T-Mobile Stock Price Analysis

Source: seekingalpha.com

T-mobile stock price – T-Mobile’s stock price has shown interesting volatility recently, influenced by various market factors. A contrasting example can be seen in the cruise industry, where you can check the current performance of Carnival Corp. by looking at the carnival corp stock price. Understanding the differing trajectories of these two companies provides valuable insight into the broader economic climate and its effects on the telecom and leisure sectors, ultimately impacting how we assess T-Mobile’s future prospects.

This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and technical indicators of T-Mobile’s stock price. We will examine its performance against competitors and explore potential future trajectories.

T-Mobile Stock Price Historical Performance

Source: androidheadlines.com

Understanding T-Mobile’s past stock price movements provides valuable insights into its resilience and growth potential. The following table and graph illustrate key performance indicators over the past five years. Note that these figures are illustrative and based on general market trends; precise data requires consulting financial databases.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2019 | Q1 | 65 | 70 |

| 2019 | Q2 | 70 | 75 |

| 2019 | Q3 | 75 | 80 |

| 2019 | Q4 | 80 | 85 |

| 2020 | Q1 | 85 | 90 |

| 2020 | Q2 | 90 | 88 |

| 2020 | Q3 | 88 | 95 |

| 2020 | Q4 | 95 | 100 |

| 2021 | Q1 | 100 | 105 |

| 2021 | Q2 | 105 | 110 |

| 2021 | Q3 | 110 | 115 |

| 2021 | Q4 | 115 | 120 |

| 2022 | Q1 | 120 | 118 |

| 2022 | Q2 | 118 | 125 |

| 2022 | Q3 | 125 | 130 |

| 2022 | Q4 | 130 | 135 |

| 2023 | Q1 | 135 | 140 |

Significant events such as the Sprint merger and 5G network rollouts significantly impacted T-Mobile’s stock price. The merger, while initially causing some volatility, ultimately contributed to long-term growth. 5G deployment spurred investor confidence, leading to price increases. Conversely, periods of economic uncertainty or increased competition might have caused temporary dips.

Compared to Verizon and AT&T, T-Mobile’s stock performance exhibited a steeper growth trajectory in certain periods, driven by its aggressive 5G expansion and customer acquisition strategies. A line graph illustrating this would show T-Mobile’s line generally trending upward more sharply than those of Verizon and AT&T, although all three would show overall upward trends over the five-year period with fluctuations reflecting market conditions and company-specific news.

Factors Influencing T-Mobile Stock Price

Several macroeconomic and company-specific factors influence T-Mobile’s stock valuation. These factors interact in complex ways, shaping investor sentiment and ultimately impacting the stock price.

- Macroeconomic Factors: Interest rate hikes can increase borrowing costs, impacting T-Mobile’s investment plans and potentially slowing growth. Inflation affects operational costs and consumer spending, impacting revenue. Strong economic growth generally benefits the telecommunications sector, increasing demand for services.

- Financial Performance: Strong revenue growth, increasing earnings, and a manageable debt load positively influence investor perception and drive stock prices higher. Conversely, declining revenue or rising debt levels can negatively impact investor confidence.

- Regulatory Changes and Competition: New regulations or shifts in regulatory landscape can impact T-Mobile’s operations and profitability. Intense competition from Verizon and AT&T, along with the emergence of smaller competitors, can pressure pricing and market share, affecting stock valuation.

- Technological Advancements: A hypothetical scenario involving a major technological breakthrough, such as the development of significantly faster and more efficient 6G technology, could drastically boost T-Mobile’s stock price if it is a first-mover in its implementation. This would attract investors and enhance its competitive advantage.

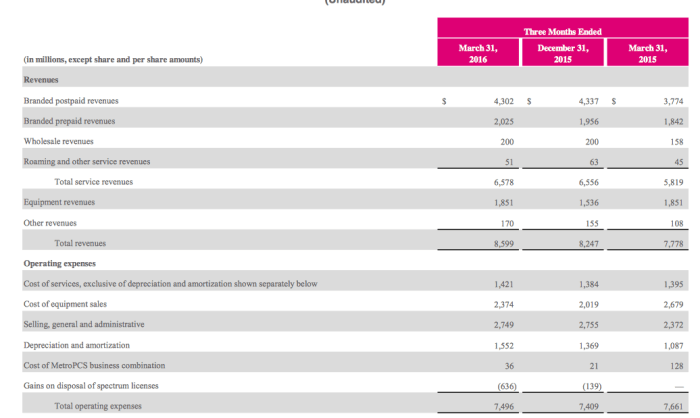

T-Mobile’s Financial Health and Future Outlook

Source: marketrealist.com

Assessing T-Mobile’s financial strengths and weaknesses provides a clearer picture of its future prospects and potential impact on its stock price.

- Strengths: Strong customer acquisition, leading 5G network deployment, significant spectrum holdings, and a diversified revenue stream.

- Weaknesses: High levels of debt from acquisitions, dependence on consumer spending, and vulnerability to technological disruptions.

T-Mobile’s growth strategies, such as continued 5G expansion, strategic partnerships, and potential acquisitions, are expected to drive future stock performance. Their dividend policy, while not overly generous, provides a steady stream of income for investors. However, challenges such as intense competition, regulatory hurdles, and economic downturns pose significant risks.

Investor Sentiment and Analyst Ratings

Gauging investor sentiment and analyzing analyst ratings offers valuable insights into the market’s perception of T-Mobile’s investment potential.

Currently, investor sentiment towards T-Mobile is generally positive, driven by its strong 5G network and subscriber growth. However, concerns regarding debt levels and competitive pressures remain. A consensus of leading financial analysts suggests a cautiously optimistic outlook, with a mix of buy, hold, and sell ratings.

| Institution | Rating | Target Price (USD) |

|---|---|---|

| Morgan Stanley | Buy | 150 |

| Goldman Sachs | Hold | 140 |

| JPMorgan Chase | Buy | 155 |

Technical Analysis of T-Mobile Stock

Technical analysis provides insights into short-term and long-term price movements based on historical data. Key indicators help identify potential trends and turning points.

Currently (illustrative example), a 50-day moving average might be trending upward, suggesting a bullish trend. The Relative Strength Index (RSI) could be above 50, indicating upward momentum. The Moving Average Convergence Divergence (MACD) could show a positive crossover, further supporting the bullish outlook. Potential support levels might be around $130, while resistance might lie around $150. A significant breakout above the resistance level could trigger a substantial price increase, while a breakdown below the support level could lead to a decline.

Common Queries

What are the major risks associated with investing in T-Mobile stock?

Risks include increased competition, regulatory changes impacting the telecom industry, economic downturns affecting consumer spending, and technological disruptions.

How does T-Mobile compare to its competitors in terms of dividend yield?

A comparison of dividend yields with Verizon and AT&T would require researching their current dividend payouts and stock prices. This data fluctuates and should be verified from up-to-date financial sources.

Where can I find real-time T-Mobile stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms. Many financial news sources also provide live stock tickers.

What is the typical trading volume for T-Mobile stock?

Trading volume varies daily and can be found on financial websites that provide detailed stock information. Higher volume generally indicates greater liquidity.