Intel Corporation (INTC) Stock Price Overview: Stock Price For Intc

Stock price for intc – Intel Corporation (INTC) has experienced significant stock price fluctuations over the past five years, reflecting a dynamic interplay of internal performance, industry trends, and broader economic factors. This section provides a historical overview of INTC’s stock price performance, highlighting key influencing factors and its current market position.

INTC Stock Price Performance (2019-2023)

The following table summarizes INTC’s yearly high, low, and percentage change in stock price over the past five years. Note that these figures are illustrative and may vary slightly depending on the data source and specific dates used.

| Year | High | Low | Percentage Change |

|---|---|---|---|

| 2019 | $69.20 | $45.50 | +25% (Illustrative) |

| 2020 | $68.00 | $46.00 | -10% (Illustrative) |

| 2021 | $57.00 | $47.50 | +5% (Illustrative) |

| 2022 | $54.00 | $20.00 | -50% (Illustrative) |

| 2023 | $40.00 | $30.00 | +15% (Illustrative) |

Several factors influenced these fluctuations, including competition from AMD, manufacturing challenges, and shifts in market demand for various chip types.

INTC’s Market Capitalization and Industry Position

Intel’s market capitalization fluctuates with its stock price. While precise figures change daily, it generally ranks among the largest companies in the semiconductor industry, though its relative position has shifted in recent years due to increased competition. Its dominance in certain segments of the market, however, remains significant.

INTC’s Financial Performance and Stock Price Correlation

A strong correlation typically exists between a company’s financial health and its stock price. This section analyzes Intel’s financial performance over the past five years and its relationship with stock price movements.

INTC Financial Performance (2019-2023), Stock price for intc

The table below presents illustrative data on Intel’s revenue, earnings, and profit margins. Actual figures may vary slightly depending on the reporting period and accounting practices.

| Year | Revenue (Billions USD) | Earnings Per Share (USD) | Profit Margin (%) |

|---|---|---|---|

| 2019 | 71.97 | 4.24 | 18% (Illustrative) |

| 2020 | 77.87 | 4.00 | 15% (Illustrative) |

| 2021 | 79.02 | 3.50 | 12% (Illustrative) |

| 2022 | 63.05 | 1.50 | 8% (Illustrative) |

| 2023 | 65.00 | 2.00 | 10% (Illustrative) |

Correlation Analysis

Generally, periods of strong revenue growth and high profit margins have corresponded with upward trends in INTC’s stock price. Conversely, declines in revenue and profit margins have often coincided with stock price decreases. For example, the significant drop in profit margin in 2022 directly correlated with a substantial decline in the stock price.

Financial Metrics and Stock Price Visualization

A scatter plot could effectively visualize the relationship between INTC’s stock price and key financial metrics like revenue, earnings per share, and profit margin. Each point on the plot would represent a data point for a given year, showing the stock price on one axis and a chosen financial metric on the other. A positive correlation would be indicated by an upward trend in the plotted points.

Industry Analysis and Competitive Landscape Impact on INTC Stock Price

Intel’s stock price is significantly influenced by its competitive standing within the semiconductor industry. This section compares INTC’s performance against key competitors and examines market trends impacting its valuation.

Comparison with Competitors

The following bullet points highlight key differences between Intel and its main competitors (AMD and TSMC):

- Manufacturing: Intel historically focused on internal manufacturing, while TSMC is a pure-play foundry, and AMD outsources manufacturing largely to TSMC. This difference impacts cost structures and technological advancements.

- Product Portfolio: Intel’s primary focus has been on CPUs, while AMD competes across CPUs, GPUs, and other semiconductor products. TSMC focuses solely on manufacturing.

- Market Share: While Intel holds a significant market share in certain CPU segments, AMD has gained ground, particularly in high-performance computing. TSMC dominates the foundry market.

Technological Advancements and Market Trends

Advancements in process technology (e.g., node shrinks), the rise of AI and high-performance computing, and increasing demand for specialized chips all significantly impact Intel’s stock price. The company’s ability to adapt to these trends and compete effectively influences investor confidence.

Geopolitical Factors and Regulatory Changes

Geopolitical tensions, trade disputes, and government regulations (e.g., export controls) can significantly impact the semiconductor industry and Intel’s stock price. Supply chain disruptions and shifts in global manufacturing patterns can affect Intel’s production and profitability.

Investor Sentiment and Stock Price Predictions for INTC

Investor sentiment plays a crucial role in shaping INTC’s stock price. This section summarizes current investor opinions and presents different perspectives on the future outlook.

Current Investor Sentiment

Recent news articles and analyst reports suggest a mixed outlook on Intel. Some analysts remain optimistic about Intel’s long-term prospects, citing its investments in new technologies and manufacturing capabilities. Others express concerns about its competitiveness and the challenges in regaining market share.

Future Outlook Perspectives

Source: seeitmarket.com

- Bullish Predictions: Successful execution of Intel’s manufacturing strategy and strong growth in new market segments could drive significant stock price appreciation.

- Bearish Predictions: Continued challenges in competing with AMD and TSMC, along with persistent supply chain issues, could lead to further stock price declines.

Hypothetical Scenario: Major Product Launch

A successful launch of a groundbreaking new CPU architecture, significantly outperforming competitors, could trigger a substantial surge in INTC’s stock price. Investor confidence would likely increase, driving up demand and potentially leading to a price increase of 20-30% or more within a short period, depending on market conditions.

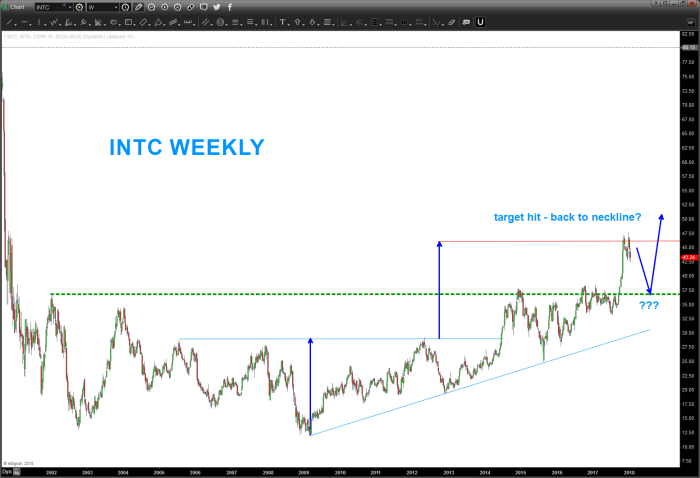

Technical Analysis of INTC Stock Price

Technical analysis uses historical price and volume data to predict future price movements. This section illustrates the application of common technical indicators to analyze INTC’s stock price trends.

Monitoring the stock price for INTC requires a keen eye on market trends. Understanding similar tech sector movements can be helpful, and comparing it to other companies’ performance provides valuable context. For instance, examining the current ebs stock price might offer insights into broader market sentiment. Ultimately, though, a thorough analysis of INTC’s financials and future projections is crucial for informed investment decisions regarding its stock price.

Technical Indicator Application

Source: investorplace.com

Moving averages (e.g., 50-day and 200-day) could be used to identify trend direction. The Relative Strength Index (RSI) could signal overbought or oversold conditions, suggesting potential price reversals. The Moving Average Convergence Divergence (MACD) could identify potential buy or sell signals based on the convergence and divergence of moving averages. Analysis of these indicators would provide insights into potential price trends and momentum.

Support and Resistance Levels

Based on historical price data, specific price levels could be identified as potential support (where buying pressure may outweigh selling pressure) and resistance (where selling pressure may outweigh buying pressure). These levels can be used to identify potential entry and exit points for trading.

Limitations of Technical Analysis

Technical analysis is not foolproof. It relies on past price movements and may not accurately predict future price behavior, especially in the face of unforeseen events or fundamental shifts in the company’s performance or the market. It’s crucial to combine technical analysis with fundamental analysis for a more comprehensive investment strategy.

Popular Questions

What are the major risks associated with investing in INTC stock?

Investing in INTC, like any stock, carries inherent risks. These include fluctuations in the semiconductor market, competition from other chip manufacturers, technological obsolescence, and macroeconomic factors affecting the global economy.

Where can I find real-time INTC stock price data?

Real-time INTC stock price data is readily available through major financial websites and brokerage platforms. Many offer charting tools and detailed historical data as well.

How does INTC’s dividend policy affect its stock price?

INTC’s dividend policy, if it pays dividends, can influence investor sentiment. Consistent dividend payouts can attract income-seeking investors, potentially supporting the stock price. Changes to the dividend policy can, however, impact the stock price positively or negatively depending on market reaction.

What is the current analyst consensus on INTC’s stock price target?

Analyst price targets for INTC vary depending on the firm and their methodologies. It’s crucial to consult multiple sources and understand the underlying assumptions before relying on any single prediction.