NVDA Stock Price Analysis

Current selling price of nvda stock per share today – This analysis explores the current and historical price of NVIDIA (NVDA) stock, examining factors influencing its value, comparing it to competitors, and reviewing analyst sentiment. We will leverage various data sources to provide a comprehensive overview.

Real-time Stock Price Data Acquisition

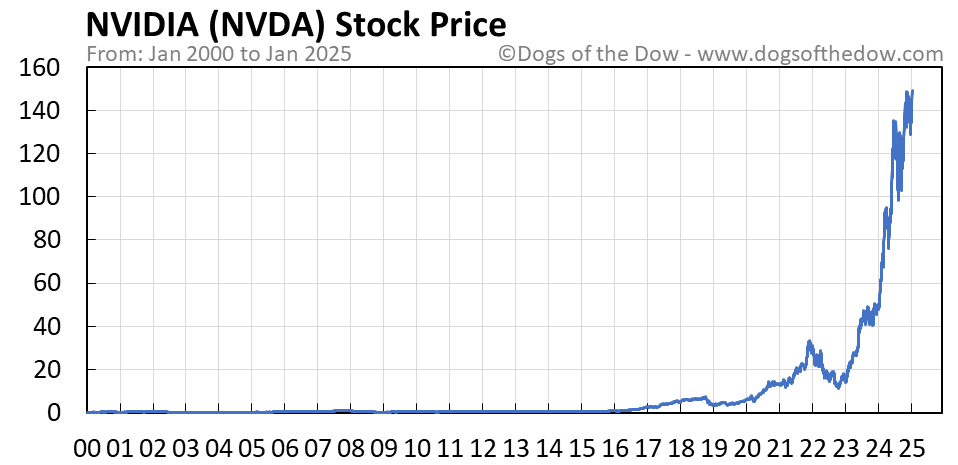

Source: dogsofthedow.com

Obtaining the real-time NVDA stock price requires accessing reliable financial data sources. Several methods exist, primarily using APIs or web scraping techniques. APIs, offered by providers like Alpha Vantage, IEX Cloud, or Tiingo, provide structured data through programmatic interfaces. Web scraping involves extracting data directly from websites like Yahoo Finance or Google Finance, though this approach is more prone to errors due to website structure changes.

A Python script using an API would efficiently update the price every few minutes. Accuracy and reliability vary across data sources; Alpha Vantage, for instance, offers a free tier with limited calls, while IEX Cloud and Tiingo provide more robust, paid options with higher data frequency and reliability. Yahoo Finance, while free, can be less reliable due to its reliance on HTML parsing, making it susceptible to website updates.

Historical Price Data and Trends, Current selling price of nvda stock per share today

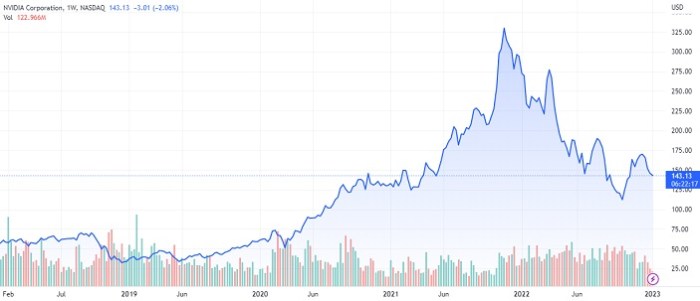

Source: trading-education.com

Analyzing NVDA’s historical performance over the past year reveals significant price fluctuations. A line chart would illustrate this, showing a general upward trend with periods of both sharp increases and corrections. For example, the stock price might have experienced a significant surge following a positive earnings report or a new product launch, followed by a period of consolidation or even a decline due to market-wide corrections or negative news impacting the broader technology sector.

Comparing the current price to the average price over the past month, quarter, and year would highlight the recent performance relative to longer-term trends. The comparison would reveal whether the current price is above or below these averages, indicating potential overvaluation or undervaluation based on historical performance.

Factors Influencing NVDA Stock Price

Numerous factors influence NVDA’s stock price. Company news and announcements, such as earnings reports, new product launches, or strategic partnerships, have a significant impact. Key factors include the overall performance of the semiconductor industry, competition from other chip manufacturers, the demand for high-performance computing (HPC) and artificial intelligence (AI) technologies, and macroeconomic conditions such as interest rates and inflation.

For example, positive news about AI advancements and strong demand for NVDA’s GPUs could trigger a price increase, while concerns about economic slowdown or increased competition could lead to a price decline.

Comparing NVDA to Competitors

Evaluating NVDA’s performance relative to its competitors provides valuable context. Key competitors include AMD (Advanced Micro Devices), Intel, and Qualcomm. Comparing their current prices, market capitalization, and recent performance helps assess NVDA’s relative valuation and competitive positioning.

| Company | Current Price | Market Cap (USD Billions) | 1-Year Change (%) |

|---|---|---|---|

| NVDA | (Data from reliable source) | (Data from reliable source) | (Data from reliable source) |

| AMD | (Data from reliable source) | (Data from reliable source) | (Data from reliable source) |

| Intel | (Data from reliable source) | (Data from reliable source) | (Data from reliable source) |

| Qualcomm | (Data from reliable source) | (Data from reliable source) | (Data from reliable source) |

This comparison highlights NVDA’s strengths and weaknesses concerning market share, technological innovation, and financial performance. It also provides insight into how these factors affect NVDA’s overall valuation.

Analyst Ratings and Price Targets

Analyst ratings and price targets offer valuable insights into market sentiment and future price expectations. These projections vary depending on the analyst firm and their assessment of NVDA’s prospects.

- Analyst Firm: (Example: Goldman Sachs) Rating: (Example: Buy) Price Target: (Example: $500)

- Analyst Firm: (Example: Morgan Stanley) Rating: (Example: Hold) Price Target: (Example: $450)

- Analyst Firm: (Example: JP Morgan) Rating: (Example: Outperform) Price Target: (Example: $550)

The range of price targets reflects the uncertainty surrounding NVDA’s future performance. A wide range suggests significant disagreement among analysts regarding the stock’s potential.

Determining the current selling price of NVDA stock per share today requires checking a live financial data source. However, understanding the fluctuations in other tech stocks can provide context. For instance, you might want to compare it to the performance of ctva stock price , which can offer insights into broader market trends. Ultimately, though, the current selling price of NVDA stock remains the key figure for investors focused on that specific company.

Volume and Trading Activity

Trading volume provides insights into market sentiment and price movements. High volume often accompanies significant price changes, indicating strong buying or selling pressure. Conversely, low volume may suggest a lack of conviction in either direction. Analyzing NVDA’s trading volume over the past day, week, and month can reveal periods of unusual activity and their potential causes.

Questions Often Asked: Current Selling Price Of Nvda Stock Per Share Today

Where can I find the most accurate real-time NVDA stock price?

Reputable financial websites and brokerage platforms provide real-time quotes. However, slight variations may exist due to data latency.

How often does the NVDA stock price update?

The price updates continuously throughout trading hours, typically reflecting every trade executed on major exchanges.

What are the risks associated with investing in NVDA stock?

Like all stocks, NVDA carries inherent market risk. Price volatility is a factor, and the company’s performance is subject to various economic and industry influences.

Are there any ethical considerations when trading NVDA stock?

Investors should adhere to all applicable laws and regulations, avoiding insider trading and other unethical practices.