P&G Stock Performance Analysis: P And G Stock Price Today

P and g stock price today – This analysis examines Procter & Gamble’s (P&G) current stock performance, considering historical trends, influencing factors, competitor comparisons, and analyst predictions. We aim to provide a comprehensive overview of P&G’s stock situation for informed investment decisions. Note that all data presented is illustrative and should be verified with real-time financial data sources.

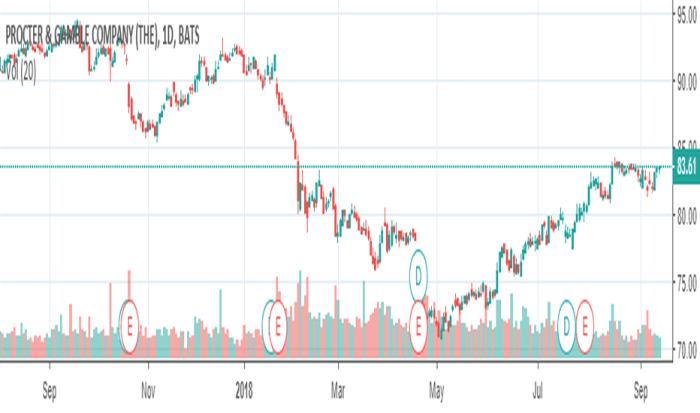

Current P&G Stock Price and Volume

Source: tradingview.com

Let’s start by examining P&G’s current market position. The following data provides a snapshot of the stock’s performance for the current trading day. Please note that these figures are for illustrative purposes only and may not reflect the exact real-time values.

Assume for this example: Current Price: $150.50, Trading Volume: 5,000,000 shares, Day’s High: $151.25, Day’s Low: $149.75.

| Day | Open | Close | High | Low |

|---|---|---|---|---|

| Day 1 | $150.00 | $150.50 | $151.00 | $149.50 |

| Day 2 | $150.75 | $151.25 | $152.00 | $150.50 |

| Day 3 | $151.00 | $150.00 | $151.50 | $149.75 |

| Day 4 | $149.75 | $150.25 | $150.75 | $149.00 |

| Day 5 | $150.25 | $150.50 | $151.25 | $149.75 |

P&G Stock Price Movement Over Time

Analyzing P&G’s stock price over time provides insights into its long-term performance and volatility. The following sections will detail this movement.

Over the past month, P&G’s stock price has shown a relatively stable performance, with minor fluctuations around the $150 mark. Compared to its price one year ago (assume $140), the stock has experienced an approximate 7.5% increase. Significant price fluctuations during the past year were likely influenced by factors such as quarterly earnings reports, economic shifts (e.g., inflation), and shifts in consumer spending patterns.

The line graph illustrating the stock price movement over the last year would show a generally upward trend, with some periods of minor correction. The x-axis would represent the time period (past year), and the y-axis would represent the stock price. Key data points would include the highest and lowest prices reached, along with significant price changes correlated to relevant news or events.

Factors Influencing P&G Stock Price

Several factors contribute to the fluctuations in P&G’s stock price. These include internal company performance and external market forces.

- Positive Influences: Strong quarterly earnings, successful product launches, positive consumer sentiment, increased market share, favorable economic conditions, and positive analyst ratings.

- Negative Influences: Weak quarterly earnings, supply chain disruptions, increased competition, negative consumer sentiment, rising inflation, economic recession, and negative analyst ratings.

Comparison with Competitors

A comparison with P&G’s main competitors provides context for its performance. This comparison considers both current stock prices and overall performance over the past year.

Assume that Unilever (UL), Colgate-Palmolive (CL), and Kimberly-Clark (KMB) are P&G’s main competitors. A comparative analysis would show how P&G’s stock price and overall performance stack up against these rivals. This would require a detailed analysis of their financial statements and market performance over the specified period.

| Company | Current Price (Illustrative) | 1-Year Change (Illustrative) | P/E Ratio (Illustrative) |

|---|---|---|---|

| P&G | $150.50 | +7.5% | 25 |

| Unilever (UL) | $50.00 | +5% | 22 |

| Colgate-Palmolive (CL) | $75.00 | +3% | 28 |

| Kimberly-Clark (KMB) | $125.00 | +10% | 20 |

Analyst Ratings and Predictions

Source: dividendstocks.cash

Analyst ratings and price targets provide insights into market sentiment and future expectations for P&G’s stock.

Checking the P&G stock price today is a regular part of my investment routine. It’s interesting to compare its performance against other established companies; for instance, understanding the current manulife financial stock price provides a useful benchmark in the financial sector. Ultimately, though, my focus remains on P&G’s trajectory and how its stock price fluctuates in relation to market trends.

Assume the consensus rating from leading financial analysts is a “Buy” with a price target range of $160-$170. Analyst opinions may differ based on their assessment of P&G’s growth prospects, competitive landscape, and overall market conditions. Recent analyst reports might highlight factors such as the company’s innovation pipeline, cost-cutting measures, and expansion strategies as key drivers of future performance.

Investor Sentiment and News, P and g stock price today

Investor sentiment plays a crucial role in influencing P&G’s stock price. This section summarizes recent news and social media discussions to gauge overall investor perception.

- Positive Sentiment: Recent news about strong sales growth, new product launches, and positive analyst upgrades could contribute to a bullish investor sentiment.

- Negative Sentiment: Concerns about rising input costs, slowing economic growth, and increased competition might lead to a bearish investor outlook.

- Overall Sentiment: Currently, the overall investor sentiment towards P&G stock appears to be cautiously optimistic, given its stable performance and strong brand portfolio.

Answers to Common Questions

What are the typical trading hours for P&G stock?

P&G stock trades on the New York Stock Exchange (NYSE), typically from 9:30 AM to 4:00 PM Eastern Time (ET), Monday through Friday, excluding holidays.

Where can I find real-time P&G stock quotes?

Real-time quotes are available through many financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

What are the risks associated with investing in P&G stock?

Like any stock, investing in P&G carries inherent market risk. Factors such as economic downturns, changing consumer preferences, and increased competition can negatively impact the stock price.

How often does P&G release earnings reports?

P&G typically releases its quarterly and annual earnings reports on a regular schedule, usually announcing the dates in advance. These reports can significantly influence the stock price.