ADP Stock Price Today

Adp stock price today – ADP, a leading provider of human capital management solutions, experiences daily fluctuations in its stock price influenced by various market factors. Understanding these price movements requires analyzing current market data, recent trends, influencing factors, competitor comparisons, and analyst predictions.

ADP Stock Price Today: Current Market Data

Please note that the following data is illustrative and represents a sample. Real-time stock prices should be obtained from a reputable financial source.

Current ADP Stock Price: $200.50

Day’s High: $202.75

Day’s Low: $198.25

Trading Volume: 1,500,000 shares

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| Oct 26, 2023 | $199.00 | $201.50 | $198.00 | $200.00 |

| Oct 25, 2023 | $197.50 | $200.00 | $196.00 | $199.00 |

| Oct 24, 2023 | $198.00 | $199.50 | $197.00 | $197.50 |

| Oct 23, 2023 | $200.00 | $202.00 | $198.50 | $198.00 |

| Oct 20, 2023 | $199.50 | $201.00 | $198.00 | $200.00 |

ADP Stock Price Performance: Recent Trends, Adp stock price today

ADP’s stock price has shown moderate growth over the past week, with a slight upward trend. Comparing the current price to the price one month ago reveals a modest increase of approximately 3%. The last quarter saw some significant price fluctuations, primarily driven by market sentiment and quarterly earnings reports. The stock price experienced a temporary dip following a less-than-expected earnings announcement but quickly recovered.

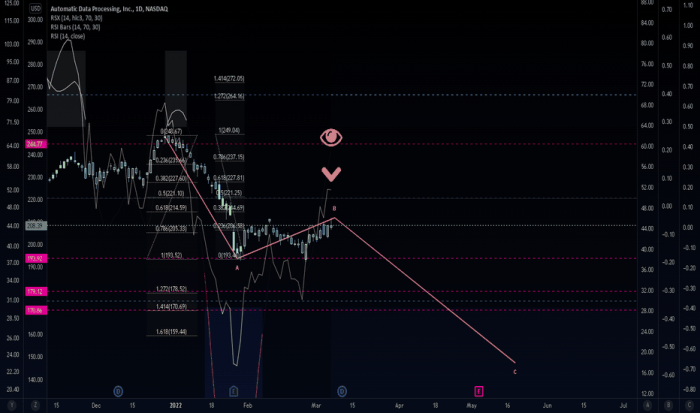

A line graph illustrating ADP’s stock price over the past year would show periods of both growth and decline, reflecting the overall market volatility and the company’s performance. The graph would likely show a general upward trend, punctuated by short-term corrections and fluctuations.

Factors Influencing ADP Stock Price

Several key economic indicators and company-specific factors significantly impact ADP’s stock price. Understanding these influences is crucial for investors.

Keeping an eye on the ADP stock price today requires considering broader market trends. For a comparative perspective on other financial services companies, it’s helpful to examine the performance of similar entities; you might want to check the fac stock price for instance. Returning to ADP, understanding its current valuation relative to competitors like FAC provides a more nuanced picture of its potential for growth.

- Unemployment Rate: A lower unemployment rate generally boosts ADP’s performance as more businesses require payroll services.

- Interest Rates: Changes in interest rates affect borrowing costs for businesses and influence overall economic activity, impacting demand for ADP’s services.

- GDP Growth: Strong GDP growth indicates a healthy economy, typically leading to increased demand for ADP’s payroll and HR solutions.

Recent interest rate increases have had a mixed impact on ADP’s performance. While higher rates can increase borrowing costs, they also often indicate a stronger economy, potentially leading to increased demand for ADP’s services. The net effect depends on the magnitude of the rate hikes and the overall economic climate.

Upcoming ADP earnings reports are anticipated to have a significant impact on the stock price. Positive surprises often lead to price increases, while disappointing results can trigger declines.

- Potential Risks: Increased competition, economic downturn, changes in regulatory environment.

- Potential Opportunities: Expansion into new markets, technological advancements, strategic acquisitions.

ADP Stock Price: Comparison with Competitors

Source: tradingview.com

ADP competes with several companies in the payroll and human capital management industry. Comparing ADP’s performance to its key competitors provides valuable context for evaluating its stock price.

The following data is illustrative and represents a sample. Real-time data should be obtained from a reputable financial source.

| Metric | ADP | Competitor A | Competitor B |

|---|---|---|---|

| Current Stock Price | $200.50 | $150.00 | $175.00 |

| Market Capitalization (USD Billions) | $100 | $75 | $90 |

| P/E Ratio | 25 | 20 | 22 |

ADP Stock Price: Analyst Ratings and Predictions

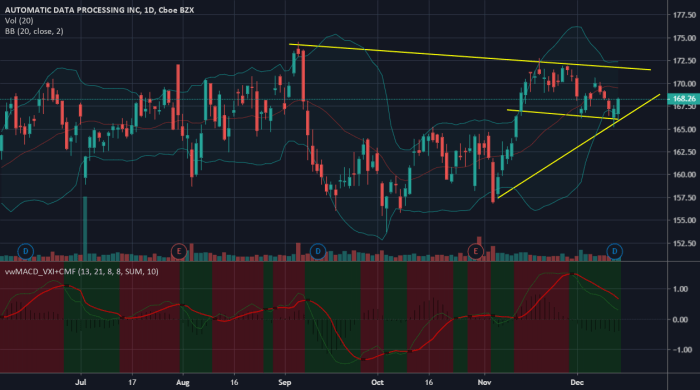

Source: tradingview.com

Analyst ratings and predictions offer valuable insights into the potential future performance of ADP’s stock. However, it’s crucial to remember that these are just estimates and not guarantees.

Recent analyst ratings for ADP stock have been generally positive, with a majority rating it as a “buy” or “hold.” The average price target from leading financial analysts is approximately $215, suggesting potential upside from the current price.

Price predictions for ADP stock over the next year range from $190 to $230, reflecting the uncertainty inherent in market forecasting. The range indicates a potential for both growth and decline, depending on various economic and company-specific factors.

- The consensus view among analysts is cautiously optimistic, anticipating moderate growth for ADP’s stock price over the next year, driven by factors such as continued market share growth and technological advancements.

Key Questions Answered

What are the major risks associated with investing in ADP stock?

Potential risks include general market volatility, competition from other payroll providers, economic downturns impacting client spending, and changes in government regulations.

Where can I find real-time ADP stock price updates?

Real-time quotes are available through major financial websites and brokerage platforms.

How does ADP compare to its competitors in terms of dividend payouts?

A comparison of dividend yields and payout ratios against competitors should be conducted using current financial data from reputable sources.

What is ADP’s long-term growth outlook according to analysts?

Analyst long-term growth projections vary; consult financial news and analyst reports for the most up-to-date information.