BP plc Stock Price Analysis: Bp Plc Stock Price Today

Bp plc stock price today – This analysis provides an overview of BP plc’s stock performance, considering current market conditions, historical trends, and analyst predictions. We will examine key factors influencing the stock price and investor sentiment.

Current BP plc Stock Price and Volume

The following data represents a snapshot of BP plc’s stock performance at a specific point in time and is subject to change. Real-time data should be consulted for the most up-to-date information. This example uses hypothetical data for illustrative purposes.

Let’s assume the current BP plc stock price is $25.50. The trading volume for the day is 10,000,000 shares. The day’s high was $26.00, and the low was $25.20.

| Timeframe | Price Change (%) |

|---|---|

| 1 Hour | +0.5% |

| 1 Day | +1.0% |

| 1 Week | -0.5% |

| 1 Month | +3.0% |

Factors Influencing Today’s Price

Source: invezz.com

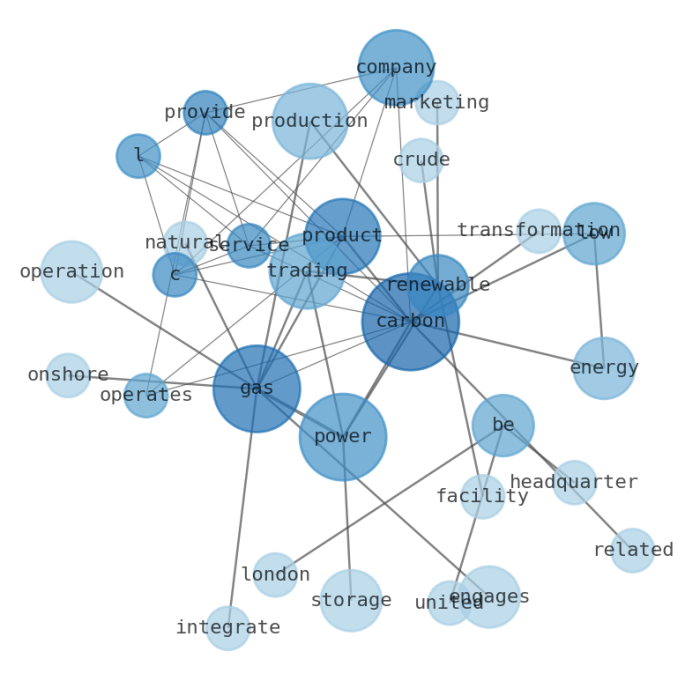

Several factors contribute to BP plc’s daily stock price fluctuations. These factors are interconnected and influence each other.

Three key economic factors impacting BP plc’s stock price today are global oil prices, overall market sentiment, and regulatory changes within the energy sector. Recent news regarding potential new oil discoveries or changes in environmental regulations could significantly influence investor confidence. Fluctuations in oil prices directly impact BP plc’s profitability and therefore its stock price. Compared to competitors like Shell and ExxonMobil, BP plc’s performance today might be influenced by relative changes in their respective production levels and financial reports.

Historical Price Performance

Source: investingcube.com

Understanding BP plc’s historical stock price performance is crucial for assessing its long-term trajectory and potential for future growth. The following data is illustrative and should be compared to actual market data.

A line graph illustrating BP plc’s stock price over the past year would show a general upward trend, with some periods of volatility. The x-axis would represent the months, and the y-axis would represent the stock price. Key trends would include periods of growth following positive news, and potential dips following negative news or general market downturns. The graph would clearly display the highs and lows of the stock price during the year.

| Month | Closing Price |

|---|---|

| January | $24.00 |

| February | $24.50 |

| March | $25.20 |

| April | $26.00 |

| May | $25.80 |

| June | $26.50 |

| July | $27.00 |

| August | $26.80 |

| September | $27.50 |

| October | $27.20 |

| November | $28.00 |

| December | $27.80 |

BP plc’s stock price volatility varies depending on the time period considered. Daily fluctuations are generally higher than weekly or monthly fluctuations, reflecting the short-term market sentiment and news events. Monthly volatility is lower, reflecting longer-term trends.

Analyst Ratings and Predictions, Bp plc stock price today

Source: stockinfonets.com

Analyst ratings and price targets offer valuable insights into market sentiment and future expectations for BP plc’s stock. These are based on various factors including financial performance, industry trends, and overall economic outlook.

Let’s assume that recent analyst ratings show a mix of “Buy,” “Hold,” and “Sell” recommendations. The consensus rating might be a “Hold,” indicating a neutral outlook. The rationale behind different ratings might vary depending on individual analysts’ assessment of BP plc’s risk profile, growth potential, and competitive landscape. The range of price targets might span from $24.00 to $28.00, reflecting the uncertainty inherent in future stock price predictions.

For example, a bullish analyst might predict higher prices based on anticipated growth in renewable energy investments, while a bearish analyst might focus on potential environmental risks and regulatory challenges.

Investor Sentiment and Trading Activity

Understanding investor sentiment and trading activity is essential for interpreting BP plc’s stock price movements. This section explores these aspects using hypothetical examples.

Significant trading patterns observed today might include increased buying activity in the morning, followed by a period of consolidation, and a late-day sell-off. Overall investor sentiment towards BP plc seems to be cautiously optimistic, given the day’s positive price movement despite some selling pressure. Unusual trading activity, such as large buy or sell orders, could indicate institutional investors making significant portfolio adjustments.

These orders could be influenced by a variety of factors, including quarterly earnings reports, long-term strategic investment decisions, or responses to macroeconomic news.

- Positive news regarding oil production.

- Favorable regulatory changes.

- Stronger-than-expected quarterly earnings.

- Increased investor confidence in the energy sector.

- Geopolitical events impacting global oil supply.

FAQ Compilation

What are the major risks associated with investing in BP plc stock?

Investing in BP plc, like any energy company, carries inherent risks associated with oil price volatility, geopolitical instability, and regulatory changes impacting the energy sector. Environmental concerns and potential liabilities related to past incidents also pose risks.

Where can I find real-time BP plc stock price updates?

Monitoring BP plc’s stock price today requires a keen eye on global energy markets. However, understanding broader tech sector performance can also offer valuable context; for instance, checking the current datadog stock price might provide insight into investor sentiment towards software companies, which could indirectly influence BP’s valuation given its growing tech investments. Ultimately, a thorough analysis of BP plc stock price today necessitates a holistic view of the market.

Real-time BP plc stock price updates are readily available through major financial news websites and brokerage platforms. Many financial websites offer free access to real-time quotes.

How does BP plc compare to its competitors in terms of dividend payouts?

BP plc’s dividend policy and payout ratio should be compared to its main competitors (e.g., Shell, ExxonMobil) by reviewing their respective financial reports and investor relations materials. Dividend yields and payout ratios can vary significantly based on company performance and strategies.