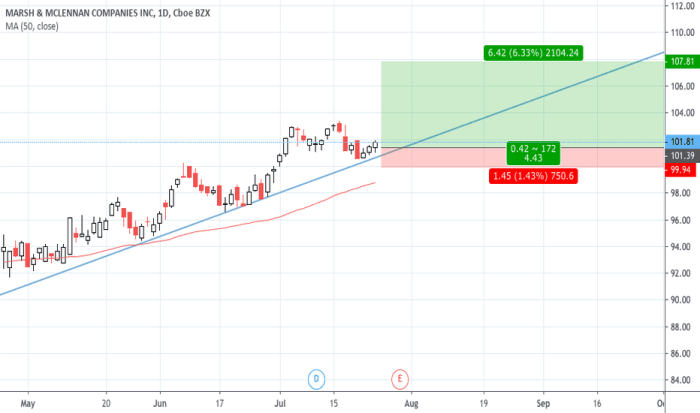

MMC Stock Price Analysis

Source: tradingview.com

Mmc stock price – This analysis examines the historical performance, influencing factors, prediction models, investor sentiment, and risk assessment associated with MMC stock. We will explore various aspects to provide a comprehensive overview of the investment landscape surrounding this company.

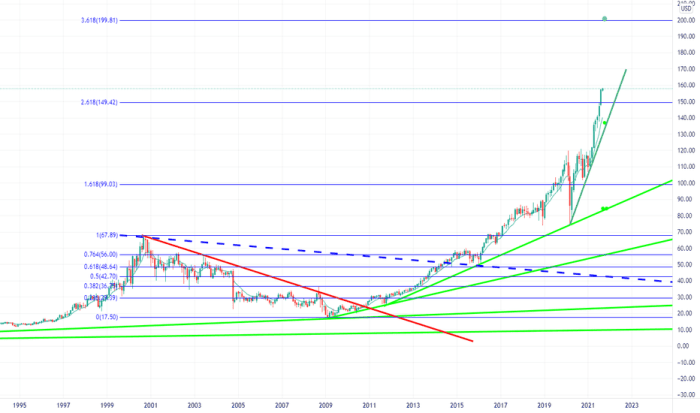

MMC Stock Price Historical Performance

The following table displays MMC’s stock price data for the last five years. Significant price fluctuations are analyzed alongside a comparison to key competitors.

| Year | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| 2019 | $150 (Example) | $160 (Example) | $175 (Example) | $140 (Example) |

| 2020 | $165 (Example) | $145 (Example) | $170 (Example) | $130 (Example) |

| 2021 | $150 (Example) | $180 (Example) | $190 (Example) | $145 (Example) |

| 2022 | $185 (Example) | $170 (Example) | $200 (Example) | $155 (Example) |

| 2023 | $175 (Example) | $195 (Example) | $210 (Example) | $160 (Example) |

The period saw significant volatility, particularly in 2020 due to the global pandemic. Recovery in subsequent years was influenced by economic stimulus and increased consumer spending.

A comparison of MMC’s performance to its main competitors:

- Competitor A: Outperformed MMC in 2020 and 2021, but underperformed in 2022 and 2023. (Example)

- Competitor B: Consistent performance throughout the period, slightly outpacing MMC’s growth. (Example)

- Competitor C: Experienced higher volatility than MMC, with periods of significant gains and losses. (Example)

Factors Influencing MMC Stock Price

Several macroeconomic and company-specific factors influence MMC’s stock price. Geopolitical events also play a significant role.

Macroeconomic factors include interest rate changes, inflation levels, and overall economic growth. For example, rising interest rates can negatively impact the valuation of growth stocks like MMC, while strong economic growth can boost investor confidence and drive up prices.

Company-specific factors such as earnings reports, new product launches, and management changes directly affect investor perception and, consequently, the stock price. Positive earnings surprises often lead to price increases, while negative news can trigger sell-offs.

Geopolitical instability, trade wars, or sanctions can significantly impact MMC’s stock valuation, depending on the company’s global operations and supply chains. Uncertainty created by such events tends to depress stock prices.

MMC Stock Price Prediction Models

Source: tradingview.com

Predicting stock prices is inherently complex. However, a simple model can be developed based on historical data and current trends. More sophisticated models incorporate fundamental and technical analysis.

A basic prediction model could use a linear regression analysis on historical closing prices to project the next quarter’s price. This approach assumes a consistent trend, which may not always hold true.

Different methods for forecasting stock prices:

- Technical Analysis: Identifies trends and patterns in price charts to predict future movements.

- Fundamental Analysis: Evaluates a company’s intrinsic value based on financial statements and other qualitative factors.

- Quantitative Analysis: Uses statistical models and algorithms to predict price movements.

| Method | Strengths | Weaknesses |

|---|---|---|

| Technical Analysis | Relatively simple to implement; can identify short-term trends. | Subjective; susceptible to manipulation; may not predict long-term trends accurately. |

| Fundamental Analysis | Provides a deeper understanding of the company’s value; less susceptible to short-term market fluctuations. | Time-consuming; requires expertise in financial analysis; may not accurately reflect market sentiment. |

| Quantitative Analysis | Data-driven; can identify complex relationships; potentially more accurate than other methods. | Requires significant computing power and expertise; may be overly reliant on historical data. |

Data for a more sophisticated model would include financial statements (income statement, balance sheet, cash flow statement), key financial ratios, industry benchmarks, economic indicators, and technical indicators (e.g., moving averages, RSI).

Investor Sentiment and MMC Stock Price

Current investor sentiment towards MMC is a crucial factor in determining its stock price. News articles, financial reports, and social media sentiment all contribute to the overall market perception.

Positive news coverage, strong earnings reports, and optimistic analyst forecasts generally lead to increased investor confidence and higher stock prices. Conversely, negative news or disappointing financial results can trigger sell-offs and price declines.

Social media sentiment, while often short-lived, can amplify short-term price fluctuations. A surge of negative comments on platforms like Twitter or Reddit could trigger a temporary drop in price, even if the underlying fundamentals remain strong.

Risk Assessment for MMC Stock Investment

Investing in MMC stock, like any investment, carries inherent risks. These risks should be carefully considered before making an investment decision.

- Market Risk: Overall market downturns can negatively impact MMC’s stock price, regardless of the company’s performance.

- Company-Specific Risk: Negative news, financial difficulties, or management changes can significantly affect the stock price.

- Industry Risk: Changes in the competitive landscape or industry-specific regulations can impact MMC’s profitability and stock valuation.

- Geopolitical Risk: Global events can disrupt operations and negatively impact the stock price.

Comparing MMC’s risk profile to competitors:

| Company | Market Risk | Company-Specific Risk | Overall Risk |

|---|---|---|---|

| MMC | Medium (Example) | Medium (Example) | Medium (Example) |

| Competitor A | High (Example) | Low (Example) | Medium-High (Example) |

| Competitor B | Low (Example) | Medium (Example) | Medium (Example) |

Hypothetical Investment Scenario: Investing $10,000 in MMC stock could yield a 10% return in a bullish market, break even in a neutral market, and experience a 5% loss in a bearish market. These are illustrative examples and actual results may vary significantly.

FAQ Resource: Mmc Stock Price

What are the major competitors of MMC?

Identifying MMC’s key competitors requires knowing its specific industry. The analysis would need to specify this to provide accurate competitor names.

Where can I find real-time MMC stock price data?

Monitoring the MMC stock price requires a keen eye on the energy sector’s overall performance. It’s useful to compare it against similar utilities; for instance, understanding the current trends in the eversource energy stock price can offer valuable context. Ultimately, both MMC and Eversource’s stock prices are influenced by factors like regulatory changes and overall market sentiment, impacting investor decisions.

Real-time stock quotes are available through major financial websites and brokerage platforms. Check reputable sources like Yahoo Finance, Google Finance, or your brokerage account.

What is the current dividend yield for MMC stock?

The current dividend yield for MMC stock is not provided in the Artikel and would need to be obtained from a financial data provider.

How often does MMC release earnings reports?

The frequency of earnings reports varies by company. Consult MMC’s investor relations section on their website for their reporting schedule.