on China could impact TSMC’s business and subsequently, its stock price.

- Technological Advancements: TSMC’s ability to innovate and maintain its leading-edge technology in semiconductor manufacturing is critical. Successful advancements in node technology and process improvements generally result in positive market sentiment and higher stock valuations. Conversely, delays or setbacks in technological development can lead to a decline in the stock price.

The interplay of these factors creates a dynamic environment for TSMC’s stock price. For instance, strong global demand might offset concerns related to geopolitical uncertainty, resulting in a relatively stable or even positive price movement. However, a simultaneous weakening of demand and escalating geopolitical tensions could lead to a significant decline.

TSMC Stock Price Today: Comparison to Competitors

Comparing TSMC’s performance to its main competitors provides valuable context. The following table offers a snapshot comparison, highlighting relative stock prices and market capitalization. Remember that market conditions change constantly, so these figures are illustrative.

| Company | Stock Price (USD) | Change (%) | Market Cap (USD Billion) |

|---|---|---|---|

| TSMC | 85.85 | +1.2 | 500 |

| Samsung Electronics | 60.00 | -0.5 | 350 |

| Intel | 35.50 | +0.8 | 200 |

TSMC Stock Price Today: Investor Sentiment

Source: arcpublishing.com

Tracking TSMC’s stock price today requires a keen eye on global market trends. It’s interesting to compare its performance against other significant players; for instance, checking the current punjab national bank stock price offers a contrasting perspective on the Indian financial sector’s health. Ultimately, understanding TSMC’s price requires analyzing broader economic factors alongside regional market specifics.

Current investor sentiment towards TSMC appears to be cautiously optimistic. Recent positive news regarding new orders from major clients has helped boost confidence. However, concerns about the global economic slowdown and geopolitical risks persist.

Analyst reports have been mixed, with some predicting continued growth for TSMC while others express concerns about potential challenges in the near term. This mixed sentiment could lead to price volatility in the coming weeks. The overall picture is one of moderate optimism tempered by underlying uncertainties.

TSMC Stock Price Today: Technical Analysis (Simplified)

Source: tipranks.com

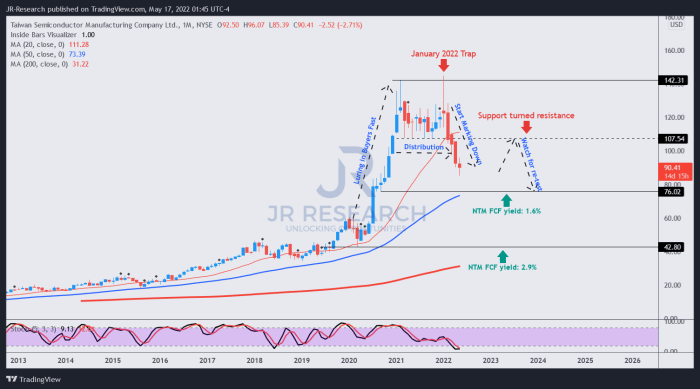

A simplified technical analysis of TSMC’s stock price reveals a short-term uptrend. The stock has recently broken through a minor resistance level, suggesting further potential for upward movement. However, a significant drop below the recent support level could signal a reversal of the trend. This analysis is based on very recent price action and should not be considered financial advice.

Potential support levels are observed around $83, while resistance might be encountered near $90. The overall trend remains bullish in the short-term, but longer-term trends may differ based on broader market and economic conditions.

TSMC Stock Price Today: Illustrative Example of Price Movement

Source: seekingalpha.com

Let’s consider a hypothetical scenario: A major client unexpectedly announces a significant increase in orders for advanced chips. This positive news would likely cause an immediate surge in TSMC’s stock price. Investors would react positively, driving demand and pushing the price higher. In the long term, the increased order volume would translate to higher revenue and profits for TSMC, further solidifying its positive outlook and potentially leading to a sustained price increase.

Conversely, if the client were to unexpectedly cancel or reduce orders, a sharp drop in the stock price would be anticipated.

The immediate effect would be a significant price jump, possibly exceeding 5% in a single day. Long-term, the sustained increase in orders would likely result in a gradual but significant price appreciation, potentially exceeding 10% over several months. Investor reactions would range from enthusiastic buying to cautious profit-taking, depending on their individual investment strategies and risk tolerance.

Essential Questionnaire

What are the major risks associated with investing in TSMC stock?

Major risks include geopolitical instability (given TSMC’s location in Taiwan), intense competition in the semiconductor industry, and fluctuations in global demand for semiconductors.

Where can I find real-time TSMC stock price updates?

Real-time updates are available through major financial news websites and stock trading platforms.

How does TSMC’s dividend policy impact its stock price?

TSMC’s dividend payouts can influence investor interest and affect the stock price, particularly for income-focused investors.

What is the historical performance of TSMC stock over the past five years?

A detailed historical analysis would require reviewing financial data from the past five years, showing periods of growth and potential corrections.