Delta Airlines Stock Price Analysis: Delta Airlines Stock Price Today

Delta airlines stock price today – This analysis provides an overview of Delta Airlines’ current stock price, recent fluctuations, influencing factors, analyst predictions, investor sentiment, and long-term performance. Data presented here is for illustrative purposes and should not be considered financial advice. Always consult with a financial professional before making investment decisions.

Current Delta Airlines Stock Price

The current stock price for Delta Airlines (DAL) will vary depending on the time of access. To obtain the most up-to-date information, please refer to a live stock ticker or your preferred financial data provider. The last updated time will also be reflected on these platforms. The following table shows example data for the last five days’ open, high, low, and closing prices.

Note that these are example values and may not reflect real-time data.

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| Oct 26, 2023 | $35.50 | $36.00 | $35.25 | $35.75 |

| Oct 25, 2023 | $35.00 | $35.50 | $34.75 | $35.00 |

| Oct 24, 2023 | $34.50 | $35.25 | $34.25 | $34.75 |

| Oct 23, 2023 | $34.00 | $34.75 | $33.75 | $34.50 |

| Oct 20, 2023 | $33.50 | $34.25 | $33.25 | $34.00 |

Recent Stock Price Fluctuations

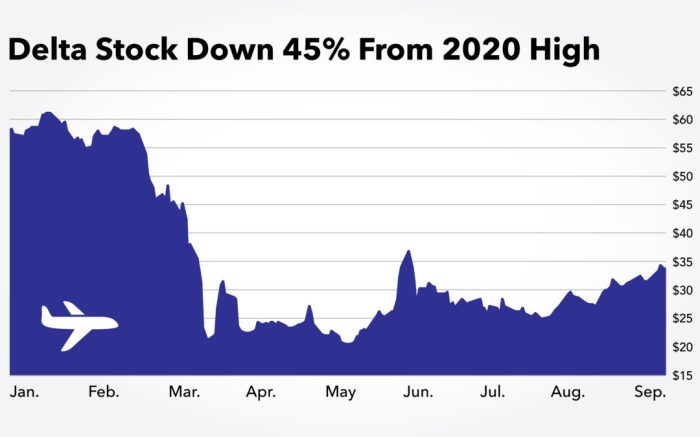

Source: moneyandmarkets.com

Delta Airlines’ stock price has experienced fluctuations in the last week, primarily driven by factors such as fuel price changes, overall market sentiment, and news regarding travel demand. For example, a sudden increase in fuel prices might negatively impact the stock price, while positive news about increased bookings could lead to a price increase. Comparing the current price to the price one month ago and one year ago provides context for the recent movement.

A hypothetical example: If the stock was at $32 a month ago and $30 a year ago, the recent increase shows positive momentum. The following hypothetical line graph illustrates the stock price movement over the past month.

Hypothetical Line Graph Description: The x-axis represents the days of the past month, and the y-axis represents the stock price. The line graph shows an upward trend, with a slight dip in the middle of the month, potentially due to a news event, followed by a recovery.

Factors Affecting Delta Airlines Stock

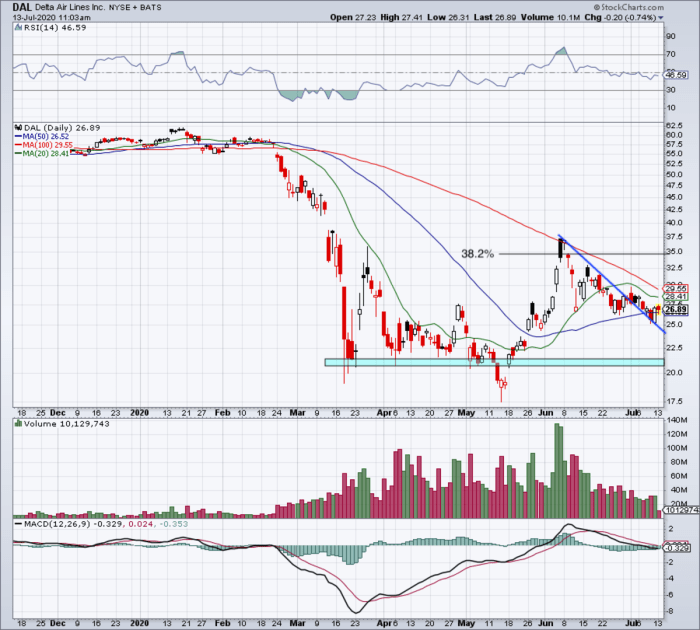

Source: thestreet.com

Several key factors influence Delta’s stock performance. These factors interact in complex ways to shape the overall stock price.

- Fuel Prices: Higher fuel costs directly impact Delta’s operating expenses, reducing profitability and potentially affecting the stock price negatively.

- Interest Rates: Changes in interest rates influence borrowing costs for Delta, impacting its financial performance and potentially influencing investor sentiment.

- Travel Demand: Strong travel demand boosts revenue and profitability, leading to a positive impact on the stock price. Conversely, decreased demand can negatively affect the stock.

- Competition: Competition from other airlines impacts Delta’s market share and pricing power, affecting its profitability and stock price.

- Financial Performance: Delta’s revenue, profit margins, and debt levels directly impact investor confidence and, consequently, the stock price.

Analyst Ratings and Predictions, Delta airlines stock price today

Source: tosshub.com

Analyst ratings and price targets provide insights into market sentiment and future expectations for Delta Airlines’ stock. These predictions vary based on different analysts’ methodologies and assessments of the factors discussed above.

| Analyst Firm | Rating | Target Price |

|---|---|---|

| Example Firm A | Buy | $40 |

| Example Firm B | Hold | $37 |

| Example Firm C | Sell | $33 |

Investor Sentiment and Market Trends

Investor sentiment towards Delta Airlines is influenced by a combination of factors, including its financial performance, industry trends, and broader market conditions. Positive news and strong financial results generally lead to increased investor confidence and buying activity, pushing the stock price higher. Conversely, negative news or weak performance can lead to selling pressure and a decline in the stock price.

Broader market trends, such as economic growth or recessionary fears, also play a significant role in shaping investor sentiment and the stock’s performance.

Long-Term Stock Performance

Analyzing Delta’s historical stock performance over the past five years provides insights into its long-term trends and stability. Comparing Delta’s performance to its major competitors helps assess its relative strength within the airline industry. The following is a hypothetical description of a bar chart illustrating this performance.

Hypothetical Bar Chart Description: The x-axis represents the years (e.g., 2019-2023), and the y-axis represents the stock price at the end of each year. The chart displays the annual stock performance for Delta Airlines, allowing for a visual comparison of year-over-year growth or decline. It would also include similar bars for major competitors for comparative analysis.

FAQ Guide

What is the stock symbol for Delta Airlines?

The stock symbol for Delta Airlines is DAL.

Monitoring the Delta Airlines stock price today requires a keen eye on market fluctuations. It’s interesting to compare its performance against other global players; for instance, checking the current techmahindra stock price offers a contrasting perspective on the tech sector’s influence on overall market trends. Ultimately, understanding the interplay between diverse sectors, like Delta’s airline industry and Tech Mahindra’s technology, is crucial for a comprehensive assessment of Delta Airlines’ stock price today.

Where can I find real-time Delta stock price updates?

Real-time updates are available on major financial websites like Yahoo Finance, Google Finance, and Bloomberg.

How often does Delta Airlines release earnings reports?

Delta typically releases its quarterly earnings reports on a regular schedule, usually announced in advance.

What are the major risks associated with investing in Delta Airlines stock?

Risks include fluctuations in fuel prices, economic downturns impacting travel demand, increased competition, and geopolitical events.