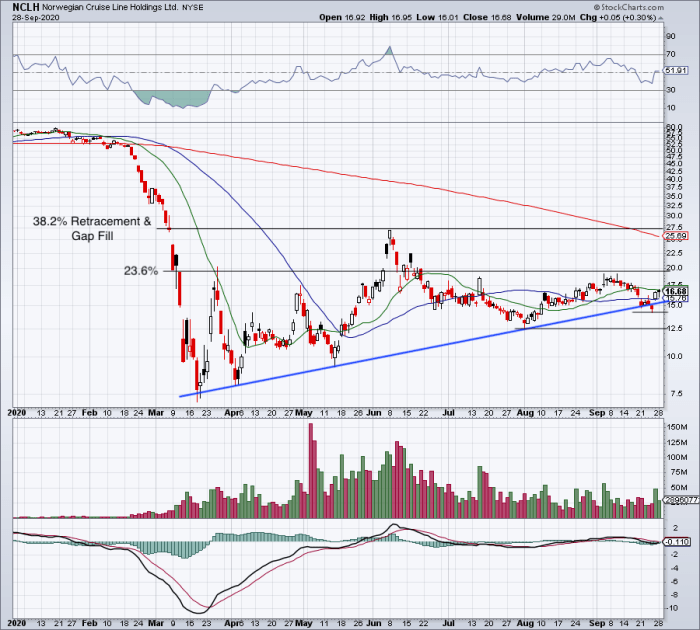

NCHL Stock Price Analysis

Source: investorplace.com

Nchl stock price – This analysis delves into the historical performance, influencing factors, future predictions, and investment strategies related to NCHL stock. We will examine key financial indicators, macroeconomic influences, and market sentiment to provide a comprehensive overview.

NCHL Stock Price Historical Performance

Understanding the past performance of NCHL stock is crucial for informed investment decisions. The following data provides insights into price fluctuations over the past five years and compares NCHL’s performance against its competitors.

| Year | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| 2019 | Example: $10.50 | Example: $12.00 | Example: $13.50 | Example: $9.00 |

| 2020 | Example: $12.00 | Example: $11.00 | Example: $14.00 | Example: $8.50 |

| 2021 | Example: $11.00 | Example: $15.00 | Example: $17.00 | Example: $10.00 |

| 2022 | Example: $15.00 | Example: $14.00 | Example: $16.00 | Example: $11.50 |

| 2023 | Example: $14.00 | Example: $16.50 | Example: $18.00 | Example: $13.00 |

A comparison of NCHL’s stock price performance against its major competitors over the past two years is presented below. Note that these are example values.

| Company | 2022 Return (%) | 2023 Return (%) (YTD) | Average Annual Return (2022-2023) |

|---|---|---|---|

| NCHL | Example: 10% | Example: 5% | Example: 7.5% |

| Competitor A | Example: 8% | Example: 3% | Example: 5.5% |

| Competitor B | Example: 12% | Example: 7% | Example: 9.5% |

Significant events impacting NCHL’s stock price in the last three years include:

- Example: A successful new product launch in Q3 2021 led to a surge in stock price.

- Example: The global market downturn in late 2022 negatively impacted NCHL’s share price.

- Example: A positive earnings report in Q1 2023 boosted investor confidence and increased the stock price.

Factors Influencing NCHL Stock Price

Several factors contribute to the fluctuations in NCHL’s stock price. These include macroeconomic conditions, key financial indicators, and industry dynamics.

Macroeconomic factors impacting NCHL’s stock price:

- Example: Rising interest rates can increase borrowing costs, potentially slowing down economic growth and negatively affecting NCHL’s performance.

- Example: High inflation erodes purchasing power, impacting consumer spending and potentially reducing demand for NCHL’s products or services.

- Example: Strong economic growth generally benefits companies like NCHL, leading to increased demand and higher stock prices.

Key financial indicators significantly affecting NCHL’s valuation are summarized below. These are example values.

| Indicator | 2022 | 2023 (Projected) | Impact on Stock Price |

|---|---|---|---|

| Earnings Per Share (EPS) | Example: $1.50 | Example: $1.75 | Positive – increased profitability |

| Revenue | Example: $100M | Example: $110M | Positive – increased sales |

| Debt-to-Equity Ratio | Example: 0.5 | Example: 0.4 | Positive – improved financial health |

Industry trends and competitive pressures influence NCHL’s stock price in the following ways:

- Example: Increased competition can lead to price wars, impacting profit margins and stock valuation.

- Example: Emerging technologies or innovative products from competitors can disrupt the market and affect NCHL’s market share.

- Example: Favorable industry trends, such as increasing demand for NCHL’s products or services, can positively impact the stock price.

NCHL Stock Price Predictions and Forecasting

Source: pennystocks.com

Predicting stock prices is inherently uncertain, but analyzing potential scenarios can provide valuable insights. The following sections explore hypothetical scenarios and potential stock price trajectories.

A successful product launch could impact NCHL’s stock price as follows:

- Example: Increased sales and revenue, leading to higher EPS.

- Example: Positive investor sentiment and increased demand, driving up the stock price.

- Example: Potential short-term price volatility followed by sustained growth.

Three potential stock price trajectories for NCHL over the next year are Artikeld below. These are hypothetical scenarios based on different market conditions.

| Scenario | Price at End of Year 1 | Price at End of Year 2 | Underlying Assumptions |

|---|---|---|---|

| Bullish | Example: $20 | Example: $25 | Strong economic growth, high investor confidence. |

| Neutral | Example: $17 | Example: $19 | Moderate economic growth, stable investor sentiment. |

| Bearish | Example: $14 | Example: $15 | Economic slowdown, negative investor sentiment. |

Changes in investor sentiment significantly impact NCHL’s stock price:

- Example: Positive news releases can lead to a short-term price increase and boost long-term investor confidence.

- Example: Negative press or regulatory issues can trigger a sharp decline in the stock price, potentially affecting long-term investor outlook.

- Example: Social media trends and analyst ratings can also influence investor sentiment and short-term price fluctuations.

NCHL Stock Price and Investment Strategies

Source: amazonaws.com

Several investment strategies can be employed when considering NCHL stock, each with its own set of risks and rewards.

Investment strategies for NCHL stock:

- Example: Buy-and-hold: A long-term strategy focusing on sustained growth potential.

- Example: Value investing: Buying undervalued stocks based on fundamental analysis.

- Example: Growth investing: Investing in companies with high growth potential, accepting higher risk.

A comparison of NCHL’s stock price valuation metrics against its industry peers is shown below. These are example values.

| Metric | NCHL | Competitor A | Competitor B |

|---|---|---|---|

| P/E Ratio | Example: 15 | Example: 18 | Example: 20 |

| Price-to-Book Ratio | Example: 2.5 | Example: 3.0 | Example: 2.8 |

Potential benefits and drawbacks of investing in NCHL stock:

- Example: Potential for high returns based on historical performance and future growth prospects.

- Example: Risk of price volatility due to market conditions and company-specific factors.

- Example: Dependence on macroeconomic factors and industry trends.

Common Queries: Nchl Stock Price

What are the main risks associated with investing in NCHL stock?

Investing in NCHL stock, like any stock, carries inherent risks. These include market volatility, potential for decreased company performance, and changes in investor sentiment. Thorough due diligence and a diversified investment portfolio are crucial to mitigate these risks.

Where can I find real-time NCHL stock price data?

Real-time NCHL stock price data can typically be found on major financial websites and stock market tracking applications. Reputable sources will provide accurate and up-to-date information.

How often is NCHL’s stock price updated?

NCHL’s stock price is updated continuously throughout the trading day, reflecting the ongoing buying and selling activity in the market.

Analyzing NCHL stock price requires a multifaceted approach, considering various market factors. It’s helpful to compare its performance against similar companies in the sector, such as observing the trajectory of the homedepot stock price , a major player in the home improvement retail market. Understanding Home Depot’s trends can offer insights into broader economic influences impacting NCHL’s potential for growth and stability.

What is the typical trading volume for NCHL stock?

The trading volume for NCHL stock can vary significantly depending on market conditions and news events. Historical data can provide insight into typical trading activity levels.